The Bank of Japan will probably adjust its yield curve control program at its policy meeting this month given that inflation is stronger than expected, according to a former executive director at the bank.

“I expect they will make some kind of adjustment to YCC this month,” former director Hideo Hayakawa said in an interview Thursday. “If they don’t, it doesn’t make sense.”

Hayakawa, who is also a former BOJ chief economist, said that the central bank must raise its inflation outlook for this fiscal year to match reality.

That would mean the central bank will also likely consider slightly cutting its forecast for the following year, to avoid fueling normalization calls by predicting inflation at or above 2% for three years in row, he added. The BOJ’s estimate for next year is already at 2%.

“Then they can buy time for six months or so” to monitor the outlook of wage growth and inflation, Hayakawa said. “I feel that’s the only way they can rebuild their case” for keeping the overall framework unchanged.

Hayakawa spoke as BOJ watchers and traders are positioning for a policy decision on July 28 from the last global anchor of low interest rates. Barclays and Bank of America pushed back their policy change forecast to October from July this week, while at the same time financial market indicators signal traders are seeing more risk of a shift this month.

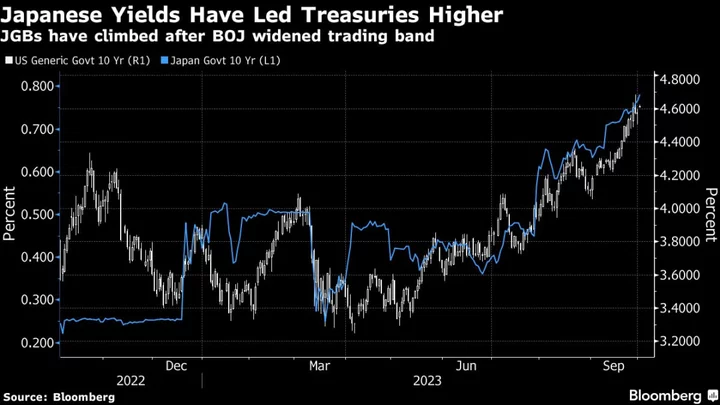

Japan’s benchmark bond yields have edged higher toward their 0.5% ceiling this week, proving resistant to a global debt rally. Ten-year swap rates, popular with international funds, rose through 0.7% Friday, well beyond the central bank’s line in the sand.

Any policy tweak that pushes Japan’s yields significantly higher threatens to cause a destabilizing spillover into global markets thanks to the risk of repatriation of its overseas holdings. Japanese investors own more than $1 trillion of US Treasury securities and significant amounts of bonds from the Netherlands, France, Australia and the UK as well as other assets.

Doubling the BOJ’s allowed trading band for the 10-year yield from 0.5% either side of zero is a likely way to adjust yield control, Hayakawa said. The recent lack of market attacks on the central bank’s yield defense line makes it easier for the BOJ to make adjustments, he added.

The recent gains in the yen would also help the bank to look like its move wasn’t a response to weak yen risks, he added. Either way it’s better for the BOJ to make changes while it can, said Hayakawa, who is currently a senior fellow at the Tokyo Foundation for Policy Research.

“Side effects are always there even if it’s not completely apparent,” Hayakawa said, referring to the YCC. “It’s not a good policy if the BOJ can only move after getting into serious trouble.”

If the BOJ decides not to adjust policy this time despite the current strong inflationary momentum, the bank would be risking a massive bond sell off once prices overshoot, said Hayakawa, who left the bank in 2013. There is a high likelihood of upside surprises after inflation coming in faster than expected in recent months, he said.

The BOJ is widely expected to raise its inflation outlook for this fiscal year from 1.8%. Economists saw it at 2.6% in the latest Bloomberg survey, after it rose 3% in the previous year.

“The BOJ is very close to the situation the Fed was once in — saying inflation is transitory and then being forced to ditch that stance after the situation worsens,” Hayakawa said. “The focus of this policy meeting and the outlook report is how the BOJ will change their assessment of the situation.”

Further out, the BOJ is likely to scrap yield control and raise its negative interest rates for the first time early next year, once it becomes certain about achieving its stable inflation goal, Hayakawa said. “There is a good chance that the BOJ will attain its price target.”

--With assistance from Cormac Mullen.

(Updates with Friday’s market moves)