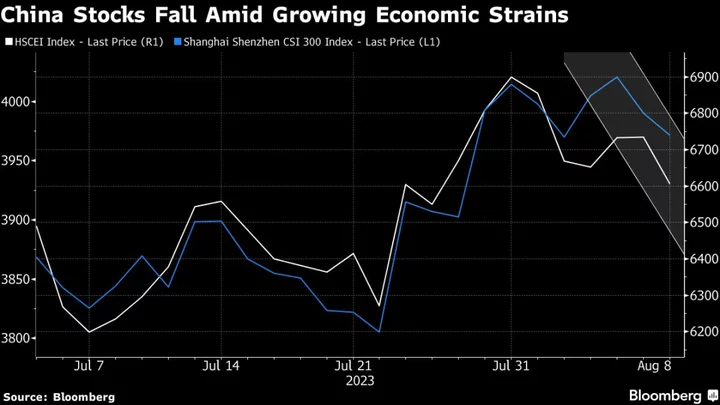

Chinese stocks in Hong Kong declined on Tuesday as investor concerns about the strength of the nation’s economic recovery persisted after the latest trade data.

The Hang Seng China Enterprises Index was down 1.4% as of 11:23 a.m. in Hong Kong, with the biggest decliners including property-related names like Longfor Group Holdings Ltd. and Country Garden Services Holdings Co. The onshore CSI 300 Index was little changed.

China’s economic recovery has witnessed increased signs of strain, with data Tuesday showing exports - a strong growth engine that supported the economy during the pandemic - fell for a third straight month in July. Imports plunged. Meanwhile, data on Wednesday will likely show consumer prices declined in July, which would be the first time since late 2020 that both consumer and producer prices register contractions.

“Deflation is a significant risk that reflects weak demand and it will impact earnings for corporate China,” said Marvin Chen, an analyst at Bloomberg Intelligence. “The upside is that the weaker inflation numbers leave the door open for more monetary easing.”

The boost China stocks received after Beijing showcased its determination to shore up the economy at the Politburo meeting at the end of July is fading fast. Economic data are pointing to more weakness, and the effects of pro-growth policies remain to be seen.

“People’s patience on stimulus is also waning,” said Willer Chen, senior research analyst at Forsyth Barr Asia Ltd.

READ: Bearish Bets on Country Garden Jump to Record as Doubts Grow (1)

--With assistance from Abhishek Vishnoi, Haidi Lun, David Ingles and Yvonne Man.