Unreal Food ended its pursuit of an eggless egg. Remastered Foods stopped developing vegan bacon. The Meatless Farm halted its plant-based sausages.

The great shakeout in the world’s fake meat sector is here and it’s widening.

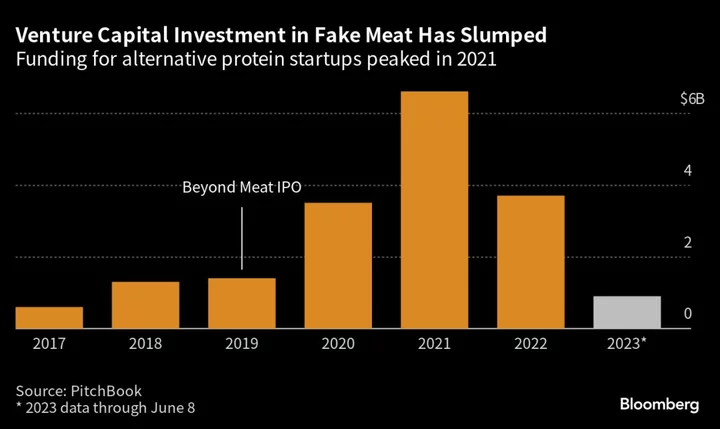

As money flows less freely due to surging interest rates, investors have sharply pulled back funding just as inflation increases production costs and makes consumers more selective about their food choices. That’s hitting a crowded field, which had mushroomed after the early success of Beyond Meat Inc. and Impossible Foods Inc.

With shoppers put off by excessive processing, nutritional value and taste, a growing list of alternative-protein companies are shutting down, laying off staff and selling themselves. Industry observers say more turmoil is coming before the sector stabilizes.

“You probably need a bit of a clear out in some of these categories to allow winners to come through,” said Mark Lynch, a partner at Oghma Partners in London, a corporate-finance advisory specializing in the food and beverage sector. Fewer players means resources will be more concentrated and survivors will control more of the available shelf space, he added.

Enthusiasm for alternatives to beef and pork surged in the aftermath of Beyond Meat’s 2019 initial public offering, and venture capitalists were willing to invest in companies that offered little more than a recipe book.

But sales haven’t matched wildly optimistic projections, as high prices and odd tastes and textures made the costly products easy to cross off shopping lists. The spate of failures extends from plant-based proteins and vertical farmers, to insect breeders and lab-grown meats. Global investment in food and agriculture tech dropped 44% in 2022, according to AgFunder.

The downturn has so far mainly claimed obscure names and early-stage companies, like Canada’s Merit Foods and China’s Hey Maet.

But in the UK, two up-and-coming companies recently appointed administrators: The Meatless Farm laid off staff at its headquarters in Leeds, while Plant & Bean got hit by soaring food and energy prices just two years after opening a mega factory in Lincolnshire.

The upheaval is part of an adjustment phase that happens in almost every high-growth consumer segment from smoothies to popcorn, said Andy Shovel, co-founder of British plant-based meat company THIS, whose sales are up about 45% this year.

The result will be less confusion at stores, better quality and prices getting closer to meat, according to Shovel. “From a customer’s point of view, this is only good news,” he said.

Industry stalwarts have also stumbled. Beyond Meat, which has seen its market value drop over 90% from its peak, has had multiple rounds of layoffs in the past year, as has Impossible Foods. Cuts have also affected Spain’s Heura Foods and California-based Eat Just Inc., which has continued to expand distribution in the US.

Traditional food companies are also retrenching. Nestle SA pulled its Garden Gourmet line and Wunda pea milk from the UK because of intense competition. Meat giant JBS SA discontinued its Planterra unit after pouring money into a mega factory in Colorado.

Despite the turmoil, some investors remain upbeat. Big Idea Ventures, a food-tech investor fund, said last month that it’s closing in on a $75 million fund-raising target. Fake bacon maker MyForest Foods raised $15 million in fresh funding earlier this month, and Israeli startup Chunk Foods announced a seed round of the same size in the spring.

Agricultural giant Archer-Daniels-Midland Co. still has faith in the sector, too. At an innovation center in Manchester, England, the company mixes processed soy with flavors to help make alternative proteins more appealing. Its venture capital unit is also continuing to invest in startups.

“The category is now evolving into what really consumers have been asking for,” said Leticia Gonçalves, ADM’s president of global foods. “Companies are now learning from the past and adjusting with new launches.”

ADM expects the alternative-protein market to grow annually by “high single-digits” and reach $100 billion in sales by 2030. Euromonitor International, which tracks sales in retail outlets and food services, predicts global sales volume of meat and seafood substitutes to grow more than 10% this year.

About two-thirds of young consumers are planning to spend more on vegan meat and dairy products citing health perceptions and environmental benefits, according to Emma Ignaszewski, associate director at Good Food Institute, an industry group.

For some companies, the disruption is an opportunity. Minnesota-based Wicked Kitchen — a maker of vegan convenience foods like jackfruit pepperoni pizza — acquired plant-based seafood company Good Catch for over $7 million in stock as well as vegan fish brand Current Foods in a deal valued between $7 million and $10 million, Chief Executive Officer Pete Speranza told Bloomberg.

Food is now widely understood as central to efforts to combat the climate crisis and alternative proteins are seen as delivering the biggest benefit, according to Rosie Wardle, a partner and co-founder of Synthesis Capital, who has been active in the space for a decade.

“This correction was overdue,” she said. “The best companies in the sector will be able to find the capital they need even in these challenging times. Ultimately this sector is here to stay.”

--With assistance from Sabah Meddings, Dasha Afanasieva, Yihui Xie and Tarso Veloso.