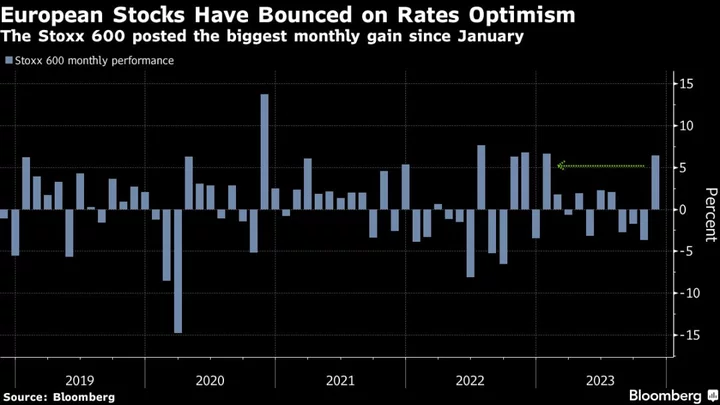

European stocks kicked off December with gains, extending a rally that added $1.2 trillion to the Stoxx 600’s market value last month, ahead of remarks from Federal Reserve Chair Jerome Powell.

The benchmark index rose 0.5% by 8:13 a.m. in London, with miners climbing the most. LVMH shares fell as much as 1.9% after the luxury goods maker was downgraded to equal-weight from overweight at Morgan Stanley, given the likelihood of a further deterioration in demand for the industry in the fourth quarter.

Among other individual stocks, L’Oreal SA and Beiersdorf AG gained on the back of strong earnings from US peer Ulta Beauty. Swiss Re also rose after the insurance firm posted high profit targets for 2024 ahead of its capital markets day.

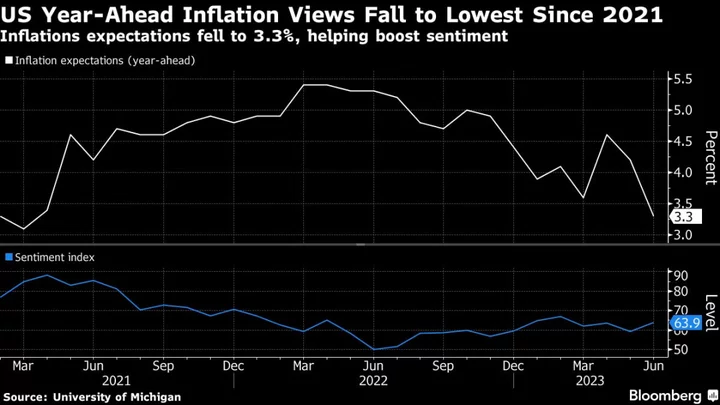

European stocks marked their strongest advance since January last month on optimism around easing inflation and a peak in interest rates. A broad rally on Wall Street also led the S&P 500 to one its best November gains in a century.

The focus Friday will be on remarks from Powell for further clues on the Fed’s next steps. Expected data include final manufacturing PMI figures for the EU and the UK. Eyes will also be on France as its credit status faces closer scrutiny, with the possibility of a humbling downgrade is looming ever larger.

Richard Flax, chief investment officer at European digital wealth manager Moneyfarm, said he was more cautious about the rally extending into the year end.

“Going into 2024, we haven’t increased our equity positioning from where we are as we expect an economic slowdown to begin to appear in a way that it didn’t in the US this year,” Flax said. “The key question is how growth begins to evolve. If we begin to see slowing macro growth translate into earnings downgrades, that would call the equity rally into question.”

SECTORS IN FOCUS:

- European personal-care stocks such as L’Oreal, Beiersdorf and Henkel may be active as US peer Ulta Beauty jumped in post-market trading after beating Wall Street’s comparable sales growth estimates and raising the lower end of its earnings per share forecast for the full year.

For more on equity markets:

- Data Not Good Enough to Revive the China Trade Yet: Taking Stock

- ASIA M&A WEEK AHEAD: Premiata, Hahn & Co., Otsuka, Silvercorp

- European States Facing Losses on Bank Stake Sales: ECM Watch

- US Stock Futures Fall; Marvell Technology, Tesla, Alibaba Fall

- Dr. Martens Gets a Kicking Over US Struggle: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Sagarika Jaisinghani.