Sticky inflation, rising bills and the fastest set of interest rate hikes in a generation have plunged the UK into a deep cost-of-living crisis. For Britain’s youngest workers, the pain stretches deeper; the country’s adult Zoomers, now in the first half of their twenties, face a toxic cocktail of exorbitant housing costs, weakening job prospects and a heavy load of student debt.

Together the headwinds threaten to choke not just their ability to progress economically, but also the future prosperity of a country that desperately needs to fill jobs. Anemic growth means there’s no immediate end in sight.

Recent economic data suggests that there’s little reason to be optimistic that living standards are set to improve either; productivity growth has stalled and workers are suffering from long-term health issues. The government is also facing public sector workers striking about their pay, many of whom are threatening to leave for better prospects; one in three NHS junior doctors said they planned to move abroad for better pay and working conditions, according to a poll carried out late last year by the British Medical Association, a trade union body.

“Without productivity growth, we’re not going to see the real wage growth or the kind of improvement in living standards that younger generations previously expected over their lifetime,” said Sophie Hale, principal economist at the Resolution Foundation, an economic think tank.

“High inequality in the UK is causing issues for younger generations, but it’s particularly for lower- and middle-income households where that combination of high inequality and and really slow growth is a particularly toxic combination,” she said. “They’ve seen this really big decline in relative living standards over the past of decade and a half.”

Here’s a snapshot of what life is life for Britain’s young:

Wages

While the UK has so far managed to avoid a recession, alarm bells are ringing. The Bloomberg Reed Jobs Report shows that job postings are down almost a quarter in the three months to June from a year earlier, an indicator that a possible downturn that could lead to layoffs may be on the horizon.

A university education, long heralded as an earnings booster, is also no longer enough to help boost pay. Analysis of advertised graduate roles on Reed Recruitment shows that the average salary growth began to slump just as price rises picked up pace, leading to real-term cuts for these workers. Meanwhile, both Prime Minister Rishi Sunak and Bank of England Governor Andrew Bailey have called for wage restraint to avoid fueling inflation.

Read more: England’s Graduates Suffer the Worst Jobs Market in Years

At the same time, the country’s tax burden is the highest since the end of the Second World War, and more workers are being dragged into paying more to the Treasury as thresholds stay frozen. Put together, disposable income per head has fallen for British households in five of the last six quarters. While older workers may be able to fall back on savings, the same isn’t true for recent graduates. That also helps to explain why 10.4% of newly enrolled employees are opting out of making pension contributions, according to the most recent data from last August.

There’s another factor at play too: if workers in the wider economy think their wages aren’t going up, it’s because the increase is limited. Although average income after housing costs in the country climbed 300% between 1961 and 2019-2020, that growth was uneven, according to analysis by the Resolution Foundation. While households saw bigger jumps in the earlier period, real household income barely increased over the 15 years before the Covid-19 pandemic. That period also saw the weakest economic growth since the inter-war period between 1919 to 1934.

This is a British problem. When comparing spending power across Europe between 2007 to 2018, households saw a jump of 27% in Germany and 34% in France, the think tank’s analysis shows. The UK meanwhile saw a 2% fall over the same period.

Student Loans

The impact of having a university education interrupted by the Covid-19 pandemic is hard to quantify. What can be calculated, however, is recent graduates’ looming student debt. The average forecasted debt for students in England who started their course in the 2022-23 academic year is £45,600 ($58,956) when they leave university compared with £15,000 for those who started their course in 2006-07. The debt carried by students who study at English universities is high when compared internationally, according to OECD analysis.

Students who begin their university career last year likely took out loans with repayment rates that increase yearly in line with retail price inflation (or up to 3% above RPI for those who earn more than £49,130 per year). While the government introduced a temporary cap on the maximum interest rate attached to those loans, fixing it at 7.1%, it’s due to revert in September. March’s RPI reading came in at 10.1%.

Regardless of the loan amount, graduates pay 9% of their salary above £27,295 towards reducing their debt, which is wiped out 30 years after they start paying. This means the elevated rate has limited impact for some, but also ensures that others will spend more time paying towards it.

New student debt arrangements, starting with this autumn’s first-year university students, will lock graduates into a 40-year schedule with a lower repayment threshold, stretching the burden — and affecting potential savings — into their sixties.

Housing

Even with the government restricting the ceiling, the interest on student loan payments is still higher than that of the average home loan. But a mortgage isn’t typically on the minds of the youngest working generation as house price growth and scarce housing stock have essentially locked many Britons out of homeownership. A first-time homebuyer forks out an average of 5.5 times their annual salary for a house, and the ratio rises to 8.9 for London properties.

This means that Britons are increasingly relying on help from parents to buy their first property — and those who are lucky enough to receive this support end up with a deposit that’s more than double their colleagues, and a smaller loan. Those without help from relatives — often referred to as the ”Bank of Mum and Dad” — have a 10-year disadvantage in buying a home at a similar price level (£254,000).

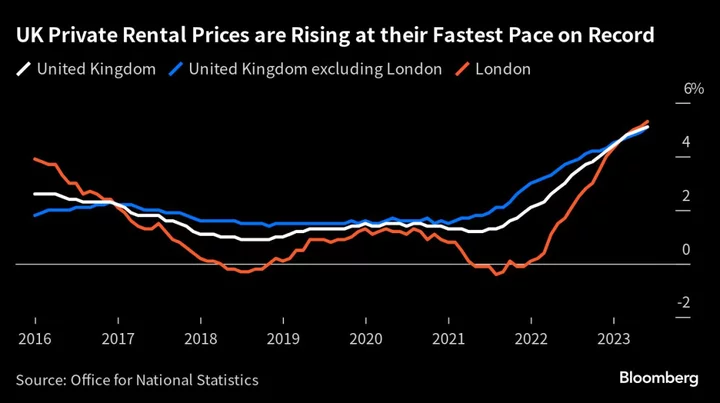

At the same time, the rental market is no more affordable. Rents paid by private tenants rose 5.1% in the year to June, according to the Office for National Statistics, the fastest pace since records began in 2016. Earlier this year, the average cost of a newly let home outside of the capital rose above £1,000 a month for the first time. The alternative? Stay with parents, where possible. The proportion of first-term renters who move out of family homes has fallen since 2015, according to Nationwide data, as young people stay at home in a bid to build up their savings.

Health

The picture looks bleaker still when considering those not in work. An uptick in economic inactivity, where people are neither in work nor looking to be, has persisted beyond the worst of the Covid pandemic.

While led by older adults who left work largely due to health issues, a parallel pattern has emerged among the young, with the proportion of 16- to 24 year-olds who are economically inactive because of long-term sickness almost doubling since a decade ago. In addition to increases progressive illnesses, such as cancer, anxiety and mental illness is taking its toll in keeping the young out of work.

Research published this week by the Trades Union Congress showed that three in five workers reported being exhausted by the end of the work day. That’s not a good sign for an economy in need of a productivity jolt.