Mainland China remained the world’s busiest spot for initial public offerings during the first half of the year, but slowing economic growth is expected to increasingly drag on domestic activity.

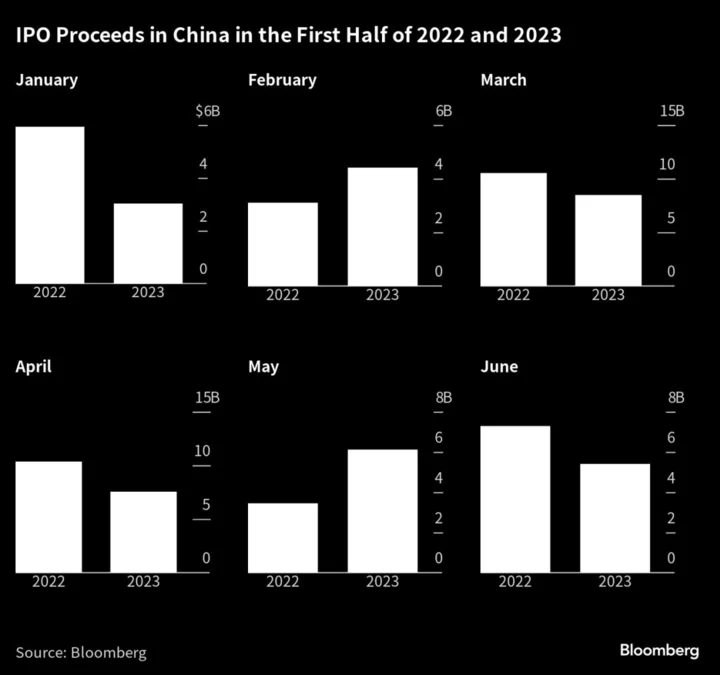

Proceeds raised in Shanghai, Shenzhen and Beijing totaled $35 billion, about half of all what was amassed globally in the six months through June. While China kept the top position for the most listings with 176 newcomers, the amount priced was 14% lower than a year earlier, and activity has been slowing month-by-month.

The demand that’s kept mostly Chinese bankers busy during the past two years is seen cooling as companies take a wait-and-see stance for potential measures to drive the economy. In Hong Kong, a traditional venue for Chinese firms seeking exposure to a wider pool of investors, the prospects of a market revival mostly relies on spin offs from tech giants and listings from artificial intelligence or automotive startups.

For offerings by Chinese firms to pick up, “overall market sentiment needs to improve. Investors’ view on the Chinese economic outlook is also a pre-condition,” said Peihao Huang, co-head for Asia ex-Japan ECM at JPMorgan Chase and Co. in Hong Kong. “We are relatively optimistic regarding the second half of the year, even with the reopening momentum seeming to have slowed. Some good news will boost confidence and we hope to see some of that in the next few months.”

The year started on a strong note for both mainland and Hong Kong-based Chinese issuers amid upbeat sentiment as the country reopened after ending its Covid Zero policy. March saw the highest amount raised by IPOs domestically this year, with proceeds almost double those amassed in February.

During the first quarter, authorities ended reviews of IPO and merger policies, lifting limits on the size or price of IPOs. The changes, widely flagged before being announced, were well-received. China’s securities regulator also cleared rules for companies seeking listings abroad, particularly for those that deal with data deemed as sensitive.

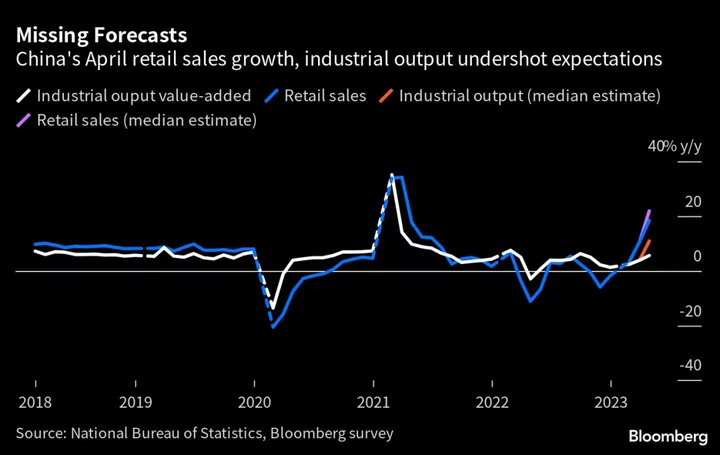

Still, momentum in the country’s economy failed to build over the second quarter, hurting domestic and offshore fundraising plans. Proceeds raised in the onshore market dropped each month between March and June, Bloomberg-compiled data show. The average size for IPOs in mainland China so far this year stands at $183 million, versus $230 million in the first six months of 2022. In Hong Kong, there hasn’t been any listing larger than $700 million this year.

As China-related offerings are expected to slow, listings from other regions could see “a good opportunity” to tap investors looking to allocate in Asia, said Selina Cheung, co-head of Asia equity capital markets at UBS AG in Hong Kong. She highlighted markets such as Japan, South Korea, Southeast Asia and India as being active in upcoming months.

A widely expected offering in mainland China by Syngenta Group during the second half could help the country keep its ranking among top IPO venues in 2023 amid the slower activity. The firm last month got Shanghai stock exchange approval for a 65 billion yuan ($8.96 million) listing that’s been in the works since 2019 and could potentially be one of the world’s largest this year.

In coming months, “Chinese IPOs are going be divided between security sensitive and non-sensitive technologies, and anything that’s been identified as strategic by the Chinese,” said Drew Bernstein, co-chairman of Marcum Asia in New York, adding that most offerings will be onshore as getting approval to trade abroad will most likely be hard to get. “Things like AI, semiconductors, maybe quantum computing, they’ll probably have to IPO on the A-share market.”