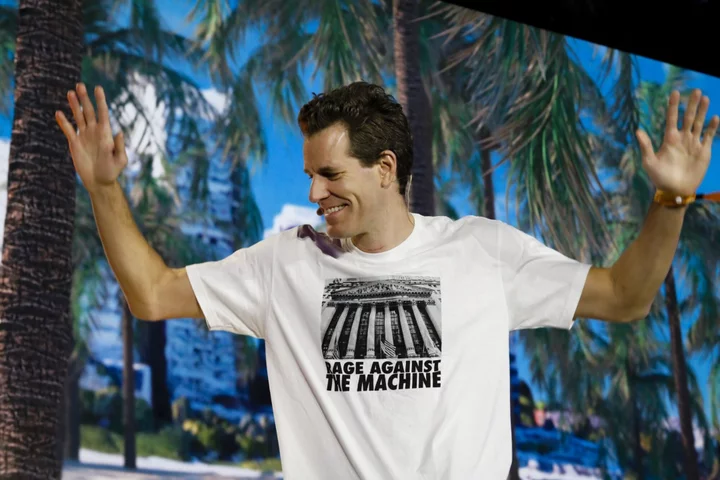

Billionaire Cameron Winklevoss, co-founder of the Gemini Trust Co. crypto platform, outlined what he termed a “best and final offer” for digital-asset lender Genesis Global Holdco’s bankruptcy restructuring.

The proposal is the “floor” that creditors will accept, Winklevoss said in an open letter on Twitter late Monday in New York.

The offer lists a $275 million forbearance payment, a $355 million debt tranche due in two years and an $835 million debt tranche due in five years. DCG would retain the proceeds from the sale of Genesis Global Trading, while creditors would get the funds from the disposal of all other Genesis companies.

Silbert and DCG, as well as Cameron and twin brother Tyler — co-founder of Gemini — didn’t immediately reply to requests for comment.

Hundreds of thousands of Gemini customers have about $900 million locked in Earn, a program in which they lent coins via Genesis to earn yields.

Genesis froze withdrawals in November — hurt by the FTX exchange’s implosion — and its January bankruptcy revealed that the top 50 unsecured claims amounted to about $3.4 billion.

Genesis, DCG and creditors including Gemini have been locked in court-appointed mediation talks. In early June, a bankruptcy judge gave them more time to come up with a revised payout proposal. DCG in mid-May missed a $630 million payment that was due to Genesis.

Winklevoss said Gemini “looks forward to working with the Genesis Special Committee to bring the mediation process to a close” and advance the bankruptcy restructuring.

--With assistance from Olga Kharif.