The US new-car market is returning to pre-pandemic norms as supply-chain issues resolve, forcing carmakers to ramp up deals to sustain sales growth.

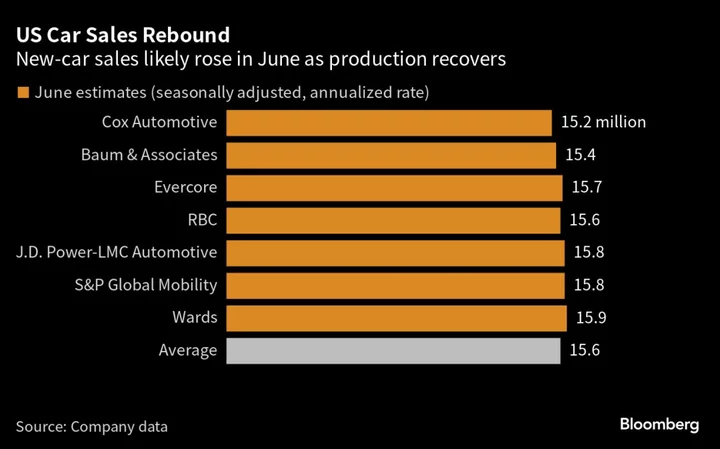

The annual pace of new-car sales likely rose to 15.6 million in June, from 13 million a year ago, according to the average forecast of seven market researchers. Cox Automotive raised its full-year forecast to 15 million, from 14.2 million in March, as deliveries to businesses and rental-car companies, which evaporated during pandemic scarcity, rebounded.

“Pent-up demand from individuals and business that couldn’t find product last year is now being unleashed,” Charlie Chesbrough, senior economist at Cox, said on a call with reporters this week. “Not only has supply returned to the market, but so has discounting.”

Car prices have skyrocketed in recent years from a confluence of factors. For two years auto manufacturers and dealers took advantage of tight inventory due to supply problems to jack up car prices. That fueled inflation and triggered interest rate hikes, which together bumped up the overall cost of owning a car.

Meanwhile, more mass-market models sell for premium prices as carmakers stuff vehicles with expensive tech features and luxurious interiors. For their part, electric vehicles, which are gaining in popularity, tend to cost more than combustion cars because of their expensive lithium-ion batteries.

Now that the semiconductor shortage is easing, manufacturer incentives are making a comeback and prices are starting to ebb, albeit slowly. Incentives made up 4.2% of the sticker price on a new car on average as of May, up from 2.4% last October, and are poised to keep climbing, according to consulting firm AlixPartners.

The average price of a new car was $47,892 in May, down 1.3% from its peak in December, according to Edmunds.

“We’re still in a pull market, but getting much more normalized over this period, which puts pressure on pricing, and of course pressure on manufacturer profits,” said Mark Wakefield, head of the automotive practice at AlixPartners’ office outside Detroit.

Costs continue to drive shoppers into the used market, said David Kelleher, owner of a Chrysler, Dodge, Jeep and Ram dealership in Philadelphia.

“I’ll have a customer come back on a three-year lease on a Ram truck — he leased the truck for $394 a month three years ago. I say, ‘Well, great news, you’re going to be at $687.’”

“That’s very difficult to do,” Kelleher said. “It’s led to a choppy market.”

Jeep, Ram and Nissan offered the highest incentives as a percentage of transaction price among a dozen brands in May, according to analysis by Cox Automotive.

General Motors Co. likely increased market share in the first half of the year by outselling all of its peers, while Honda Motor Co. and Tesla Inc. also gained share, according to Cox. Toyota Motor Corp and Stellantis NV lost market share, according to the forecast. Many of the largest car companies, including GM and Toyota, will report second-quarter US sales numbers on Monday.

Second Half Outlook

The need to replenish dealer lots will continue to drive sales in the second half of the year, though analysts are doubtful the industry can maintain the same momentum. Automakers have also vowed to keep a tighter rein on inventory to preserve pricing power.

Prior to the pandemic, annual US auto sales topped 17 million for five consecutive years, well above the 15 million forecast for 2023.

Tesla, which slashed prices earlier this year to defend its position as the EV market leader, could also pressure automakers to swallow more of the cost of electric vehicles.

“There will be an easing of the current record levels of pricing and profitability as manufacturer incentives gradually increase,” said Thomas King, president of data and analytics at J.D. Power. “Nevertheless, this will be offset to some extent by an increase in overall sales volumes.”