It’s likely just a formality before Country Garden Holdings Co.’s missed dollar bond interest payment is declared a default, as creditor focus shifts to a potential debt restructuring for the distressed Chinese developer.

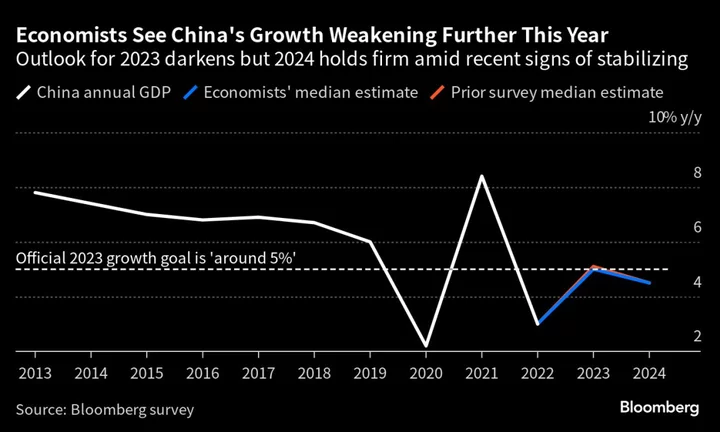

China’s former top builder hasn’t offered fresh comments after saying Wednesday it doesn’t expect to be able to meet all offshore payment obligations on time. It cited China’s home market weakness and its own subdued sales as reasons, according to a statement to Bloomberg News at that time, adding that it hopes to seek a “holistic solution” to its debt problems.

It issued the statement in response to questions about plans for the $15.4 million of interest on a dollar note that remains unpaid after the expiry of a 30-day grace period earlier this week. A default can be called after that.

With the delinquency increasingly a foregone conclusion, creditors’ attention is moving toward whether the latest payment failure would trigger a cross-default on other debt, as well as how soon the developer can deliver a restructuring blueprint. A messy debt overhaul by Country Garden risks sending China’s housing sector into deeper turmoil and posing a threat to social stability, given its large number of projects and heavy presence in smaller cities.

“It would be helpful to market participants that the company officially announces its default and communicates its future plans,” said Leonard Law, senior credit analyst with Lucror Analytics. “Nevertheless, bondholders would have to assume that the company has defaulted, and form creditor groups to carry out debt restructuring negotiations.”

Country Garden’s creditors have been in discussions with several financial advisers, including PJT Partners Inc. and Moelis & Co., as they seek to form an ad-hoc group ahead of a possible offshore-debt restructuring.

With $186 billion of total liabilities, Country Garden is one of the world’s most indebted builders. A symbol of China’s broader property debt woes, the company’s latest coupon payment failure would trigger a cross-default on all of its about $10 billion of dollar notes, JPMorgan Chase & Co. analysts including Karl Chan wrote in a note.

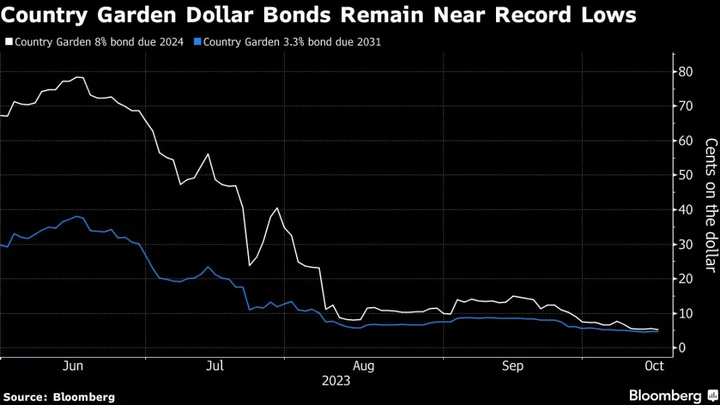

Country Garden’s dollar notes have been indicated around 5 cents, showing how little money investors expect to recover, after some were near 80 cents in June. Its shares have dropped 72% this year.

--With assistance from Wei Zhou.