China’s economy isn’t yet on secure footing, as recent green shoots have been offset by lingering fears about the property crisis and a stubborn inability to revive confidence.

Data due Wednesday will likely show a modest pickup in quarter-on-quarter gross domestic product growth, though year-on-year comparisons may be less favorable.

The pace of expansion for July-September compared with a year ago probably slowed to 4.5%, below Beijing’s annual growth target of about 5%.

Earlier data for the quarter contained some promising figures that supported a steadying of economic activity, with factory activity improving and a drop in exports moderating as authorities rolled out stimulus and eased restrictive real estate policies. Rreleases in the coming week on industrial output, retail sales and unemployment are expected to show how widespread that stabilization is.

The recovery remains uneven, though. Consumer prices returned to the brink of deflation in September, data on Friday showed. Home sales have also failed to mount a turnaround, which may weigh on investment and counter any support from stronger government-led infrastructure spending.

“The upcoming September activity data will be important to watch,” said Xiaojia Zhi, head of research at Credit Agricole CIB. While the figures “may also send the message that the Chinese economy could be showing more signs of stabilizing, uncertainty remains related to the continued property drag.”

Questions also remain about how much additional stimulus China will roll out to support the economy. The People’s Bank of China on Monday will set the rate on its one-year medium term lending facility, a key policy rate. Economists broadly expect that to remain unchanged for now, though several expect a cut before the end of 2023.

There may be other measures on the horizon as well. China is considering raising its budget deficit for the year by issuing more debt to spent on infrastructure, Bloomberg reported. Authorities are also mulling the formation of a state-backed stabilization fund to shore up stock market confidence, while the nation’s sovereign wealth fund recently purchased the equivalent of about $65 million worth of shares in the nation’s biggest banks.

Some economists still point to the need to address the biggest albatross of all: the real estate market.

“The Chinese government will still need to do more policy easing, especially related to property,” Zhi said. “There is still room to further relax or remove various policy restrictions in major cities.”

What Bloomberg Economics Says:

“China’s recovery is starting to get some traction, supported by stronger public investment and monetary easing. This should be clear in September activity and in third-quarter GDP data — beneath the headline readings. This would set growth up for a better performance in the second half of 2023.”

—For full analysis, click here

Elsewhere, a speech by the Federal Reserve chief and UK inflation and wage data will draw attention, while central banks in Indonesia and South Korea may keep interest rates unchanged.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

US and Canada

Following data showing still-brisk inflation, investors will parse comments by Jerome Powell on whether the Fed is leaning toward another rate hike before year-end. The Fed chairman addresses the Economic Club of New York on Thursday — the headline event in a hectic week of speeches.

Regional Fed bank presidents Patrick Harker, Thomas Barkin, Neel Kashkari, Lorie Logan, Loretta Mester and Austan Goolsbee are slated to appear at various events. Fed Governors Lisa Cook and Christopher Waller will also speak.

Among upcoming economic data, retail sales are expected to reveal subdued consumer demand as the third quarter drew to a close. The September value of purchases, unadjusted for price changes, is seen rising about half as much as in the previous month.

Tuesday’s release may also show a decline in so-called control group sales, the first such decrease in six months. These sales, which exclude receipts at food service establishments, auto dealers, building materials stores and gas stations, are used to calculate spending on most goods in the GDP report.

Another report in the coming week is expected to show the weakest annual rate of existing-home sales since 2010 as the real estate market continues to suffer from high borrowing costs and limited inventory.

Housing starts, meanwhile, probably snapped back after plunging in August on a slump in multifamily home construction.

In Canada, among several reports due, a highlight will be inflation on Tuesday, which will show whether price gains of about 4% on key measures have slowed further.

- For more, read Bloomberg Economics’ full Week Ahead for the US

Asia

Away from China, the week starts with voters in New Zealand having opted for a new conservative government in Saturday’s general election.

Inflation figures out Tuesday will likely show that the cost-of-living crunch continues to weigh on households there, even as food-price growth is slowing.

Three Reserve Bank of Australia officials will speak in the coming week, with Governor Michele Bullock continuing to flesh out the vision of her fledgling leadership on Wednesday. Jobs figures come out the following day.

Bank Indonesia is expected to hold rates steady on Thursday, as it’s done since raising them in January. That’s also likely the case for the Bank of Korea, even as inflation there heats up again.

Trade data from Indonesia, Malaysia and Japan is also released during the week.

Tokyo’s main event is likely to be Thursday’s unveiling of union pay demands for next year. Bank of Japan officials citing the need for strong wage gains will likely watch that announcement closely, alongside nationwide CPI figures on Friday.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Europe, Middle East, Africa

The UK will take center stage for Europe. After numbers on Thursday showed that growth stayed weak in August, further releases will signal to Bank of England officials whether their recent pause in rate hiking is justified.

On Tuesday, wage data may point to weakening pressures in August, with accompanying labor-market numbers also probably showing a loss of momentum.

The following day, core inflation, which strips out volatile elements such as energy, as well as headline CPI, are anticipated to have fallen in September.

It’s a quieter week in the euro zone. Germany’s ZEW gauge of investor confidence is released on Tuesday, while euro-area inflation data on Wednesday may confirm initial readings that showed weakening pressures.

For the European Central Bank, the first three days of the week will mark the end of a pre-decision window to speak out on monetary policy before officials meet on Oct. 26. Central bank governors from France, Spain, the Netherlands and Germany are among those scheduled to deliver remarks.

ECB president Christine Lagarde will be in Luxembourg on Monday for a meeting of euro-zone finance ministers that US Treasury Secretary Janet Yellen is also scheduled to attend.

Italian Finance Minister Giancarlo Giorgetti will be there as well, but only after he presents his budget law that incorporates the looser fiscal plans of Prime Minister Giorgia Meloni’s coalition. A sovereign rating assessment for Italy is due from Standard and Poor’s on Friday.

Turning north, several Riksbank officials are due to speak, including Governor Erik Thedeen — remarks that may be closely watched after evidence of stubborn core inflation added to the case for another rate hike next month.

In the Middle East, Israel publishes data on Sunday that will probably show price increases didn’t accelerate last month after an upside surprise in August took inflation above 4%.

The outlook is now in flux as the shock of Hamas attacks on Israel leads to a military escalation that’s likely to scar the economy by hurting consumption, investment and tourism. The market no longer expects a rate hike from the Bank of Israel and is positioning instead for its first monetary easing since the pandemic. A decision is currently scheduled for Oct. 23.

In Africa, data on Monday will likely show Nigeria’s inflation quickened for a ninth straight month, to over 27%. That may see the central bank, under new leadership, raise borrowing costs at its next meeting.

On Tuesday, South Africa’s monetary officials will issue a review on domestic and international developments that affect their policy. Data the next day may show September’s inflation quickened from the 4.8% reading seen in August, buoyed by transport.

A weaker rand, higher oil costs and an outbreak of avian flu could keep price gains elevated for some time. Forward-rate agreements starting in two months — used to speculate on borrowing costs — show traders are pricing in a 70% chance of a quarter-point increase Nov. 23.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Latin America

Peru on Monday posts its August GDP-proxy figures and Lima jobs report less than a week after finance minister Alex Contreras delivered a downbeat take on the economy to congress. Peru’s recession worsened in July, with the economy contracting 1.3%.

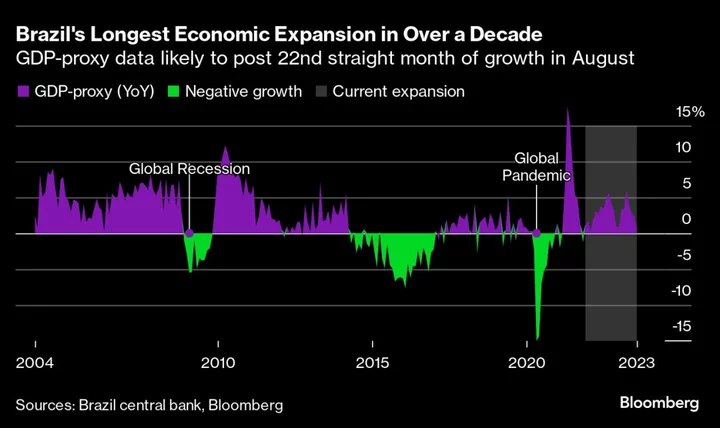

Brazil GDP-proxy data published on Thursday are likely to show Latin America’s biggest economy expanded for a 22nd straight month in August, its longest run since President Luiz Inacio Lula da Silva’s second administration more than a decade ago.

Economists surveyed by the central bank have almost tripled their 2023 GDP forecast to 2.92% since early May.

In Colombia, August’s GDP-proxy print should show an economy that’s barely expanding. Economists surveyed by Bloomberg have trimmed their third-quarter output forecast to 0.7% from 1%.

Elsewhere, the central banks of Brazil and Colombia post surveys of economists, while Citibanamex publishes its bi-weekly survey of Mexican analysts.

The region’s two biggest economies report retail sales figures for August. In the two decades starting in 2000 Brazil’s results easily outpaced Mexico’s. But since the height of the pandemic that relationship has flipped: since January 2021, Mexico’s retail sales have been humming along at a year-on-year average of 9.6% to Brazil’s sluggish 1.8% pace.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

--With assistance from Vince Golle, Piotr Skolimowski, Paul Jackson, Jill Disis, Robert Jameson, Fran Wang, Alan Wong, Monique Vanek and Paul Wallace.