The auditor for Indian tech firm Byju’s quit, the latest setback for the once high-flying startup that’s had its offices searched by anti-money laundering officials and is embroiled in a tussle with creditors over a $1.2 billion loan.

Deloitte Haskins & Sells resigned as auditors to Think & Learn Pvt., better known as Byju’s, citing a delay in submitting financial statements, according to a letter seen by Bloomberg and confirmed by officials who declined to be identified.

Deloitte hasn’t been able to start an audit due to the delays and that will have a “significant impact” on its ability to “plan, design, perform and complete” the audit as per standards, it said in the letter sent to India’s Registrar of Companies.

The resignation compounds troubles at the Indian ed-tech company started by former teacher Byju Raveendran, which once touched a valuation of $22 billion as a prime example of India’s fledgling internet economy.

Business boomed during the pandemic, with the number of users of its flagship app topping 100 million. The startup spent heavily on marketing, such as sponsorship of India’s national cricket team and the FIFA World Cup.

But demand for online tutoring dropped off after schools reopened, and Byju’s has for months been in talks with lenders of its $1.2 billion debt after it breached investor protections by missing a deadline to disclose annual financial results.

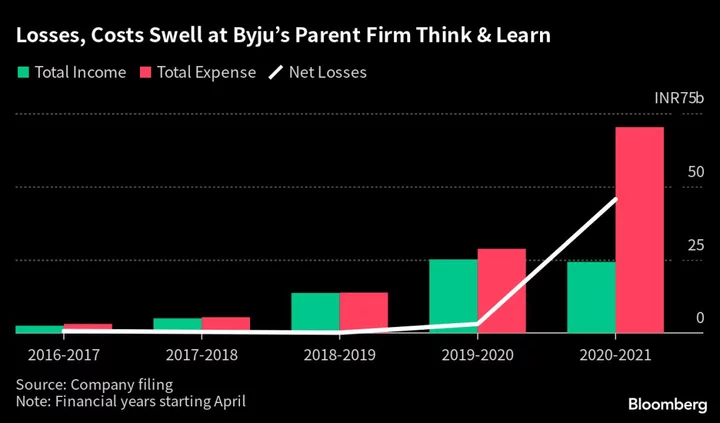

There is no earnings statement for Byju’s for 2022 in the public domain. The most recent available shows expenditure more than doubled in the year to March 31, 2021, while revenue fell.

Byju’s said in a statement on Thursday it appointed MSKA & Associates, a member of international accounting network BDO, as statutory auditors. A spokesperson for Deloitte wasn’t available for comment.

The Economic Times newspaper also said several board members of the company, including early backer G.V. Ravishankar, had tendered their resignations, a report which Byju’s called “entirely speculative.”

Legal Action

India’s anti-money laundering investigation agency conducted searches at offices of Byju’s in April as part of a probe. Then the standoff over the loan taken out in 2021 with a due date of 2026 heated up in May, when an agent for the lenders sued Byju’s in the US state of Delaware.

In a court hearing that month, lenders accused the tech company of hiding $500 million. Byju’s was trying to protect the money from predatory lenders, Joe Cicero, a lawyer for the Indian firm, said during the hearing. Delaware Chancery Court Judge Morgan Zurn didn’t make any ruling about whether moving the money was appropriate.

On June 6, Byju’s said it “elected” to halt making any payments on the $1.2 billion term loan and skipped a $40 million interest payment due that day.

It also filed a lawsuit in New York, alleging a group of investors manufactured a fake debt crisis to extort money from it. The lenders’ group has called the lawsuit meritless.

The loan is being quoted at 63.8 cents on the dollar, Bloomberg-compiled data show. A level below 70 is generally considered distressed.

--With assistance from P R Sanjai and Advait Palepu.

(Adds context and background throughout)