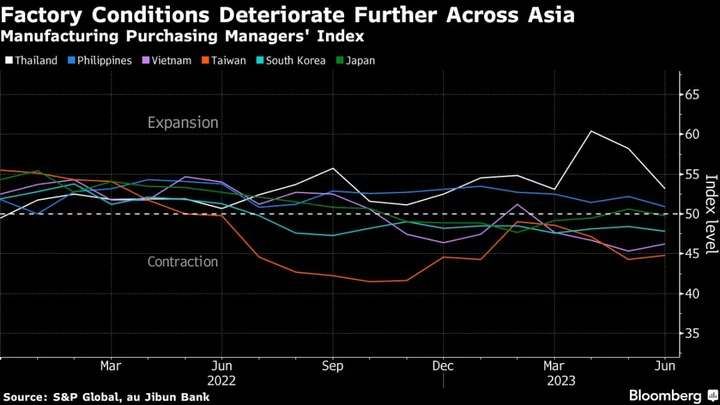

Manufacturing across most of Asia deteriorated further in June as a weak Chinese economy sapped demand for the region’s goods.

Factory activity remained stuck in contraction in neighboring countries South Korea, Japan and Taiwan, according to manufacturing purchasing managers’ indexes published Monday by S&P Global and au Jibun Bank.

Much of Asia’s manufacturing sector had pinned its hopes on a strong Chinese post-pandemic rebound, only to see weaker-than-expected trade with the world’s second largest economy. With a similarly sluggish global economy, damped by high borrowing costs and elevated inflation, factories are struggling to find a catalyst for growth.

South Korea’s PMI fell further to 47.8 in June, while Japan’s reading slipped back below 50, which separates expansion from contraction, as it dropped to 49.8 from 50.6 in May. Taiwan’s PMI inched up slightly but still marked a 13th straight month of shrinking activity.

“It seems unlikely the sector will move back into recovery until we see improvements in global economic conditions and stronger demand across key markets such as Europe and the US,” S&P Global Market Intelligence’s Annabel Fiddes said of Taiwan.

The malaise has spread further down the region, with Vietnam and Malaysia’s manufacturing extending contractions. Factory activity in the Philippines and Myanmar expanded at a slower pace on weaker output while region’s-best Thailand saw its PMI plunge to 53.2 from 58.2.

That follows similarly dismal signals from China last Friday, with its official manufacturing PMI registering a third straight month of contraction and bolstering the case for further stimulus. A separate, private survey published Monday showed China’s manufacturing activity expanding at a slower pace, as companies turned more cautious on their output outlook.

Other signs of weak demand from China have flashed additional warning signs for the region. Korean trade data over the weekend showed shipments to the world’s second-largest economy dropping 19% from a year earlier, the 13th straight months of declines.

One bright spot in the region was Indonesia, which saw its manufacturing momentum pick up in June amid stronger production, new orders and employment.

Southeast Asia is faring well “despite the post-Covid boom subsiding. That said, lingering global economic uncertainty and policy rate hikes worldwide map a challenging road ahead,” said Maryam Baluch, an economist at S&P Global Market Intelligence.

(Updates with additional context.)