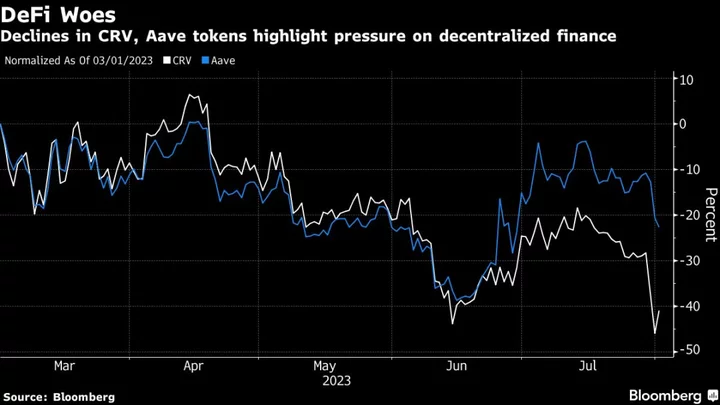

A tumble in the native token of key decentralized cryptocurrency exchange Curve Finance sapped sentiment toward digital assets on concern that the episode could trigger cascading liquidations of positions throughout the embryonic sector.

Curve Finance is one of the largest liquidity providers in DeFi, especially for stablecoins. A hack that took place in the project over the weekend has led to sharp declines in both the total amount of funds deposited on Curve and price of CRV, the token used to facilitate transactions on the protocol. The as much as 30% drop in CRV has put more than $100 million worth of loans of Curve Finance founder Michael Egorov at risk of being liquidated.

Curve Finance, like other decentralized projects, relies on blockchain-based software known as smart contracts, rather than Wall Street-style middlemen, to facilitate trading activities. DeFi projects in general are run by so-called decentralized autonomous organizations, or DAOs, with members using their tokens to vote on key changes to the projects. Advocates praise the transparency of DeFi’s design, but the incident reveals a key flaw of DeFi that decentralized decisions don’t always lead to the right ones.

“There are rules in traditional finance around these sorts of super concentrated insider positions,” said Leo Mizuhara, founder and chief executive of DeFi institutional asset management platform Hashnote. It’s “important to note how interconnected many of these DeFi protocols can be, a liquidation on one protocol or chain could have ramifications on the others.”

Egorov told Bloomberg News that he’s working on reducing the sizes of his loans. Crypto investors such as Justin Sun said they’re also supporting the protocol.

I “cannot comment much about contagion effects apart from saying that we, and I personally, work on minimizing or eliminating the impact,” Egorov wrote in an email on Monday. “In any case, I think that we and all DeFi will come out stronger surviving this event.”

Sun told Blooomberg News that he has purchased roughly 5 million CRV tokens for about $2 million, or well below the current market price. Chinese billionaire Jihan Wu, the founder of Bitmain Technologies Ltd., wrote on the platform formally known as Twitter that he bought CRV as well.

Clara Medalie, director of research at blockchain data firm Kaiko, pointed out that Curve Finance is mostly used by large investors who need to trade stablecoins. Since at least 2021, the average trading size on Curve has ranged between $200,000 and $1 million, according to Kaiko’s data, whereas on all other crypto exchanges, the average size is just a few thousand dollars.

The episode also raises comparisons to the FTT tokens that served as the native cryptocurrency of the now bankrupt FTX exchange. FTT didn’t appear to be problem until it was revealed that not only were the tokens one of the main assets that made up FTX’s balance sheet, but they also were used as collateral on loans by FTX’s sister trading firm Alameda Research.

In DeFi lending, when a position is liquidated, the underlying collateral, in this case, CRV, will be sold in a market that already saw steep price declines. A series of liquidations of Egorov’s loans would leave “bad debt” for some lending protocols, Medalie said.

The amount of crypto using the Curve Finance service, once second-largest decentralized — or DeFi — digital-asset exchange, is down to $1.7 billion from $3.6 billion since the hack was revealed on Sunday, tracker DefiLlama data shows.

(Corrects the spelling of Jihan Wu in the seventh paragraph.)

Author: Muyao Shen, Sidhartha Shukla and Suvashree Ghosh