By Mike Dolan

LONDON Hype or hope, this year's boom in artificial intelligence along with other productivity-enhancing tech developments may be one of few ways to sustain an increasingly fragile "global balance sheet" over coming decades.

There is little doubt about the market heat, corporate alarm and social anxieties created in the mere six months since the breakthrough in "generative AI" tools took the world by storm. What it means for jobs, productivity, profit margins and even trustworthy information dominates the debate.

Even Bank of America's strategists have taken to describing the stock market craze around it as a "baby bubble" already.

But in a study into the sustainability of two decades of debt-fueled asset-price gains - a $160 trillion ballooning of "paper wealth" - McKinsey Global Institute reckons accelerating productivity may be the only one of four scenarios that can keep income and wealth growing over coming decades by seeding an economic expansion that catches up with a bloated balance sheet.

That notional global balance sheet - which comes in at more than $500 trillion, or half a quadrillion - adds up all the real assets in the economy, such as real estate, plants, machinery and intangibles, and all the financial assets and liabilities, such as equity, debt, deposits and pension assets.

The nub of McKinsey's question is how potentially seismic changes afoot in inflation, interest rates, banking, geopolitics and supply chains may upend those past two decades of slow growth, high liquidity, "seemingly endless" wealth gains and rising inequality.

That was a world in which the notional world balance sheet outpaced GDP growth, with every dollar of investment generating $1.90 in debt, McKinsey claimed.

And last year's $8 trillion asset price implosion was just a taster of what that shakeup can do to global household wealth.

The four possible scenarios sketched by McKinsey through 2030 in a report called "The future of wealth and growth hangs in the balance" have extreme outcomes.

The first scenario is just a reversion to pre-pandemic growth and inflation norms, weak investment and a savings glut. It sees the biggest annual asset price gains over the coming eight years as an extension of the "wealth illusion" of the past decade. The worst asset price losses and GDP drop comes in a scenario that apes post-property-bust Japan of the 1990s.

Between the two is a higher-for-longer inflation picture that echoes the 1970s energy crisis and erodes real wealth.

The only unambiguously positive outcome is a productivity surge - with tech deployment, productive investment, real wealth gains, falling balance sheet risk and falling inequality - not unlike early post-World War Two decades in the United States.

In that rosy scenario, sustainable real interest rates return to a positive 1% over the 2022-2030 period, average annual real equity and bond gains hit 4-5%.

U.S. household wealth alone would expand by some $17 trillion by 2030, compared with a $31 trillion collapse in the case of 1990s Japan.

"Governments and corporations alike should collectively strive toward accelerated productivity growth, the only one of MGI’s modeled scenarios that achieves strong growth in income and wealth over the long term and a healthy global balance sheet," the report concluded, highlighting demographic and supply-chain problems ahead that demand this direction.

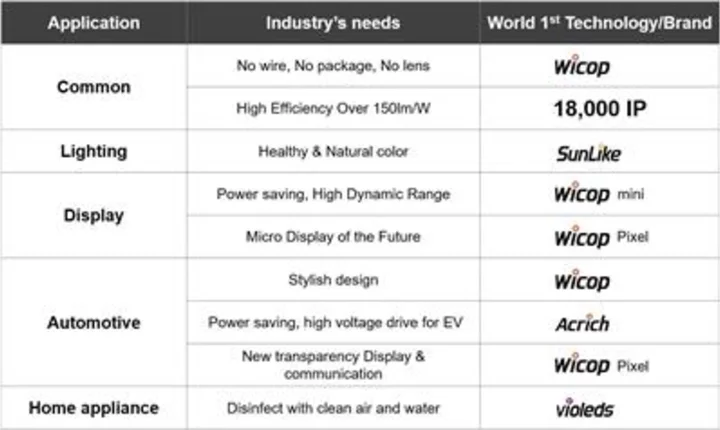

"First and foremost, it requires productive capital allocation and investment as well as more rapid adoption of digital tools."

WORKER SHORTAGE VS AI LAYOFFS

But there are many doubts, not least the acknowledgment by MGI that digitization over the past 20 years has not yet led to that sort of surge in productivity growth.

Even if the latest hoopla around generative AI is overstated, there is genuine trepidation about waves of white- collar worker redundancy that may come from this. That hardly jibes with a rosy outlook - even if asset wealth is enhanced.

After all, Goldman Sachs earlier this year estimated 300 million jobs worldwide could be at risk from automation and generative AI could dispense with a quarter of all current work in the United States and Europe - even though productivity enhancements may lift world economic growth by 7% and average profit margins of S&P 500 companies by 4%.

Others have talked of pressure on governments to ultimately offset potentially devastating job losses with schemes such as Universal Basic Income, which some fear may require central banks to cap borrowing costs artificially in future - even proving inflationary as a result.

But if looming worker shortages were the big worry within ageing developed countries, then the tech may not be as dire for the world of work as it first seems - even if requiring deft management, sequencing and even regulation to avoid outsized hits to different countries or population cohorts.

Deutsche Bank strategists Jim Reid and Henry Allen this week examined how most new technologies over recent centuries were feared due to unemployment concerns - but these were typically unfounded as freed-up resources, higher productivity and real wages lifted living standards at large and made way for other industries and jobs to spring up.

"Humans are inherently ambitious and will always seek new opportunities when technology closes off previous areas. Such upheaval has always been growth- and employment-enhancing," they concluded.

"Whilst there are legitimate fears about what AI means for society, we are sceptical that this time is different and it will lead to widespread job losses."

The opinions expressed here are those of the author, a columnist for Reuters.

(Writing by Mike Dolan; Editing by Matthew Lewis)