The corporate bond market seems surprisingly blase about the risk of an economic downturn now.

US job growth is slowing and consumer spending is looking increasingly sluggish. While blue-chip American corporates remain broadly healthy, some early signs of trouble are emerging, including rising costs and pressure on profit margins, Citigroup analysts including Daniel Sorid wrote this week.

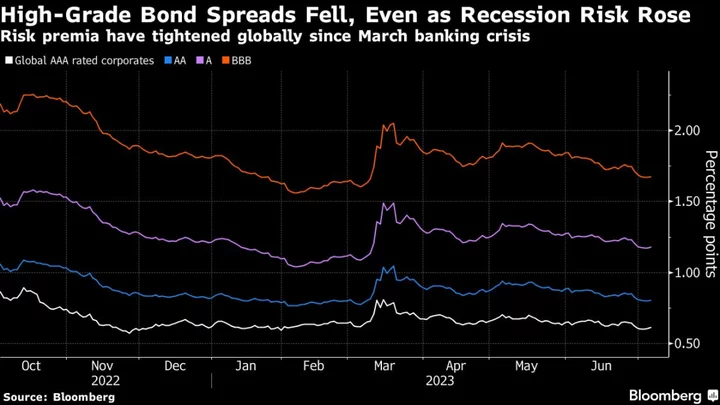

So far, investors aren’t necessarily pricing that in. Growing demand for global blue-chip debt slashed the extra yield it pays over government bonds, or spreads, to the lowest since March, when the US regional banking crisis battered global credit markets.

“The rate hikes that the economy is digesting are going to start to manifest on the income statements of investment-grade companies,” said David Knutson, a senior investment director at Schroders Plc. “The economy is going to continue to gradually slow, and a slowing economy generally means wider spreads.”

Any downturn would be painful for companies that have built up huge amounts of cheap debt in recent years. As companies refinance, those borrowings risk becoming a millstone. More than $500 billion of bonds rated BBB, or two steps above junk status, are at risk of a rating downgrade globally, according to an analysis by Bloomberg Intelligence last month.

Weaker Metrics

“Cash flow metrics and margins were weaker in virtually all sectors,” said Joel Levington, director of credit research at BI, after it reviewed almost 1,450 issuers. “If the business trends continue, you wind up with weaker leverage metrics like debt/Ebitda. And that could have implications for ratings.”

More companies being downgraded to junk status would also make it harder for existing companies with speculative credit ratings to raise cash and could potentially lead to a rise in defaults.

UBS Group AG last month forecast that defaults in leveraged loans and junk bonds will top out at 8% and 6% respectively in early 2024.

Even executives at investment-grade companies appear to be preparing for a turn in the economy. The Citigroup analysts point out that buybacks as a percentage of earnings before interest, tax, depreciation and amortization are already falling, as are dividends when compared with the same metric.

More Conservative

“The trends in capital returns to shareholders suggest that IG corporates are becoming more conservative with using cash ahead of a possible downturn,” the analysts wrote.

Others are more positive about the outlook. “The well telegraphed pending recession that has yet to materialize has led many companies to remain conservative with their growth plans and balance sheets, leaving them better positioned than we would usually see late in the cycle,” said Travis King, head of US investment-grade corporates at Voya Investment Management.

Still, Apollo Global Management Inc. economist Torsten Slok points to an increase in recent weeks in the number of companies with liabilities of $50 million or more seeking bankruptcy protection as a sign the default cycle may have begun in the wider credit market.

“Maybe the interest rate increases are starting to come through,” he said, adding “the Fed is succeeding in slowing the economy.”

Week in Review

- Private equity firms are having to reduce the leverage in buyouts to get deals done, in the hopes of adding more debt later.

- Private credit firms, having shaken up financing markets by snatching buyout debt deals from Wall Street, are now changing the landscape in a part of the $1.3 trillion CLO business.

- Bonds backed by car loans are headed for their first loss since the 1990s as Americans fall behind on payments and dealerships collapse.

- ESG funds that piled into green bonds sold by Thames Water Plc are trying to figure out what the environmental, social and governance disasters threatening the future of the utility mean for their holdings.

- Rallye SA, the holding company that controls troubled grocer Casino, faces a €25 million ($27.2 million) fine after French market regulators accused it of artificially inflating its stock price by being deceitful about its access to cash.

- State-backed builder Sino-Ocean’s dollar bonds almost halved in a week, after news that its shareholders had set up a working group to look into its debt and hired a financial adviser.

On the Move

- Wells Fargo & Co. has hired two Credit Suisse Group AG high-yield salespeople, namely Brian Harris and Emma Bramson.

- UBS Group leveraged loan salesperson Teresa Debenedictis has departed the Swiss lender after working there for over 25 years.

- Royal Bank of Canada’s corporate credit trader Adam Russell has left the bank, while three new hires joined the European debt capital markets team, including Alex Ulrich and Eugen Eichwald in Frankfurt.

Author: Neil Callanan, James Crombie and Olivia Raimonde