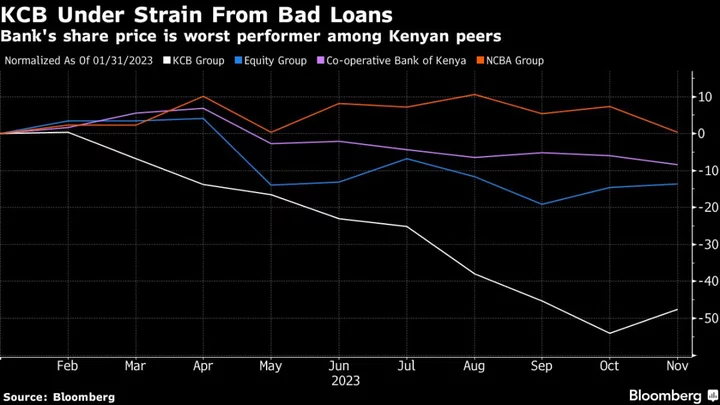

Investors in KCB Group Plc, Kenya’s biggest bank by assets, got a reminder this week why the stock lags far behind its peers on the Nairobi Securities Exchange — the lender’s painful efforts to reduce its pile of non-performing loans.

The bank on Wednesday more than doubled its provisions for bad debt to 15.8 billion shillings ($103 million), following a 25% jump in NPLs to 187 billion shillings in the nine months ended September. Chief Executive Officer Paul Russo hopes the moves will eventually turn around sentiment.

It is an industry-wide pain point. Anticipating repayment stress, rivals Equity Group Holdings Plc and Standard Chartered Bank of Kenya Ltd. doubled and tripled amounts set aside for potential bad debt at their nine-month earnings, respectively. KCB’s NPL ratio was 16.1% at end-September, down from 17.8% a year earlier, but higher than the industry average of 15% in August.

“When I speak to investors, they tell me ‘Paul, we are worried about your NPLs,’” Russo said. “It’s the right thing to do, to be aggressive on our provisions.”

KCB shares have slumped 48% this year, as the bank contends with corporate customers struggling to receive payment from clients including the government, rather than with retail account holders.

The bank’s moves to step-up provisions are positive, said Michael Odundo, a banking analyst at Standard Investment Bank Ltd. in Nairobi. With interest rates likely to have peaked, economic conditions should get better in Kenya, but it may take more than a year for the NPL picture to improve, he said.

“NPLs should sustain even for next year,” he said. “Come 2025, non-performing loans should start coming down as rates come down and business activity begins to pick up.”

--With assistance from Helen Nyambura.