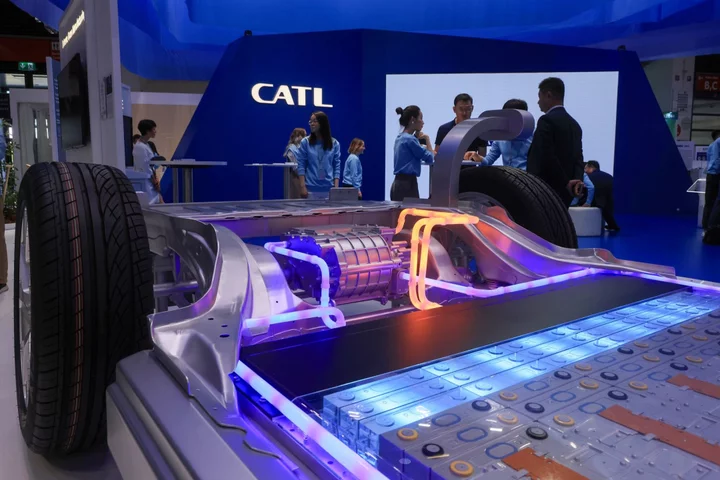

China’s Contemporary Amperex Technology Co. is studying a potential second listing in Hong Kong, according to people familiar with the matter.

A potential share sale in Hong Kong could come after the battery maker put a plan to sell global depository receipts in Switzerland on hold, said one of the people, who asked not to be identified as the information is private. It’s too early to tell the fundraising size of the Hong Kong listing, the people said.

Considerations are at an early stage and Shenzhen-listed CATL could still decide against the share sale, the people said. IFR reported CATL’s Hong Kong listing plans earlier on Wednesday, saying a share sale may take place as soon as early next year. A representative for CATL didn’t respond to requests for comment.

CATL, the world’s biggest maker of electric-car batteries, chose banks earlier this year for its planned GDR sale, which aimed to raise at least $5 billion, Bloomberg News reported in February. China International Capital Corp., China Securities International, Goldman Sachs Group Inc. and UBS Group AG were among those working on the GDR issuance.

Shares of CATL have fallen about 19% this year, giving the company a market value of about $109 billion. The stock was down about 2% on Wednesday.

Chinese firms have increasingly turned to GDR offerings in Europe in recent years after the Shanghai-London Stock Connect cross-border listing program was expanded to link Zurich and Frankfurt with Shanghai and Shenzhen. Beijing however held up approvals for such sales earlier this year on concern a substantial portion of the issue was being taken up by Chinese investors who later converted the securities into shares in their home market to profit from persistent price gaps.

--With assistance from Danny Lee.

(Updates throughout with information from people familiar with the matter.)