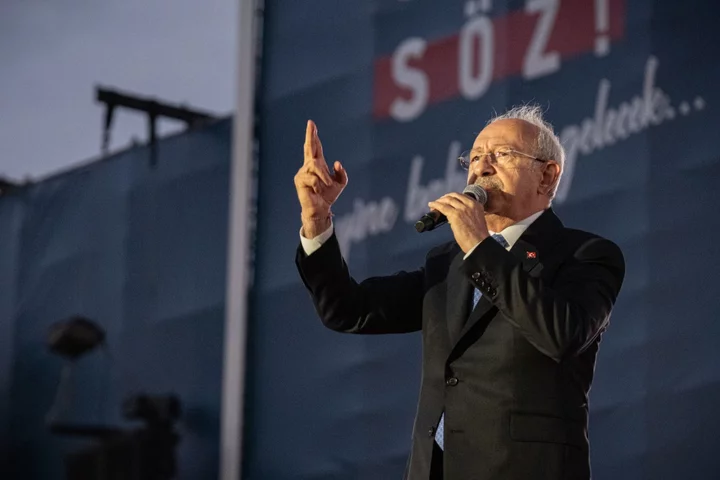

Turkey’s main opposition leader has accused President Recep Tayyip Erdogan’s government of covering up the true state of the economy and the country’s finances, capping his campaign with a jolting message before a closely contested vote later this week.

Kemal Kilicdaroglu, the presidential candidate of a six-party opposition alliance, framed the incumbent administration in unsparing terms, suggesting official economic data is untrustworthy and calling for a probe into Turkey’s stock exchange that he said had been turned “into a robbery tool.”

In an interview with Bloomberg, he said that if elected, his government would set up a team to assess the damage and understand what’s really happening in the economy. For now, Kilicdaroglu said, his team even lacked visibility on the central bank and state lenders.

“The numbers in Turkey are not transparent, they are not accurate,” he said. “We do not have enough information on our obligations, commitments, or income and expenditure.”

Turkey’s statistics service, central bank, Borsa Istanbul and the Treasury and Finance Ministry all declined to comment.

Social democrat Kilicdaroglu is raising the stakes in an election that’s already put a spotlight on Erdogan’s stewardship of the economy after its worst cost-of-living crisis in two decades.

The charges may prove damaging to a country that sorely needs to regain market confidence after unconventional policies under Erdogan drove out foreign investors and left it with yawning imbalances in trade and external finances.

Kilicdaroglu, 74, will also lend credence to criticism of Turkey’s economic figures at home and abroad, with questions long mounting about its standards of measuring everything from inflation to the central bank’s foreign-currency reserves.

A special commission — which Kilicdaroglu says will be set up within two weeks of the election — will present the “real” picture to the opposition bloc’s leaders, providing the basis for longer-term plans.

Economic advisers to each of the six opposition parties have made clear they are already laying the groundwork for the inquiry. After a meeting on Saturday, they said preparations have been completed for the commission to “bring out the concealed flaws” in the budget, state lenders and similar institutions.

In a joint statement, senior members of the opposition bloc said the probe will determine the accuracy of inflation data and delve into “transactions related to non-transparent sales from the central bank reserves.”

Although the central bank hasn’t officially announced any direct foreign-exchange interventions for over a year, Bloomberg Economics estimates it’s spent nearly $177 billion from December 2021 through last April on backdoor currency-market operations to support the lira.

The government has previously dismissed claims that Turkey’s state statistics agency under-reports price gains. Officials in charge of their calculation were removed last year and the service also stopped publishing some details of how it compiled the data as consumer inflation accelerated to the fastest since Erdogan came to power.

Stocks, Squandering

The scrutiny promised by Kilicdaroglu will go beyond statistics.

With stocks sinking deeper into a bear market, Kilicdaroglu said his government would prioritize a probe of Turkey’s Borsa Istanbul, where domestic investors became the dominant force over the past few years in pursuit of protection against rampant inflation.

“I know how small savers are robbed, vacuumed, shaken up,” he said. “That’s why we will launch the first investigation there.”

Read more: Quiet Politician Steps Up to Challenge Erdogan as Vote Looms

Kilicdaroglu is also seizing on an issue that’s long galvanized the opposition by leveling charges against the government’s profligacy. “Probably our first decree will be on savings measures, or more accurately, preventing squandering,” he said.

The accusation has become a cornerstone of his election campaign. At rallies, Kilicdaroglu has said he would sell the president’s private jets and use the money for the benefit of the public. Last year, he vowed to turn Erdogan’s lavish, 1,000-room presidential complex partially into a “museum of squandering.”

The blueprint laid out by the opposition alliance promises a return to conventional policymaking with an “independent” central bank if Kilicdaroglu defeats Erdogan in the elections.

Read more: Wharton Professor Is Waiting in the Wings to Undo Erdogan Legacy

The two remain in a close race ahead of the May 14 vote. If none of the candidates gets more than 50% of the ballots in the first round, there would be a runoff two weeks later.

Erdogan has wielded greater sway over economic decision-making and the central bank after the introduction of the executive presidential system five years ago gave him the power to appoint or oust a government official by decree at any time. In 2020, Turkey’s longest-serving leader used his dominance to press for ever-lower interest rates to turbocharge the economy ahead of elections.

The opposition has countered by pledging to restore meritocracy in the civil service as the first step toward overhauling the economy. Kilicdaroglu echoed the message, saying he believes appointing the right people to economic institutions including the central bank, the Treasury and regulators will bring Turkey the financial fix it needs.

“If the central bank governor is someone who exudes confidence to domestic and foreign circles, the problem will be solved for the most part,” he said. “The confidence we will provide will come from the bureaucracy.”

--With assistance from Beril Akman.

(Updates with new estimate for interventions from Bloomberg Economics in 12th paragraph.)