The Bank of England raised interest rates to a new 15-year high, warning that its fight against inflation may require tighter borrowing conditions for a prolonged period.

The UK central bank lifted its key rate a quarter point to 5.25% on Thursday, a smaller hike than the half-point increase delivered in June. Investors and economists had expected the move and have priced in further increases this year.

The pound initially extended losses after the decision and short-dated gilts gained as traders pared bets on further interest-rate hikes. The currency pared its declines to trade 0.3% weaker at around $1.27 as of 12:20 p.m. in London. The yield on two-year notes was 5 basis points lower at 4.95%.

Policy makers led by Governor Andrew Bailey left the door open to further action if inflation persists and added language saying their stance will remain “sufficiently restrictive for sufficiently long” to bring it back to the 2% target.

The bank cut its forecast for growth over the next two years and raised its outlook for inflation over the medium term, signaling a bleak backdrop for the next general election, which must be held by early 2025. Prime Minister Rishi Sunak has so far backed the bank in it’s fight against inflation, making halving the rate of price increases one of his five key pledges this year.

The decision indicated a growing division on the nine-member Monetary Policy Committee about how the BOE should respond to indicators showing that wages and prices are rising too fast for comfort while activity in the economy is weakening.

Catherine Mann and Jonathan Haskel voted for a half-point hike. Swati Dhingra sought no change. The remaining six including Bailey and his deputies were in the majority and noted that their action will weigh heavily on households and businesses.

“Inflation is falling, and that’s good news,” Bailey said in a statement released Thursday by the BOE. “We know that inflation hits the least well off hardest, and we need to make absolutely sure that it falls all the way back to the 2% target.”

What Bloomberg Economics Says...

The Bank of England’s decision to step down the pace of tightening in August suggests it is a little less troubled by the inflation outlook than it was in June. That said, the messaging around the decision suggests there is a little further to go in the tightening cycle before the central bank will feel comfortable pausing.

-Dan Hanson, Bloomberg Economics. Click for the REACT.

The BOE maintained its guidance that “if there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required,” minutes of the meeting showed. It added a sentence suggesting that once the tightening cycle is finished, rates may remain elevated for some time.

“The MPC would ensure that Bank Rate was sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Key indicators, especially wage growth, “suggest that some of the risks from more persistent inflationary pressures may have begun to crystalize.”

Money-market traders now see the BOE’s key rate peaking below 5.75% by February, down from as high as 5.85% before the decision. The move was spurred by the division on the MPC about the appropriate policy response on Thursday. Some traders who were holding out for a bigger half-point hike were also caught off guard.

The BOE kept its forecast that the Consumer Prices Index, which topped 11.1% last year, will sink to 4.9% in the fourth quarter of this year, suggesting Sunak will meet his promise.

The central forecast indicates the UK economy will avoid a recession ahead of a general election. However, the charts indicating the range of possible scenarios show there is still a significant risk of a contraction.

“The committee has decided to bring some of the upside risks of inflation from persistence into its modal projections, pushing up on this inflation projection in the medium term relative to the May report,” minutes of the meeting said.

Britain’s economy will likely stagnate through to 2025, according to the BOE forecasts. It expects gross domestic product to grow 0.5% in both 2023 and 2024 and by 0.25% in 2025. By the end of the forecast period in 2026, GDP will be 0.75% lower than estimated in May.

The committee agreed that slack in the economy is likely to emerge as the quickest cycle of rate hikes in three decades cuts into the money consumers and businesses have to spend. Unemployment is likely to increase to almost 5% by the third quarter of 2026 from 4% currently, and vacancies have already started weakening.

“Given the significant increase in bank rate since the start of this tightening cycle, the current monetary policy stance was restrictive,” the minutes said. “These effects were likely to continue to build over the coming quarters.”

Economists were divided over how aggressive the BOE would be. Of the 61 economists surveyed ahead of the decision, 45 expected a quarter point rise in Bank rate and the rest predicted a half-point increase.

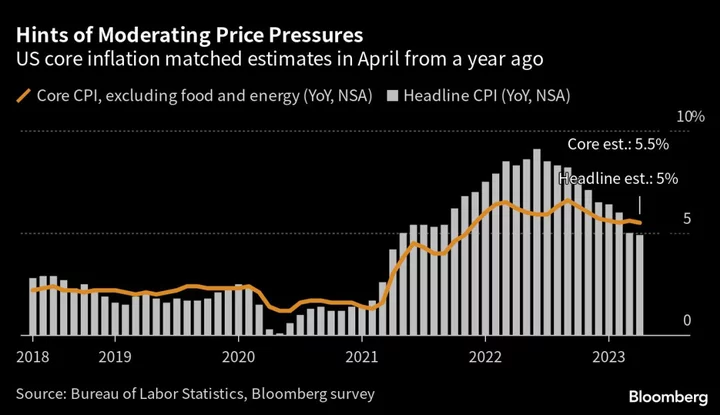

While UK inflation is still the highest of the Group of Seven countries, there were tentative signs that price pressures turned a corner in June’s data. Inflation fell to 7.9% in June, its lowest level in 15 months. Price pressures in the services sector also cooled for the first time in six months, though the BOE said they are expected to remain around their current “elevated” levels.

“If we stick to the plan, the Bank forecasts inflation will be below 3% in a year’s time without the economy falling into a recession,” Chancellor of the Exchequer Jeremy Hunt said in a statement. “But that doesn’t mean it’s easy for families facing higher mortgage bills so we will continue to do what we can to help households.’”

Upcoming Data

Before the next meeting in September, the BOE will have two more months of inflation data that will prove crucial to the path of interest rates.

The latest increase in Bank rate will hit the finances of households with variable rate mortgages immediately. However, lenders are starting to cut costs of fixed rate deals on an improved outlook on inflation.

A quarter-point hike means that average monthly payments for households on variable rate mortgages have increased by £489 since the BOE started raising rates in December 2021, according to UK Finance.

The increase pushes interest rates back up to their 100-year average after the prolonged period of low borrowing costs following the financial crisis.

On quantitative tightening, the BOE confirmed that it will decide next month on the pace of its effort to run down its balance sheet of bonds built up during a decade of stimulus. The second year of so-called QT will begin in October.

It bought as much as £895 billion ($1.1 trillion) of government and corporate debt at the peak of its quantitative easing program, which helped lower market interest rates. Now, the BOE is reversing the program, selling off the debt or allowing assets to mature at the pace of £80 billion a year.

Dave Ramsden, deputy governor for markets and banking, said in a speech in recent weeks that QT has had little impact on gilt yields and the wider economy.

--With assistance from Andrew Atkinson, Eamon Akil Farhat and Mark Evans.

(Updates with market reaction in third paragraph. A previous version corrected the number of economists surveyed by Bloomberg.)