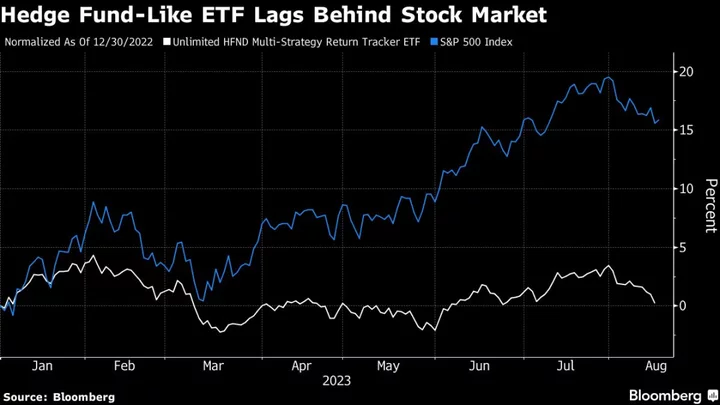

Blackstone Inc. is winding down a strategy that allocated capital to hedge funds ranging from Two Sigma Investments to Magnetar Capital.

The Blackstone Diversified Multi-Strategy fund will shutter by the end of the year. The fund operates under the European Union’s UCITS Directive and provides investors daily access to their capital, a structure that has come under pressure. It manages about $200 million in assets, down from its peak $2.3 billion in 2018.

“We are in talks with clients to move their capital to newer strategies that offer greater flexibility than the current structure allows,” a spokesman for the investment firm said in a statement confirming plans to close the fund.

The Blackstone unit that runs the fund manages about $89 billion in assets, the spokesman added.

An increasing number of large hedge funds have been locking investors for longer to avoid sudden exits of capital in a challenging market environment that could lead to fire sale of assets and bigger losses. UCITS funds on the other hand are designed to give investors more frequent access to their capital than hedge funds.

The Blackstone Diversified Multi-Strategy fund was up 4.1% through October this year. By comparison, the HFRI Fund of Funds Composite Index was up 1.8%, while hedge funds on an average made 1.9%, according to data compiled by Bloomberg.

The Financial Times newspaper reported the news of the closing earlier.