Seasonality shows that Asian equities perform best over the last three months of the year. History may not repeat itself this time around.

As investors fret over a hawkish US Federal Reserve, China’s struggling economy and the surge in oil prices, the MSCI Asia Pacific Index is nearing a technical correction. With the gauge down nearly 10% from an end-July peak, strategists from Nomura Holdings Inc. to IG Asia Pte. say the cocktail of risks will likely see markets sputter in the final quarter of 2023.

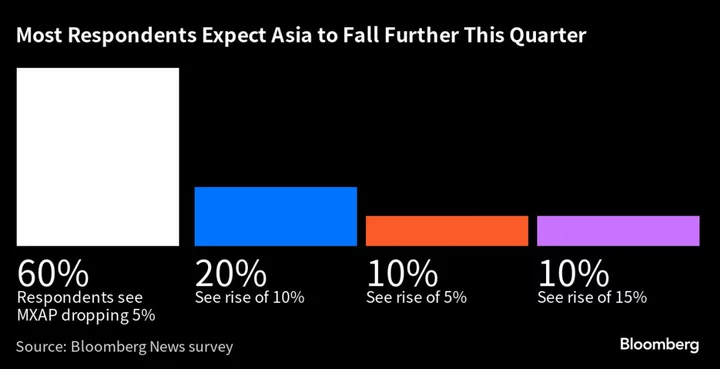

Six of 10 participants in an informal Bloomberg News survey of regional money managers predict the regional benchmark to fall 5% in the fourth quarter, putting it on track for its third straight annual drop — the longest streak of losses since the bursting of the dot-com bubble. Four respondents forecast gains of between 5% to 15% for the gauge, which is down less than 1% so far this year.

“We have a confluence of downward pressures from rising bond yields, the US dollar at its 11-month high, economic risks in China dragging for longer and elevated energy costs for the region’s oil-importers,” said Jun Rong Yeap, a strategist with IG Asia. “As long as these headwinds persist, traction in Asian equities may remain downbeat.”

China’s economic woes emerged as the most significant risk to the region’s stocks in the informal survey. Geopolitical tensions between China and the US ranked second, followed by Fed’s tighter for longer policy, oil’s rally and Japan earnings outlook.

“China’s slowdown will loom large on Asian markets,” said Sandeep Rao, a quantitative analyst at Leverage Shares. “A correlatory pulldown can be expected across the region.”

READ: China Stocks in Hong Kong Drop Most Since July as Market Reopens

China is confronted with a slew of issues, including sluggish consumer spending, a fragile real estate market and faltering exports amid tensions with the West. The problems pose an outsized risk as most of the region’s economies count China as their main trading partner.

A separate recent informal poll by Bloomberg News signaled China’s property sector crisis is likely far from over. Analysts including those at Goldman Sachs Group Inc. have earlier warned that a spillover of China’s property stress to the rest of Asia can pressure the region’s earnings and returns.

To be sure, not everyone is pessimistic on Asia.

Tina Teng, a strategist at CMC Markets, said while risks are mounting, there’s “potential in Asian stock markets due to the region’s divergent monetary policy stance from the Western central banks,” referring to the supportive policies at the central banks of Japan and China.

Asia’s equity valuations are also relatively more attractive than developed markets, with the MSCI Asia gauge trading at 13.3 times its one-year forward earnings versus 18 times for the US equity benchmark.

READ: Hawkish Fed, Expensive Oil Hit Asia’s Best Markets: Taking Stock

Still, these factors haven’t helped the region’s stocks in recent months.

Equity markets in emerging Asia excluding China have seen foreign outflows for two straight months, while a Morgan Stanley analysis shows global funds’ positioning in China stocks has dropped to lowest level since 2020.

“We see a number of headwinds for Asia markets into year-end, including higher rates, higher oil and China’s struggle with economic recovery which remains a headwind for global growth,” said Kieran Calder, head of equity research for Asia at Union Bancaire Privee.

(Updates index’s move in second paragraph.)

Author: Abhishek Vishnoi, Ishika Mookerjee and John Cheng