Credit Suisse Group AG’s asset management arm saw clients continue to pull money from its investment funds this quarter, underscoring the challenges for UBS Group AG as it integrates its former rival.

Investors took out about $6 billion through June 22 from open-end funds and ETFs tracked by Morningstar Direct. The data covers funds holding more than $150 billion worth of assets, which is roughly equivalent to 40% of the investment unit’s total assets under management. It excludes money market funds, feeders and funds of funds.

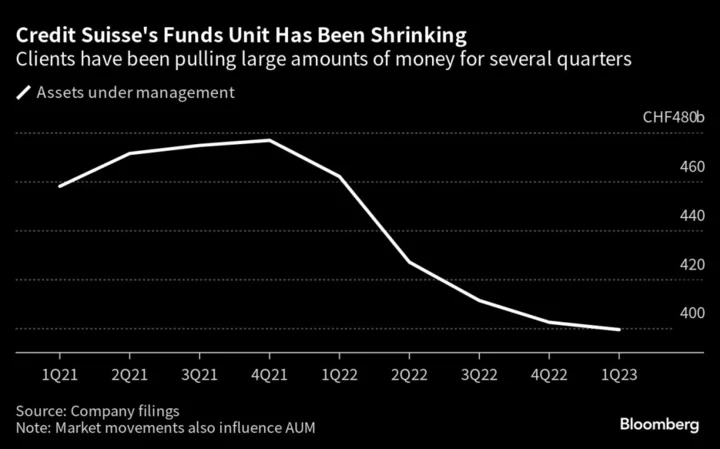

The figures are an early indication of the performance of Credit Suisse asset management unit, which has seen clients pull for five consecutive quarters amid a crisis of confidence that saw it collapse into the arms of UBS in March. Stemming those outflows has been a key priority for the leadership of the combined bank.

Assets under management at Credit Suisse’s investment unit have been dropping since the end of 2021 when they stood at 477 billion Swiss francs ($533 billion). They hit 399 billion francs at the end of the first quarter.

--With assistance from Marion Halftermeyer.