Chinese authorities have stepped up efforts in recent days to bolster financial markets in a sign that Beijing is growing uncomfortable with the pace of declines in stocks and the yuan.

Mainland exchanges this week asked some investment funds to avoid net selling equities. Officials requested state-owned banks to escalate intervention to support the yuan, while also encouraging companies listed on the tech-heavy Star Board to buy back shares. Earlier this month, China’s central bank met with private-sector property firms and pledged funding.

The moves complemented the People’s Bank of China’s surprise interest rate cut this week, which was the biggest reduction since 2020, and its most forceful yuan fixing guidance ever on Friday.

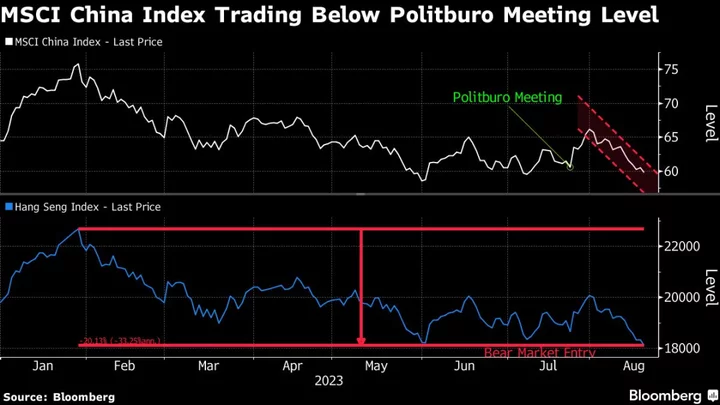

So far, the measures have yet to buoy the markets. A gauge of Hong Kong-listed Chinese stocks was on course for a third-straight week of losses. The Hang Seng Index is down more than 8% this year, ranking among the biggest global losers and on the brink of a bear market. While the yuan eked out marginal gains against the dollar Friday morning, it has fallen more than 5% this year.

Rattled by dismal economic data, deflation fears, a weakening housing market and a crisis in the shadow lending sector, the mainland financial markets are facing the possibility of a vicious cycle of capital outflows. Foreign investors were net sellers of Chinese stocks Friday, capping a record streak of outflows.

“Debt strains from property developers and local-government financing vehicles are spreading across China’s economy,” Gavekal Research analyst Xiaoxi Zhang wrote in a note dated Aug. 16.

Other investors stress a more positive longer-term view. Focusing on China’s problems may be backward-looking at this point as the time may be ripe to look for stock opportunities given declines in valuations, Joshua Crabb, head of Asia Pacific equities at Robeco Hong Kong Ltd., said in a Bloomberg Television interview.

Among other things, Crabb is expecting further stimulus to bolster consumption. Other items to watch in Beijing’s toolkit include a cut in the stamp duty on stock trading, lifting of foreign investment caps and relaxation of equity trading rules.

--With assistance from Paul Allen and Shery Ahn.