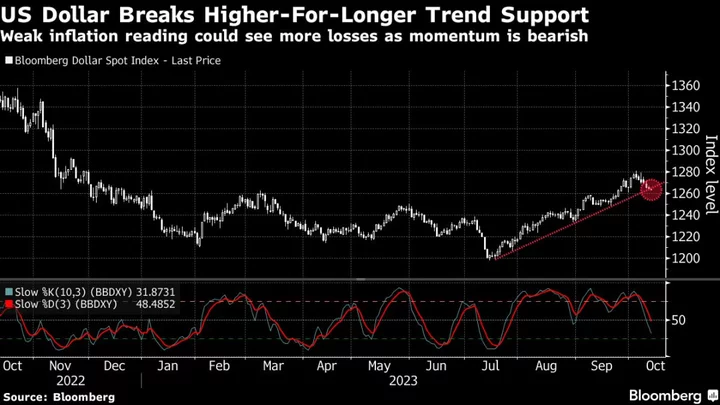

A gauge of the dollar is set for the longest run of losses in over three years, leaving analysts debating whether the greenback’s rally has finally come to an end.

The Bloomberg Dollar Spot Index fell for a seventh day after a recent chorus of commentary from Federal Reserve officials including Governor Christopher Waller suggested they may refrain from tightening further. The gauge advanced for two straight quarters and reached the strongest in almost a year last week on bets that US interest rates may remain higher for longer.

The greenback’s gains in 2023 have blindsided traders who started the year predicting that the currency would decline as US exceptionalism faded. The US inflation report later today will be critical for currency investors because it may provide more evidence about whether the Fed is likely to keep rates steady.

“Unless there is significant upside surprise today, then the US rate market should continue to price the Fed remaining on hold, which is acting as a dampener on US dollar strength,” said Lee Hardman, a senior currency analyst at MUFG.

The US dollar’s weakening has been most evident against the Swiss franc, which is on track for seven straight days of gains as investors snap up safe-haven assets. Sterling is also up for seven days, the longest streak since July 2020.

Richard Franulovich, head of foreign-exchange strategy at Westpac, is skeptical the dollar weakness will continue.

“An outsized decline in yields would put a hike back on the table,” said Franulovich. He pointed to data that indicates the US economy remains firm, payrolls are above the most bullish projections and early indications suggest core CPI may be firmer-than-expected.

--With assistance from Vassilis Karamanis.