European natural gas prices steadied following the biggest drop in more than a month, as Shell Plc sees a brighter outlook for winter supplies due to high inventories.

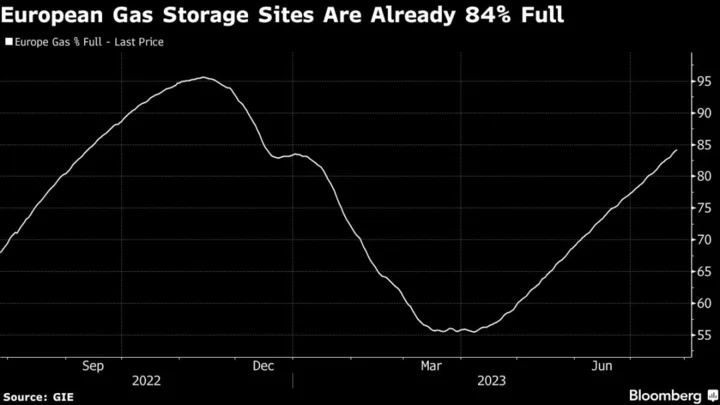

The benchmark hovered between small gains and losses after slumping 10% on Wednesday. Storage sites in the region are more than 84% full on average, with at least two months to go before the start of the heating season.

“I am encouraged by the stockpiles that Europe has,” Shell Chief Executive Officer Wael Sawan said in a Bloomberg TV interview. “I think that is going to be great to be able to avoid blackouts in Europe in winter.”

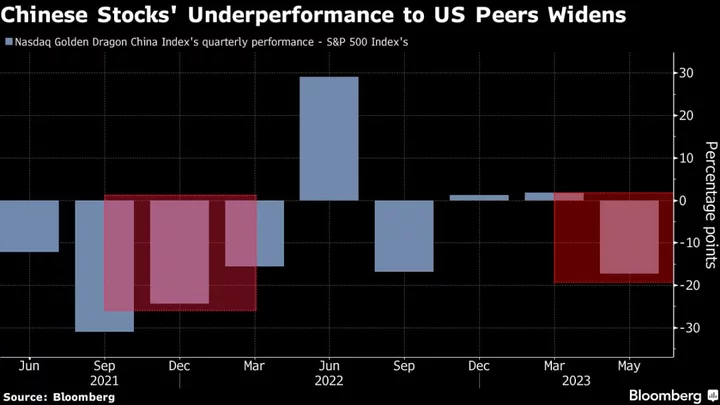

In addition to high European stockpiles, the industrial sector in China hasn’t recovered “as fast as some had predicted coming out of Covid,” Sawan said. Still, he warned that “if we have a cold winter those stocks will very quickly be drawn down,” while also predicting a tighter LNG market in the medium term.

Much of Europe is also set to cool off following a deadly heat wave that gripped the southern portion of the region. Temperatures in Madrid and Rome are set to be near the historical average into early next week, while northern cities like London and Berlin are forecast to see colder weather than usual, according to Maxar Technologies Inc.

Benchmark Dutch front-month futures were little changed at €29.28 a megawatt-hour by 9:39 a.m. in Amsterdam. UK prices also steadied.

--With assistance from Laura Hurst and Priscila Azevedo Rocha.