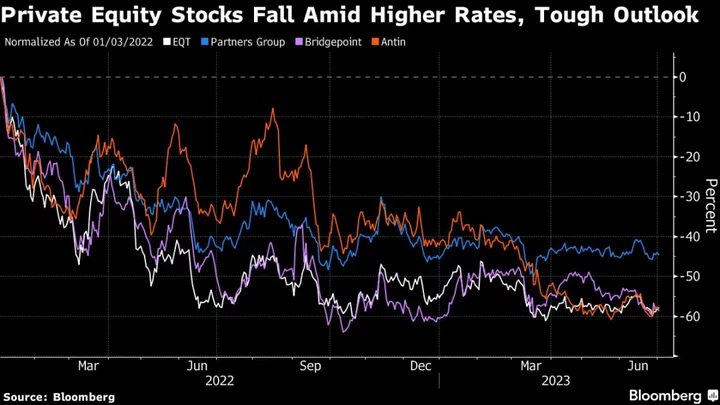

Europe’s private equity firms are a bad bet for stock investors as the industry grapples with depressed dealmaking and a squeeze from higher interest rates, according to analysts at JPMorgan Chase & Co.

“A higher cost of leverage is proving painful for the sector,” wrote analysts led by Angeliki Bairaktari in a note Monday.

They cited a slowdown in private equity firms being able to exit their investments, and said it’s unlikely that transaction activity will recover in the second half. The analysts cut fundraising forecasts and carried interest expectations for EQT AB, Partners Group Holding AG and Bridgepoint Group Plc.

The crux of the issue facing the industry is that debt is far more expensive than it used to be. Leveraged loans are a major part of how buyout shops fund their transactions, and with borrowing costs soaring, there’s now a limit on how many private equity deals can get done and their appetite for taking on risk.

Read More: Hedging Failure Hammers Private Equity as Debt Costs Skyrocket

Sweden’s EQT, which oversees $227 billion in assets, has seen its shares slide amid broader worries about financing costs and recession fears. Last month, the company sought more time to close its next flagship buyout fund, people with knowledge of the matter said, amid a difficult fundraising environment for private equity firms.

The stock slipped 0.3% on Monday, bringing its year-to-date retreat to almost 7%. Swiss firm Partners Group declined 2.5%. Both companies were placed on “negative catalyst watch” by JPMorgan.

“With the cost of leveraged debt having doubled over the past 12 months, it is no surprise that transaction activity and leveraged loan issuance are significantly down,” the JPMorgan analysts wrote.

Private equity exits have fallen 66% in the US and 35% in Europe, they said, citing data on a 12-month rolling basis as of the end of March.

Private equity firms have been able to mitigate some of the pain through hedging. JPMorgan estimated that 70% of the loan exposure of the companies under their coverage has been hedged.

“There is no imminent risk of refinancing forcing exits at depressed valuations,” the analysts wrote, noting however that “on the other hand the lack of convergence between buyers and sellers could well continue into H2 given ongoing uncertainty on the direction of interest rates.”

--With assistance from James Cone and Kit Rees.

(Updates market pricing in fifth paragraph. An earlier version of this story was corrected to clarify that the JPMorgan report was about European private equity firms.)