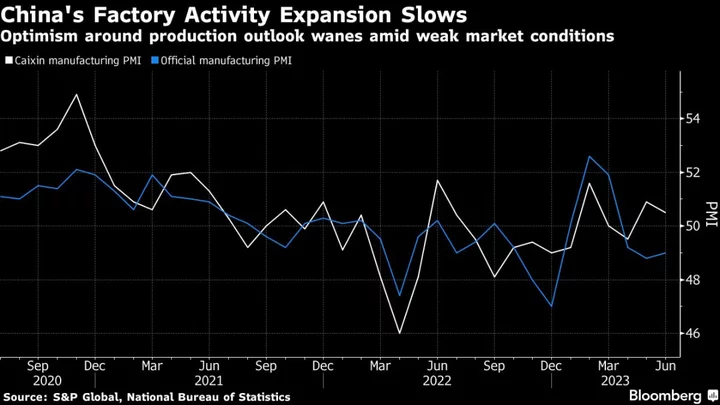

China’s manufacturing activity expanded at a slower pace in June as companies turned more cautious about their output outlook, according to a private survey.

The Caixin manufacturing purchasing managers index hit 50.5 last month, easing from 50.9 in May. Economists polled by Bloomberg had predicted the index to register a reading of 50 — exactly the line separating expansion from contraction.

The Caixin survey covers mainly smaller and export-oriented businesses as compared to the the official PMI, which last week showed manufacturing activity remaining in contractionary territory for a third straight month.

The data points to evidence that China’s economic recovery is cooling, with recent figures also showing weakness in everything from consumer spending to the housing market, exports and infrastructure investment.

“A slew of recent economic data suggests that China’s recovery has yet to find a stable footing,” said Wang Zhe, senior economist at Caixin Insight Group, in a statement accompanying the release of the survey results Monday.

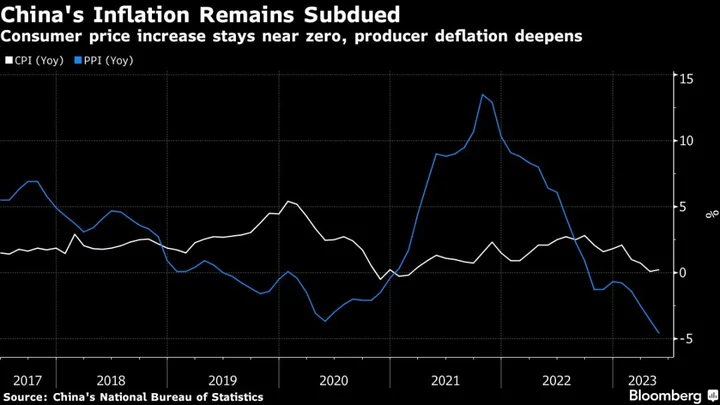

The Caixin report also showed manufacturers reporting growing concerns about an increasingly dire job market, rising deflationary pressure and waning optimism, he added.

Read More: China Growth Momentum Slows Further Amid Calls for Stimulus

Wang said that stronger macro policy support and more efficient implementation of actions from a micro perspective are needed.

The Caixin survey showed optimism around the 12-month outlook for production waning to an eight-month low in June, as some firms expressed concerns over relatively sluggish market conditions.

Manufacturers cut their staffing levels for a fourth straight month due to weaker than expected sales and efforts to readjust capacity, the survey showed.