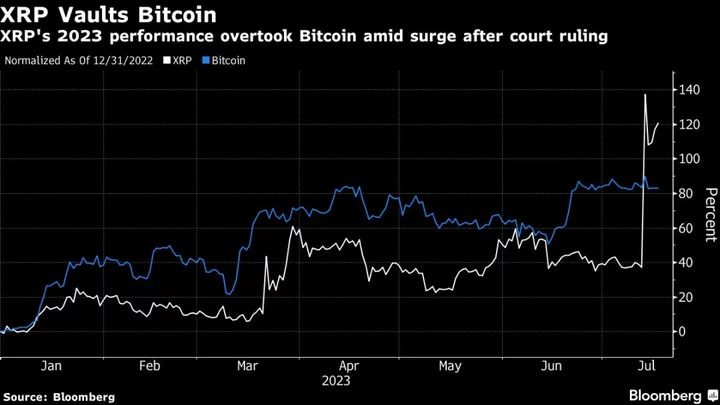

Parts of the crypto market saw frenzied trading following a break in the regulatory clouds surrounding the US digital-asset sector.

The spike stemmed from a July 13 court decision in the Securities & Exchange Commission’s case against Ripple Labs Inc. The ruling served to dent the SEC’s argument that most tokens are securities that fall under its strict purview.

Spot trading volume in XRP, the coin associated with Ripple and which was at the heart of the SEC lawsuit, jumped more than 1,700% to $11.3 billion on July 14 from $614 million a day earlier, according to data from CoinGecko.

XRP is one of more than a dozen coins, such as Solana’s SOL and Cardano’s ADA, that the SEC singled out in various lawsuits as unregistered securities, a designation that can make them harder to trade and hence repel investors.

Investor relief swept across those assets too: SOL spot volumes were 72% higher on July 14 versus the daily average for the month so far, while for ADA they were three times higher, CoinGecko figures indicate.

Bitcoin is seen as a commodity and hence shielded from the securities debate but it still saw a lift in trading. Over $21 billion of the token changed hands on July 14 and the subsequent day — about 70% above this month’s daily average.

‘Material Uplift’

“We’ve seen a material uplift in volume, and early signs of improving sentiment toward altcoins,” said Richard Galvin, co-founder at Digital Asset Capital Management, referring to smaller coins beyond the largest token Bitcoin. “That’s the first material outperformance by altcoins in some months.”

The SEC accused Ripple of misleading investors in XRP by selling more than $1 billion worth of the tokens without registering them. The court ruled XRP was a security when sold to institutions but not when bought by retail investors.

That suggests the possibility that the SEC doesn’t have the power to police secondary-market purchases of crypto on digital-asset exchanges. One big question is whether the court ruling will survive possible appeals or gain ground in other legal battles.

XRP Rally

“The initial reading of the decision as a straight win for Ripple triggered a huge rally for XRP and many other tokens, which later slightly subsided as legal nuances came into focus,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider OrBit Markets.

XRP’s rally of more than 50% over the past five days is the biggest among larger tokens, leaving it trading at about 73 cents as of 3:24 p.m. in New York on Monday, according to data compiled by Bloomberg.

A Bitcoin bump past $31,000 in the wake of the ruling has faded. The largest digital asset dropped as low as $29,677 on Monday, the least since June. Hopes that the SEC may permit the first exchange-traded fund investing directly in the token have contributed to an 80% rebound in Bitcoin from 2022’s crypto rout.

In the derivatives market, volumes for CME Group Bitcoin futures were up 69% on average over July 13 and July 14 compared with the trend in the earlier part of the month. Average volumes for Ether futures more than doubled by the same metric.

--With assistance from Akshay Chinchalkar and Emily Nicolle.

(Updates prices of cryptocurrencies.)