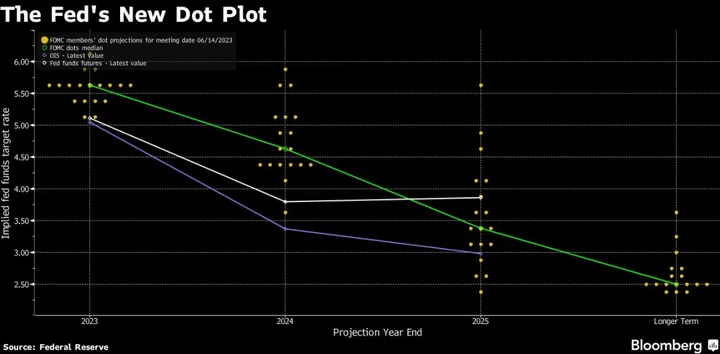

Treasury investors are turning increasingly skeptical the Federal Reserve will deliver a soft landing for the US economy next year, elevating concern of a looming recession over the risks posed by inflation and a swelling budget deficit.

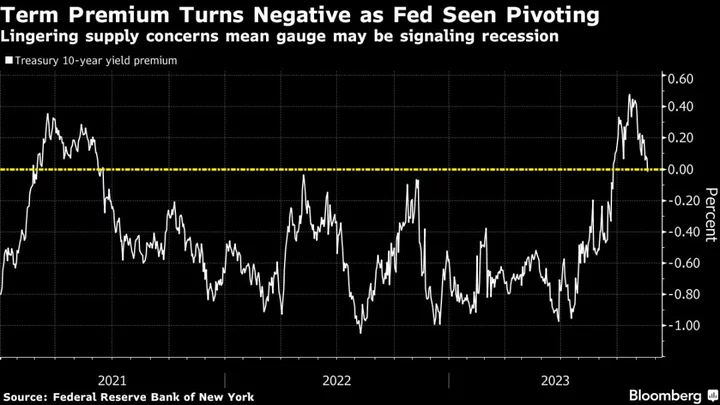

That’s the message from the latest move in the so-called term premium, which describes the extra yield investors demand to own longer-term debt instead of rolling over shorter-dates securities as they mature.

The gauge, which is famously tricky to calculate, is a measure of protection against unforeseen risks such as inflation and supply-demand shocks, encapsulating everything apart from expectations for the path of near-term interest rates.

As recently as September, it was climbing above zero for the first time in more than two years as investors sent US yields to the highest in more than a decade after the Biden administration boosted bond sales and wrangled with lawmakers over the debt ceiling.

But in a reversal, the term premium has now dropped back below zero with the gauge for 10-year notes slipping to minus 1.7 basis points Friday, from a high of 48 basis points in late October, according to the New York Fed.

That shift, accompanied by a broad rally in Treasuries, points to expectations of a 2024 recession forcing the Fed to cut interest rates, while downplaying the previous focus on surging debt issuance overwhelming demand. The Bloomberg US Treasury Index rose 0.2% on Monday and is now back about where it ended 2022.

A negative term premium is a sign that that the economic outlook is deteriorating, according to George Goncalves, head of US macro strategy at MUFG.

Read more: ‘Dark Matter’ Bond Metric Mesmerizes Wall Street and Washington

“There’s a lot of easing priced in in rates markets and not enough slowdown risk priced in,” said Alberto Gallo, chief information officer and co-founder of Andromeda Capital Management Ltd. in London. “Investors are underestimating the left tail of recession, which would hurt equity and credit.”

Bond investors are getting ahead of themselves in betting inflation has been tamed, Gallo said. “We see reflation risks on the horizon in the US and a mild recession in the euro zone.”

US 10-year yields have tumbled more than half a percentage point from a 16-year high of 5.02% touched on Oct. 23. The pace of the yield decline has fueled speculation it may have been turbocharged by hedge funds forced to bail out of outsized bets that yields would keep climbing.

“This decline in bond yields has to do less with investors changing opinions about debt or inflation and more to do with systematic investors being forced to cover their previous extreme short positions in government bonds,” said Nikolaos Panigirtzoglou, a global strategist at JPMorgan Chase & Co. in London.

--With assistance from Michael Mackenzie.

(Adds Treasury moves in sixth paragraph.)