China’s tech behemoths will shed more light on their prospects this week after peers signaled the industry is emerging from a volatile few years.

NetEase Inc., Xiaomi Corp., Meituan and Kuaishou Technology are among major players scheduled to announce their results. Earlier, internet search leader Baidu Inc. said an advertising rebound led to a stronger-than-expected 10% jump in the first quarter revenue. Tencent’s revenue growth was at its fastest pace in more than a year supported by China’s border reopening post-Covid, but sales from its advertising business missed forecast. This may signal an uneven recovery among Chinese tech giants.

A return to growth would mark a revival for the tech stocks, which have been heavily discounted in the past two years amid regulatory crackdown and stern Covid policies, Bloomberg Intelligence analyst Marvin Chen said.

The recent meeting between US and China officials is also easing geopolitical tensions as it set the stage for a possible call between the two countries’ leaders. Alibaba Group recently cleared a regulatory review by the US Securities and Exchange Commission for its fiscal 2022 annual report. The e-commerce leader said it will explore initial public offerings for two units and spin off its cloud arm after it posted sales that missed estimates.

But in an escalation of its semiconductor war with US, China said on Sunday that it found cybersecurity risks in Micron Technology Inc. products and warned against their use. Chip stocks in Asia rose after the country’s announcement.

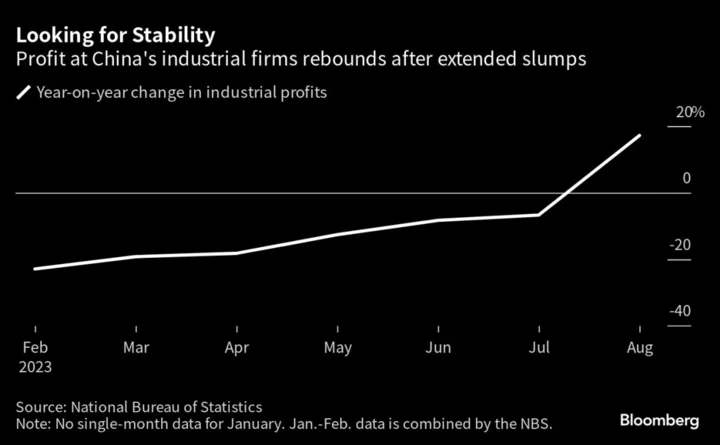

Clouding the outlook, China’s latest economic data showed the recovery is losing momentum after an initial burst in consumer and business activity early in the year, prompting calls for more policy stimulus. The nation’s central bank kept loan prime rates unchanged for May.

- As the region’s earnings season winds down, Asia Earnings Week Ahead will pause for the quarter and resume in late June.

- To subscribe to earnings coverage across your portfolio or other earnings analysis, run NSUB EARNINGS function on the Bloomberg terminal.

- For more on what’s going on in other regions, see the US Earnings Week Ahead or the EMEA Earnings Week Ahead, and see the ESG Week Ahead for a selection of the environmental, social and governance themes that may come up on earnings calls.

Highlights to look out for:

Monday: Kuaishou (1024 HK) is expected to meet, or even beat, estimates. First-quarter revenue may jump more than 16% from a year earlier, a Bloomberg survey shows. Strong live-streaming e-commerce sales during the Lunar New Year holiday were a boon, BI analysts Robert Lea and Tiffany Tam said. It should give an upbeat forecast, with e-commerce sales driving revenue over the next two quarters, they added. Jefferies analysts including Thomas Chong expect rapid growth in its high-margin online ad and e-commerce businesses, which are in the early stages of growth.

Tuesday: No major earnings expected.

Wednesday: Xiaomi’s (1810 HK) revenue and smartphone unit sales probably dropped by about a fifth year on year, a Bloomberg survey shows. It continued to suffer from lackluster consumer demand and destocking pressure, BI analysts Steven Tseng and Sean Chen said. Xiaomi’s market-share growth in China could be under strain from fewer physical stores, Tseng said, as consumers return to in-person shopping. The gross margin may improve on a shrinking proportion of low-margin products. Geopolitical tension between China and India is a headwind, but penetration in the EU and Latin America might offset that.

- XPeng Inc.’s (9868 HK) loss may widen from a year earlier, dragged down by fewer vehicle deliveries amid aggressive price cuts by Tesla. First-quarter revenue is expected to be at the top end of the company’s March guidance, which was as much as 4.2 billion yuan. The Chinese electric vehicle maker’s profitability may also be weighed down by more sales promotions and lower plant utilization, despite falling battery costs so far this year, BI analysts Joanna Chen and Steve Man said. Competition and new model rollouts may also limit margin improvement.

Thursday: Meituan’s (3690 HK) first-quarter revenue probably jumped more than 24% from a year earlier, though fell about 4% sequentially, a Bloomberg survey shows. The Chinese food delivery titan could stay profitable on an adjusted Ebitda basis this year if it scales back expansion of initiatives such as grocery retailing and ride sharing, according to BI analysts Catherine Lim and Trini Tan. Increasing spending on tourism and dining could boost its travel, hotel and in-store unit, making up for some costs, they added. The firm is also ramping up efforts to expand overseas, including services in Hong Kong by the first half of the year.

- NetEase (9999 HK) is set to report after the market close in Hong Kong. The gaming giant may see a 5% jump in first-quarter revenue from a year earlier, a Bloomberg survey shows. It may deliver earnings growth in the high-single-digit percentage range this year, BI analysts Robert Lea and Tiffany Tam said. A surge for Eggy Party, which released activities for the May golden-week holiday, probably spurred sales and downloads. Beijing’s approvals of regular games suggests regulators will support the industry, but analysts expect a decline in global mobile game net revenue after the easing of pandemic curbs.

- Weibo (9898 HK), due after the market close in Hong Kong, may post a 23% drop in first-quarter adjusted diluted EPS from a year earlier, a Bloomberg survey shows. The guidance for coming quarters will be key as the choppy recovery and global macroeconomic concerns threaten the sustainability of China’s consumption sentiment, BI analyst Tiffany Tam said.

Friday: Sun Pharmaceutical Industries (SUNP IN) will release fourth-quarter earnings. India’s biggest drugmaker is expected to report a profit, bouncing back from a massive loss last year due to one-time charges related to legal costs and an antitrust ruling. Regulatory issues continue to plague the company with its plant in western India facing import curbs in the US. Likely growth in other regions, price hikes and new launches may boost the company’s revenue. Domestic sales will be critical as intense competition in the US market is eroding generic drug prices. A ransomware attack in early March also impacted operations and may hurt revenues, the company had warned. Commentary on measures taken to address Halol plant issues will be watched.

--With assistance from Harshita Swaminathan.

Author: Felix Tam, Olivia Tam, Saket Sundria and Justina T. Lee