Franklin Templeton-managed Fondul Proprietatea raised 8.1 billion lei ($1.8 billion) in Romania’s largest ever initial public offering and this year’s biggest share listing in Europe.

About 78 million shares, or 17.3%, in hydropower utility Hidroelectrica SA will be sold at 104 lei each in the IPO, close to the middle of the indicated range, according to a regulatory statement on Wednesday. Romania’s biggest producer of electricity is set to start trading on the Bucharest Stock Exchange on July 12.

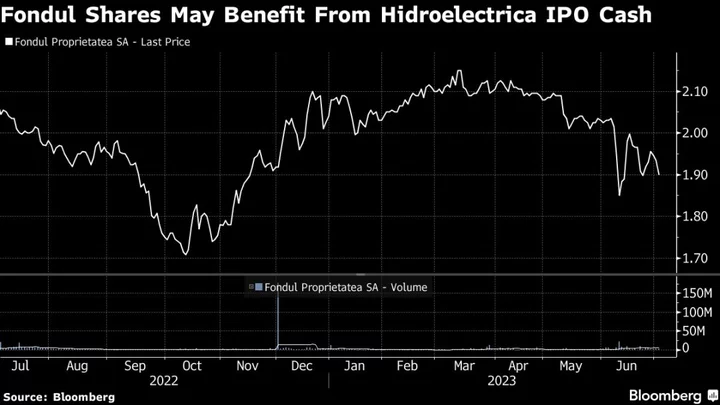

The proceeds of Europe’s biggest public offering since Porsche AG will go directly to Fondul’s coffers and are likely to be distributed to shareholders. Hidroelectrica, valued at about 47 billion lei, is poised to gain from the increased visibility and potential new funding opportunities for its ambitious renewable energy investments.

The boost in liquidity following the listing may help the Bucharest Stock Exchange secure a long-awaited upgrade by MSCI to emerging-market status. The sale of a minority stake in the company also fulfills one of the milestones in Romania’s recovery and resilience plan, helping to unlock €29 billion ($31.5 billion) in European Union funding.

“We have been waiting for this listing for over 10 years,” Energy Minister Sebastian Burduja said in a statement. “Listing means transparency, capitalization and is an indicator of a modern economy. This is the path to follow for other state-owned companies in the energy sector.”

Fondul’s remaining 2.6% stake in Hidroelectrica is “exercisable in whole or in part” within 30 days of the start of trade as an over-allotment option for stabilization purposes, according to the statement.

The Romanian IPO — the world’s third-largest of 2023 — according to data compiled by Bloomberg, could help rekindle Europe’s market for share listings. Thyssenkrupp AG’s Nucera hydrogen unit is raising €526 million ($573 million), while transaction processor CAB Payments Holdings aims to raise as much as £333 million ($423 million) in its IPO.

Surging Profits

Like other energy producers in Europe, Hidroelectrica saw revenue jump last year as Russia’s invasion of Ukraine triggered a spike in power prices. The company’s net income rose about 45% year-on-year to roughly 4.5 billion lei. Its profit rose 34% in the first quarter of this year to 1.7 billion lei, according to data released by Fondul.

To be sure, energy producers are likely to start feeling the pinch when prices stabilize as EU governments step up support for consumers. Still, Hidroelectrica’s dividend policy, which envisages returning 90% of profits to shareholders and even potential extraordinary payouts, may increase the stock’s attractiveness.

Read more: A $12 Billion Utility Races to Tap Wind and Solar Amid IPO

The offer comes close to the record eastern European share sale, held by Poland’s Allegro.eu SA, which raised $2.3 billion in 2020. It’s this year’s biggest IPO in Europe, topping a $663 million offering by Italian gaming operator Lottomatica Group SpA.

Hidroelectrica shares were initially guided to be sold between 94 and 112 lei each, before the range narrowed to 103-104 lei this week. According to the initial terms of the offering, it was expected to raise as much as 8.7 billion lei for the 17.3% stake.

--With assistance from Mark Sweetman and Alexandra Muller.

(Updates with company valuation and comments from energy minister, from the third paragraph.)