SASKATOON, Saskatchewan--(BUSINESS WIRE)--Nov 7, 2023--

All amounts in Canadian dollars unless specified otherwise

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231107426694/en/

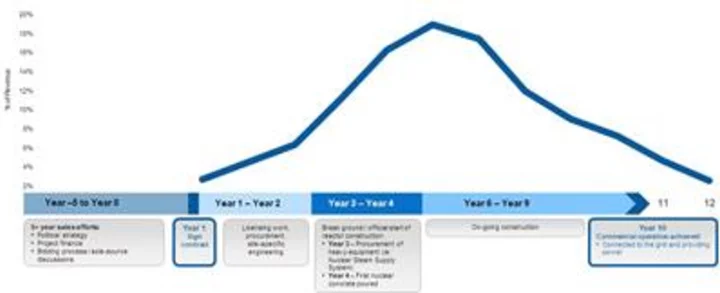

Figure 1: Illustrative framework of Westinghouse revenue flow for reactor new build project (Graphic: Business Wire)

Cameco (TSX: CCO; NYSE: CCJ) announced that the acquisition of Westinghouse Electric Company (Westinghouse) in a strategic partnership with Brookfield Asset Management alongside its publicly listed affiliate Brookfield Renewable Partners (Brookfield) and institutional partners closed today.

Cameco now owns a 49% interest and Brookfield owns the remaining 51% in Westinghouse, one of the world’s largest nuclear services businesses.

“This is a historic day for Cameco as we join Brookfield to complete our purchase of Westinghouse,” said Tim Gitzel, president and CEO of Cameco. “Since first announcing this deal a year ago, we believe the business prospects for Westinghouse have significantly improved. The sustained and positive momentum for nuclear energy has been undeniable as countries and companies around the world strive to meet their net-zero commitments and growing energy needs through clean and secure supply.

“Cameco’s 35 years of experience in uranium mining and nuclear fuel production combined with Brookfield’s expertise in clean energy is expected to provide a solid foundation for Westinghouse’s continued success in the provision of nuclear plant technologies, products and services, and to create a powerful platform for strategic growth across the nuclear sector. The partners, together with Westinghouse, are well-positioned to provide global solutions for the increasing need for secure, reliable and emissions-free baseload power.

“Our priorities over the coming weeks will include Cameco and Brookfield conducting our first Westinghouse board meeting focused on its strategic business plan. Cameco also has a number of international commitments to fulfil over the next month with some of the most influential countries, world leaders and global organizations who are seeking our advice on how to help nuclear power realize its full potential and further amplify its contributions to a clean and secure energy future. Once those commitments have been fulfilled, Cameco will host a virtual investor day on December 19, 2023, to further discuss the exciting business prospects we see moving forward for Westinghouse,” Gitzel said. Additional information and registration details for the virtual investor day can be found at the end of this release and on Cameco’s website.

The total enterprise value of $7.9 billion (US) was adjusted for working capital balances at the close, resulting in a final enterprise value of $8.2 billion (US). Westinghouse has $3.8 billion (US) in outstanding debt commitments, for which it maintains responsibility after closing and which reduces the equity cost of the acquisition.

To finance Cameco’s 49% share of the purchase price, equaling $2.1 billion (US), we used $1.5 billion (US) of cash and drew the full amount of both $300 million (US) tranches of the term loan put in place concurrently with the execution of the acquisition agreement, and which mature two years and three years from the date of close. The $280 million (US) bridge commitment that we also secured concurrently with the acquisition agreement was not required to complete the transaction and has been terminated.

The mix of capital sources to finance our share of the acquisition was chosen to preserve our balance sheet and ratings strength while maintaining healthy liquidity. We expect to maintain the financial strength and flexibility to execute on our strategy and take advantage of value-adding growth opportunities, while navigating by our investment-grade rating and self-managing risk. With exposure to improving prices under our long-term contract portfolio and the ongoing ramp-up to our tier-one run rate, we expect to see continued improvement in our earnings and cash flow profile.

Today, we believe the demand outlook for nuclear power is better and more durable than ever, driven by the recognition of the critical role it must play in helping to solve the world’s dual climate and energy security crises. We expect this acquisition will enhance Cameco’s participation in the nuclear fuel cycle at a time when there is tremendous growth on the horizon for our industry. Globally, policy makers are focused on how to accelerate investment in the expansion of the nuclear reactor fleet by removing barriers and strengthening the nuclear fuel supply chain needed to allow nuclear power to deliver on its promise to help provide a clean and secure energy future.

We expect this strategic and transformative acquisition will be accretive to Cameco. We are enhancing our ability to compete for more business by investing in additional nuclear fuel cycle assets that we expect will augment the core of our business and offer more solutions to our customers across the nuclear fuel cycle. Like Cameco, Westinghouse has nuclear assets that are strategic, proven, licensed and permitted, and that are in geopolitically attractive jurisdictions. We expect these assets, like ours, will participate in the growing demand profile for nuclear energy.

Westinghouse has a stable and predictable core business generating durable cash flows. Like Cameco, Westinghouse has a long-term contract portfolio, which positions it well to compete for growing demand for new nuclear reactors and reactor services, as well as the fuel supplies and services needed to keep the global reactor fleet operating safely and reliably. This strong base of business also helps protect Westinghouse from macro-economic headwinds as utility customers run their critical nuclear power plants. Its durable and growing business is expected to allow Westinghouse to self-fund its approved annual operating budget, to maintain its existing capacity to service its annual financial obligations from de-risked cash flows, and to pay annual distributions to its owners.

Westinghouse financial performance for the nine-month period ended September 30, 2023

The following financial information is derived from the consolidated financial statements of Westinghouse, which are reported in US dollars and prepared in accordance with US GAAP. EBITDA, Adjusted EBITDA, Levered free cash flow, and Adjusted EBITDA Margin are non-GAAP financial measures and should not be considered in isolation or as a substitute for financial information prepared according to accounting standards. Other companies may calculate these measures differently, so a direct comparison to similar measures presented by other companies may not be possible. The table below reconciles these measures to the closest US GAAP measure. See Westinghouse non-GAAP Measures below for more information.

We believe Westinghouse is well-positioned for long-term growth driven by the expected increase in global demand for nuclear power. Cameco will receive the economic benefit of its ownership in Westinghouse as of today’s close. Cameco will account for its proportionate interest in Westinghouse on an equity basis.

Westinghouse summary financial information and 2023 outlook

YEAR ENDED | NINE MONTHS | ||||

DECEMBER 31 | ENDED SEPTEMBER 30 | OUTLOOK | |||

($USD MILLIONS) | 2021 | 2022 | 2022 | 2023 | 2023 |

Net earnings (loss) | 126 | 440 | 393 | (50) | 0-40 |

Depreciation and amortization | 314 | 371 | 270 | 230 | 300-310 |

Finance income | (1) | (2) | (1) | (8) | (9-11) |

Finance costs | 187 | 202 | 148 | 223 | 290-310 |

Income tax expense (recovery) | (17) | (392) | (424) | 10 | 20-40 |

EBITDA | 609 | 619 | 386 | 405 | 610-650 |

Other (income) expenses | 10 | (5) | (7) | 12 | 10-15 |

(Gain) loss on disposal of fixed assets | 7 | (4) | (5) | 4 | 3-5 |

Loss on derivatives | 2 | - | - | - | - |

Restructuring & acquisition related costs | 67 | 92 | 66 | 76 | 85-95 |

Gain on disposition of businesses | - | - | - | (14) | (14) |

Adjusted EBITDA | 695 | 702 | 440 | 483 | 690-750 |

Capital expenditures | 154 | 165 | 95 | 125 | 170-190 |

Required debt payments | 30 | 37 | 25 | 32 | 40-45 |

Levered adjusted free cash flow | 511 | 500 | 320 | 326 | 475-525 |

Revenue | 3,286 | 3,784 | 2,564 | 3,051 | 4,200-4,400 |

Adjusted EBITDA margin | 21% | 19% | 17% | 16% | 16%-18% |

US GAAP |

Note: the ranges for 2023 outlook for EBITDA, Adjusted EBITDA and Levered Adjusted Free Cash Flow are not determined using the high and low estimates of the ranges provided for each of the detailed reconciling line items.

The expected outlook for Revenue is based on work already in backlog or additional work expected based on past trends. The expected margins are aligned with the year-to-date margins with slight variability expected from product mix in the fourth quarter as compared to previous quarters.

The primary drivers of the expected improvement in Revenue for 2023 are the contributions from new business opportunities in markets such as Central and Eastern Europe and the benefits accruing from key business acquisitions made in 2022, which have increased sales volumes in the core business. The expected Adjusted EBITDA for 2023 is being impacted by planned expenditures for strategic initiatives, including the development of the AP300™ small modular reactor (SMR) and the eVinci™ microreactor. These investments are expected to provide new business opportunities for Westinghouse in an emerging segment of our industry, and we are optimistic about the potential for the future deployment of these technologies to make a meaningful contribution to Westinghouse’s long-term financial performance.

In 2023, over 95% of Westinghouse’s Adjusted EBITDA is expected to come from its core recurring business, which is stable and characterized by long-term contracts. The remaining 2023 projected Adjusted EBITDA is expected to come from the energy systems business unit.

In general, the new reactor activity is driven by large, binary decisions by countries and companies to use Westinghouse’s technology, such as the licensed AP1000® reactor design, for the construction of new nuclear power plants. Once contracts are signed and work begins, these projects are expected to generate multi-year revenue streams and EBITDA for Westinghouse.

In addition to the AP1000 reactors already deployed in the US and China, Poland recently signed an engineering services contract for three AP1000 reactors for its new nuclear energy program. Ukraine has also selected the AP1000 reactor for nine units and has signed an engineering services contract for the first unit, and Bulgaria has chosen the AP1000 reactor for two units at the Kozloduy nuclear site. Engineering services contracts are required before work can begin. See AP1000 reactor new build framework below for more information.

Cash distributions

Annually, the partners approve a budget and business plan which outline the financial projections and capital allocation priorities. The determination of whether to make cash distributions to the partners will be reviewed quarterly based on the approved budgeted expenditures and capital allocation priorities, including growth investment opportunities, as well as available cash balances. However, the timing of cash distributions is expected to be aligned with the timing of Westinghouse’s cash flows, which are typically higher in the fourth quarter. Due to the timing of the close of this transaction, we do not expect to receive any cash distributions in 2023.

Core growth beyond 2023

Westinghouse’s core business is characterized by recurring and predictable revenue and cash flow streams, the majority of which are secured in advance under long-term contracts with durations that can range from 3 to more than 10 years, depending on the product or service being provided. Amid the ongoing demand growth and global energy security concerns, we expect there will be new opportunities for Westinghouse to compete for and win new business. Westinghouse’s reputation as a global leader in the nuclear industry and its position as a non-Russian alternative supplier for certified VVER fuel assemblies are expected to benefit its core business as Eastern European countries seek to develop a reliable fuel supply chain independent of Russia. Revenue and Adjusted EBITDA over the next three years in Westinghouse’s core business are expected to grow at approximately the anticipated average annual growth rate of the nuclear industry, which, based on the World Nuclear Association’s Reference Case, is estimated at 3.6%.

AP1000 reactor new build framework

In addition to growth in its core business, the focus on the importance of nuclear power in providing carbon-free, secure and affordable baseload power as an essential part of the electricity grid in many countries is creating new opportunities for Westinghouse’s proven AP1000 reactor design, as well as the smaller reactor designs it has in development. Its technology and experience provide a competitive advantage as the engineering and procurement aspects of new build programs are initiated.

Westinghouse undertakes its role in the design, development, engineering and procurement of equipment for new reactors. It does not provide construction services or assume any construction risk. This segment has the potential to add significant long-term value during the construction phase, and then to the core of the business through reactor services and fuel supply contracts once the reactor begins commercial operation.

Following an announcement of a successful bid, there are a number of contracts that must be signed before revenue is realized. As these large, one-time decisions by utilities to construct new nuclear power plants using Westinghouse’s proven AP1000 reactor design are made and as the associated engineering and procurement contracts are signed, we expect it will drive growth beyond that of its core business described above. However, until the contracts are signed, they will not be incorporated in the growth expectations.

The following is an illustrative framework for the expected timing of revenue flows and profitability of the energy systems business unit. (See Figure 1)

Assumptions and estimates:

- Cost to construct new AP1000 reactor in US based on MIT (Massachusetts Institute of Technology) study: $6 billion to $8 billion (US), although it can vary significantly depending on in-country labour and construction productivity rates. There is a measured and noticeable scale effect where multiple reactors have been built – for example, in China, where four AP1000 reactors are in operation and six more are under construction, and the US, where two were built and one is in operation.

- Engineering and procurement work: 25% to 40% of total plant cost, depending on the scope of the project – excluding China, where Westinghouse scope is typically less than 10% of the total project cost.

- EBITDA margin for new build activity is expected to be aligned with the overall core business, although it can vary between 10% to 20%.

Other growth opportunities

In addition to its AP1000 reactor design, Westinghouse has submitted its pre-application Regulatory Engagement Plan with the US Nuclear Regulatory Commission for the development of its AP300 SMR, which is based on the proven and licensed AP1000 reactor design. Its eVinci microreactor design was recently awarded US Department of Energy funding for a test reactor FEED (front-end engineering design) at Idaho National Lab. The AP300 SMR and the eVinci microreactor are expected to offer the same carbon-free baseload benefits as larger nuclear reactor technologies, but are tailored for specific applications, including industrial, remote mining, off-grid communities, defense facilities and critical infrastructure. As with the AP1000 reactor, they are expected to have applications beyond electricity generation, including district and process heat, desalination and hydrogen production. We are optimistic about the future competitiveness of these technologies and their potential to make a meaningful contribution to Westinghouse’s long-term financial performance. However, they are presently still in the development phase.

Background

The acquisition of Westinghouse was completed in the form of a limited partnership with Brookfield. The board of directors governing the limited partnership consists of six directors, three appointed by Cameco and three appointed by Brookfield. Decision-making by the board corresponds to percentage ownership interests in the limited partnership (49% Cameco and 51% Brookfield). However, decisions with respect to certain reserved matters under the partnership agreement, such as the approval of the annual budget, require the presence and support of both Cameco and Brookfield appointees to the board as long as certain ownership thresholds are met.

Westinghouse is a nuclear reactor technology original equipment manufacturer and a leading provider of highly technical aftermarket products and services to commercial nuclear power utilities and government agencies globally. The company has recurring and predictable revenue and cash flow profiles due to the critical and non-discretionary nature of its products and services to the operation of nuclear power plants around the world. Like Cameco, Westinghouse enables zero-emission baseload and dispatchable energy that is needed to support the energy transition, and it is therefore well-positioned for long-term growth.

Westinghouse’s core business includes:

- The critical engineering design and analysis of operating plants to enhance safety, availability and reliability. It delivers advanced products and services for outage support, including plant components, inspections, maintenance, repair and modification, and replacement. In addition, it engineers and manufactures specialized components for new and operating plants, including safety and non-safety instrumentation and control products, and provides services throughout the full nuclear power plant operating lifecycle. This work represents a large component of its core business and is built on long-term customer relationships characterized by long-term contracts. These customers seek solutions to ensure their reactors operate efficiently and reliably, and the business therefore results in recurring and predictable revenue streams.

- The design, manufacture and delivery of nuclear fuel products and services to customers across the globe and across multiple light water reactor technologies.

- The provision of nuclear sustainability, environmental stewardship and remediation services for retired nuclear power plants and site management to government customers.

As noted earlier, in addition to its core business, Westinghouse is involved in the design, development, engineering and procurement of equipment for new AP1000 plant projects and is also active in the design and development of next-generation nuclear technologies, including its AP300 SMR and eVinci microreactor.

Westinghouse non-GAAP measures

The non-GAAP measures referenced in this document are used as indicators of the financial performance of Westinghouse. Management believes that these non-GAAP measures provide useful information to investors, securities analysts and other interested parties in assessing the operational performance of Westinghouse and its ability to generate cash. These measures are not recognized measures under US GAAP, do not have a standardized meaning, and are therefore unlikely to be comparable to similar measures presented by other companies. Accordingly, these measures should not be considered in isolation or as a substitute for the financial information reported under US GAAP.

EBITDA

Westinghouse’s EBITDA is defined as Westinghouse’s net earnings, adjusted for the costs related to the impact of the company’s capital and tax structure including: (a) depreciation and amortization, (b) finance income, (c) finance costs (net, including accretion), and (d) income tax expense (recovery).

Adjusted EBITDA

Westinghouse’s Adjusted EBITDA is defined as Westinghouse’s EBITDA, adjusted for the impact of certain expenses, costs, charges or benefits incurred in such period, which are either not indicative of underlying business performance or that impact the ability to assess the operating performance of Westinghouse’s business, including: (a) other (income) expenses, (b) (gain) loss on disposal of fixed assets, (c) loss on derivatives, (d) restructuring and acquisition-related costs, and (e) gain on disposition of businesses. Westinghouse may realize similar gains or incur similar expenditures in the future.

Adjusted levered free cash flow

Westinghouse’s Adjusted levered free cash flow is defined as Westinghouse’s Adjusted EBITDA less capital expenditures and required debt repayments for the appropriate period.

Adjusted EBITDA margin

Westinghouse’s Adjusted EBITDA margin is defined as Westinghouse’s Adjusted EBITDA divided by revenue for the appropriate period.

EBITDA, Adjusted EBITDA, Adjusted levered free cash flow, and Adjusted EBITDA margin are supplemental measures which are used by Cameco and other users, including Cameco’s lenders and investors, to assess Westinghouse’s results of operations from a management perspective without regard to its capital structure. Cameco believes that these measures are useful to management, lenders and investors in assessing the underlying performance of its ongoing operations and its ability to generate cash flows to fund its cash requirements.

Investor Day

Cameco will be hosting a Virtual Investor Day on December 19, 2023, starting at 9:30 a.m. Eastern to discuss Westinghouse, its future business prospects, and the expected impact on Cameco’s business operations and financial performance.

The webcast will be open to all investors and the media. Interested parties can register for this event at www.cameco.com or https://edge.media-server.com/mmc/p/c9xowjww.

Profile

Cameco is one of the largest global providers of the uranium fuel needed to energize a clean-air world. Our competitive position is based on our controlling ownership of the world’s largest high-grade reserves and low-cost operations. Utilities around the world rely on our nuclear fuel products to generate safe, reliable, carbon-free nuclear power. Our shares trade on the Toronto and New York stock exchanges. Our head office is in Saskatoon, Saskatchewan, Canada.

Caution Regarding Forward-Looking Information and Statements

This news release includes statements and information about our expectations for the future, which we refer to as forward-looking information. Forward-looking information is based on our current views, which can change significantly, and actual results and events may be significantly different from what we currently expect.

Examples of forward-looking information in this news release include: our expectation on maintaining financial strength and flexibility; our expectation for improvement in earnings and cash flows; our expectation of the demand outlook for nuclear power; our expectation that the acquisition will enhance our participation in the nuclear fuel cycle; our expectation of accretion from the acquisition on us; our expectation that the investment will augment the core of our business; our expectation of Westinghouse being able to participate in the growing demand profile for nuclear energy; our expectation that Westinghouse’s durable and growing business will allow Westinghouse to self-fund its approved annual operating budget, maintain its existing capacity to service its annual financial obligations from de-risked cash flows, and pay annual distributions to its owners; our expectation in respect of an increase in global demand for nuclear power; our 2023 outlook for Westinghouse’s Adjusted EBITDA, capital expenditures and Revenue; our expectation for 95% of Westinghouse’s Adjusted EBITDA coming from its core recurring business; our expectation for the remaining 2023 projected Adjusted EBITDA coming from energy systems business unit which reflects the planned 2023 investments in strategic initiatives, including the development of the AP300 small modular reactor (SMR) and the eVinci microreactor; our expectation that such investments providing new business opportunities for Westinghouse will make a meaningful contribution to Westinghouse’s long-term financial performance; our expectation for Westinghouse projects generating multi-year revenue streams and EBITDA for Westinghouse; our expectation that the timing of cash distributions from Westinghouse will be aligned with the timing of Westinghouse’s cash flows; our expectation that Westinghouse’s new opportunities will allow Westinghouse to compete for and win new business; our expectation that Westinghouse’s reputation and position will benefit its core business as Eastern European countries seek to develop a reliable fuel supply chain; our expectation on the growth of Westinghouse’s revenue and Adjusted EBITDA over the next three years; our estimates in respect of the framework for the timing of revenue flows and profitability of contracts under a new build project; our expectation with respect to the development of its AP300 SMR and our expectation on Westinghouse being well-positioning for future growth.

Material risks that could lead to different results include: unexpected changes in uranium supply, demand, long-term contracting, and prices; changes in consumer demand for nuclear power and uranium as a result of changing societal views and objectives regarding nuclear power, electrification and decarbonization; the risk that our views regarding nuclear power, its growth profile, and benefits may prove to be incorrect; the risk that we and Westinghouse may not be able to meet sales commitments for any reason; the risk that Westinghouse may not achieve the growth in its business; the risk to Westinghouse’s business associated with potential production disruptions, including those related to global supply chain disruptions, global economic uncertainty, political volatility, labour relations issues, and operating risks; the risk that Westinghouse may not be able to implement its business objectives in a manner consistent with its or our environmental, social, governance and other values; the risk that Westinghouse’s strategies may change, be unsuccessful, or have unanticipated consequences; the risk that Westinghouse may be unsuccessful in respect of its new business; and the risk that Westinghouse may be delayed in announcing its future financial results.

In presenting the forward-looking information, we have made material assumptions which may prove incorrect about: nuclear power and uranium demand, supply, consumption, long-term contracting, growth in the demand for and global public acceptance of nuclear energy, and prices; Westinghouse’s production, purchases, sales, deliveries, and costs; the assumptions and discussion set out above under the heading Westinghouse summary financial information and 2023 outlook; the market conditions and other factors upon which we have based Westinghouse’s future plans and forecasts; Westinghouse’s ability to mitigate adverse consequences of delays in production and construction; the success of Westinghouse’s plans and strategies; the absence of new and adverse government regulations, policies or decisions; that there will not be any significant adverse consequences to Westinghouse’s business resulting from business disruptions, including those relating to supply disruptions, economic or political uncertainty and volatility, labour relation issues, and operating risks; and Westinghouse’s ability to announce future financial results when expected.

Please also review the discussion in our 2022 annual MD&A, our 2023 third quarter MD&A and our most recent annual information form for other material risks that could cause actual results to differ significantly from our current expectations, and other material assumptions we have made. Forward-looking information is designed to help you understand management’s current views of our near-term and longer-term prospects, and it may not be appropriate for other purposes. We will not update this information unless we are required to by securities laws.

Preliminary Financial Information

Westinghouse reports its financial results in accordance with US GAAP. All projected financial information and metrics in this presentation are preliminary. These estimates are not a comprehensive statement of Westinghouse’s financial position and results of operations. There is no assurance that Westinghouse will achieve its forecasted results within the relevant period or otherwise.

View source version on businesswire.com:https://www.businesswire.com/news/home/20231107426694/en/

CONTACT: Investor inquiries:

Cory Kos

306-716-6782

cory_kos@cameco.comMedia inquiries:

Veronica Baker

306-385-5541

veronica_baker@cameco.com

KEYWORD: NORTH AMERICA CANADA

INDUSTRY KEYWORD: NATURAL RESOURCES ENERGY NUCLEAR MINING/MINERALS OTHER ENERGY

SOURCE: Cameco

Copyright Business Wire 2023.

PUB: 11/07/2023 02:57 PM/DISC: 11/07/2023 02:57 PM

http://www.businesswire.com/news/home/20231107426694/en