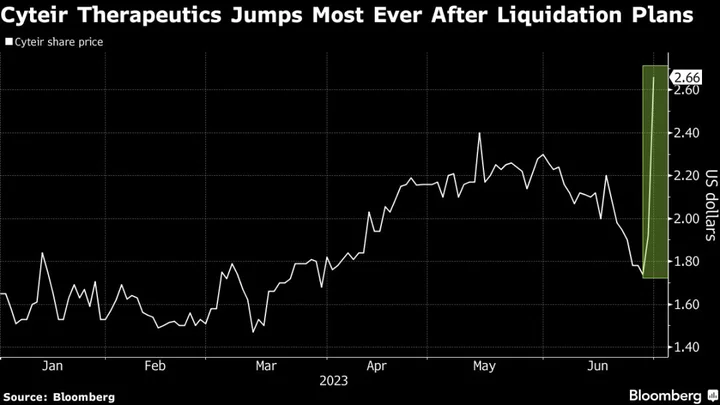

A little-known biotech company, Cyteir Therapeutics Inc., notched its best day ever — on the back of plans to dissolve the company.

Shares of the drug developer surged 35% on Friday, the stock’s biggest one-day jump on record, after announcing plans to sell all its assets and return its remaining cash to shareholders.

“Management should be applauded for returning remaining shareholder capital,” Robert Driscoll, a Wedbush analyst said.

The unexpected surge comes as Cyteir is trading underwater — like a number of other small-cap drug developers of late. The Federal Reserve’s recent tightening regime has battered the high-risk, high-reward biotechnology sector.

The firm — which was stopped work on all but one drug in January — had cash on hand of $137 million as of March 31, more than its current market value of $92 million, according to data compiled by Bloomberg.

“A major problem with a glut of companies trading at valuations below cash is how it suppresses private company valuations, and its subsequent effect on the IPO market,” Driscoll said in an email. “That said, good companies can and will get financed.”

The company plans to stop developing its experimental ovarian cancer treatment after efficacy data failed to meet the criteria to continue development, according to a statement. Patients currently enrolled in an early-stage trial will continue to be treated prior to the dissolution.

(Updates with closing prices throughout.)