China took a fresh step to ensure funding costs in its financial markets are sufficiently low so a tentative pickup in the nation’s economy can take hold.

The People’s Bank of China handed lenders a record sum of cash via a short-term liquidity tool on Friday, as an indicator for funding costs surged to the highest since April. The operation is a sign that Beijing hopes to iron out swings in rates so lenders are willing to support a higher issuance of government bonds and make more loans to clients — necessary steps for the nation to bolster its growth.

The measure was also timed to support the cash demands of the upcoming tax season.

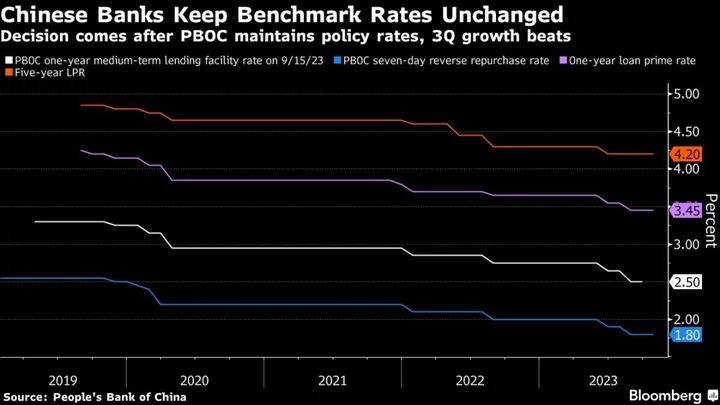

Throughout the year, Beijing has been scrambling to put the world’s second largest economy back on track, as a lack of demand and a downturn in the property sector eat into growth rates. It has cut benchmark rates and reserve requirements for banks twice and earlier this week made the largest medium-term liquidity injection in nearly three years.

The cash injections seen this week suggest the PBOC may “take more measures to assist the roll-out of fiscal stimulus,” said Bruce Pang, chief economist at Jones Lang LaSalle Inc. However, the chances for interest rate cuts have declined as the yuan remains weak and other global central banks are still hawkish.

China’s easing measures are having some effect. Gross domestic product expanded at a faster pace than analyst forecasts in the third quarter and retail sales also beat estimates last month, according to data released this week.

The injection of extra cash may also help ease market concerns over a liquidity crunch, as central and local governments are expected to sell more bonds to fund stimulus and as the tax payment season approaches. Regional authorities are paying higher yield premiums over sovereign benchmarks as they sell bonds, and rates on short-term bank debt have soared.

The steps may also play a role in steadying government bonds, which are suffering outflows due to their widest yield discount to US peers since 2002.

Beijing is considering a new round of stimulus to help the economy meet the official annual growth target of around 5%.

China could sell up to 830 billion yuan ($113 billion) of additional sovereign bonds throughout the rest of 2023 and beyond, UBS Group AG economists including Wang Tao wrote in a note this week. It may also set a higher fiscal deficit and larger quota for special local government bonds next year, they said.

In September, the Ministry of Finance sold 1.2 trillion yuan of central government bonds, 60% higher than the average for the same period in the past three years, a move which helped drain cash from the system.

However, despite Friday’s operation, liquidity remains scarce with gauges of short-term borrowing costs rising across the the curve. China’s big banks significantly reduced their lending to other institutions amid tighter conditions, according to traders who asked not to be named as they aren’t authorized to comment on the market publicly.

The PBOC injected a net 733 billion yuan of cash with the so-called reverse repurchase contracts on Friday. The seven-day repo rate, a gauge of interbank funding costs, surged 25 basis points to a six-month high of 2.32%.

Also on Friday, Chinese lenders kept the one-year loan prime rate steady at 3.45% while also leaving the five-year rate — a reference for mortgages — unchanged at 4.2%, according to data from the PBOC. Most economists polled by Bloomberg had forecast no change for either rate.

“With the positive surprise in third-quarter GDP and better September data, the need to step up easing measures has reduced somewhat,” said Michelle Lam, an economist at Societe Generale SA. The PBOC will likely reduce policy rates by 10 basis points and also slash lenders’ reserve-requirement ratios by year-end, she added.

--With assistance from Jing Zhao.

(Updates throughout.)