European natural gas prices rose for a third straight session as strikes continue at export sites in Australia.

Benchmark futures gained as much as 7.2% on Monday, before paring some gains. Chevron Corp. has applied to a labor regulator to help resolve its dispute with unions at the Gorgon and Wheatstone liquefied natural gas facilities.

Read: Chevron Asks Regulator to Intervene in Australia LNG Strikes

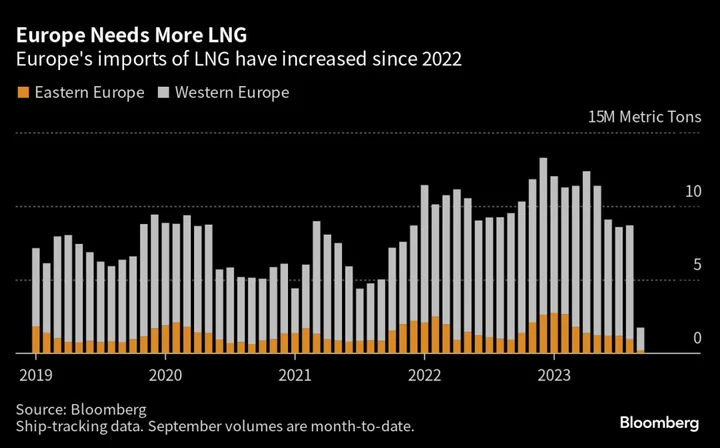

Workers on Friday began partial strikes, threatening operations that supplied about 7% of the world’s LNG last year. The risk of industrial action has held the European gas market in suspense for more than a month, triggering price volatility and highlighting dependency on global flows of the fuel.

Attention is now on key dates this week. On Tuesday, the Fair Work Commission will hear the cases. On Thursday, full walkouts are set to begin if no agreement is reached, according to the unions.

Given the importance of the facilities for Northeast Asian buyers, “we anticipate Chevron is under pressure to accelerate resolution,” said Kaushal Ramesh, vice president covering gas and LNG analytics at advisory Rystad Energy. More than 68% of capacity is contracted to buyers in the region, and actual exports to Northeast Asia account for more than 80%, he added.

Read: LNG Dispute Puts 16% of Japan’s Supply at Risk: EnergyQuest

In Europe, Norwegian pipeline gas exports remain curbed amid maintenance at key facilities, with the biggest works at the giant Troll field extended until Tuesday.

Dutch front-month futures, the continent’s gas benchmark, increased 6.08% to €36.60 a megawatt-hour by 10:02 a.m. in Amsterdam. The UK equivalent gained 7.5%.

For now, the region is relatively well-protected from any impact of the disruption in Australia, with European storage sites filled 94% on average. The perimeter — which includes Northwest Europe, Italy and Austria — is forecast to end the winter with gas inventories 44% full, according to BloombergNEF.

In addition, a warm September and mild October outlook in the northwest mean the start of the heating season isn’t yet on the horizon.

“The potential impact of the strikes is likely the only bullish element in the near-term market, given we have now entered the pre-winter shoulder season and other indicators are bearish in both Europe and Asia,” Ramesh said.