European Central Bank Governing Council member Klaas Knot said he’s content with existing monetary-policy settings as officials seek to bring inflation back to 2%.

“I think I’m comfortable with the current stance of policy as it stands,” the Dutch central bank chief told a panel discussion Friday in Slovakia. “That’s not to say that there will not be new shocks.”

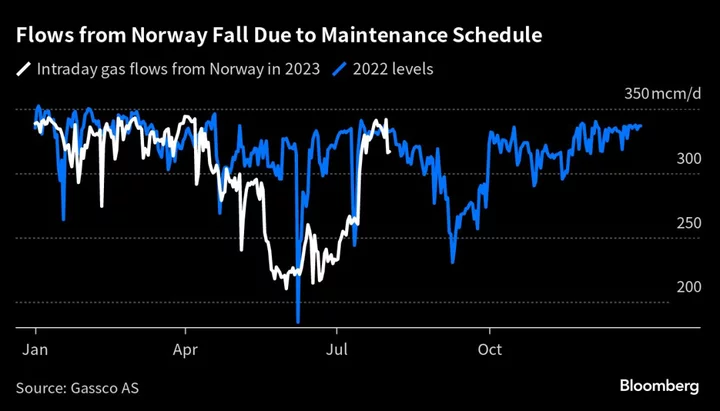

The ECB is now “getting on top of inflation,” he said, while warning that geopolitics are causing fragmentation that’s likely to force policymakers to cater more “for negative supply shocks than for positive supply shocks.”

After a 10th straight hike in the deposit rate to 4% last month, ECB officials are signaling that their unprecedented tightening campaign has probably ended. From here, borrowing costs will likely remain high for a prolonged period, they say, part of a wider theme globally that’s driving up government bond yields.

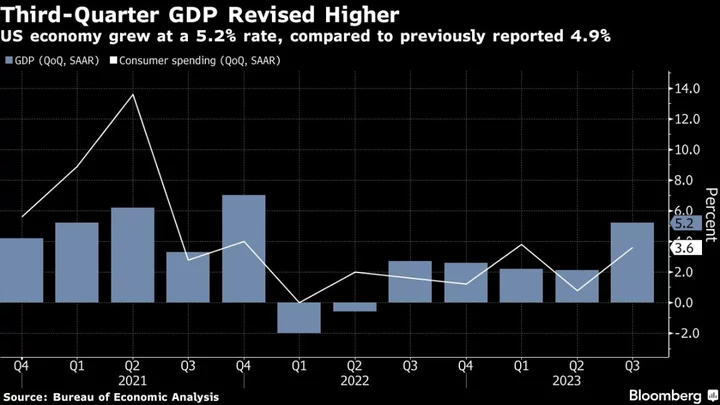

The danger is that the squeeze on borrowers intensifies headwinds for economies, including the 20-nation euro zone. Still, the bloc can still achieve a soft landing, rather than a harsher scenario, as inflation heads back toward the target.

“Growth rates are going down, but we are still well in the positive domain and I think these are all reasons we can be in camp positive on this one,” Slovenian central bank Governor Bostjan Vasle told the same event, the Tatra Summit.

Economic projections from the ECB currently see a return to the 2% inflation target in 2025 without a recession on the way. Whether that prospect holds up will play a key role in determining the future policy stance, Croatian central bank Governor Boris Vujcic said.

“I can see three, six months maybe with relative certainty what’s going to happen, and then let’s see,” he said. If the ECB’s forecast doesn’t pan out, “then there is always a possibility both for hikes or for cuts. We are data dependent, so we can go both ways, depending on where the data will be.”

Slovakia’s Peter Kazimir echoed that sentiment, saying “I will be waiting for the December and March forecasts.”

(Updates with comments from Vujcic and Kazimir from the seventh pragraph.)