Australian employment surpassed expectations in June and the jobless rate held at a lower revised rate, underlining the labor market’s resilience to rapid interest-rate increases.

The jobless rate remained at 3.5%, having hovered in a range of 3.4%-3.7% since June last year, Australian Bureau of Statistics data showed Thursday. The economy added 32,600 roles from a month prior, more than double estimates, and employment has now risen in nine out of the past 12 months.

The data increases pressure on the Reserve Bank to resume raising rates, with money market bets implying a better-than 50% chance of a hike to 4.35% at its Aug. 1 meeting. The Australian dollar extended earlier gains, rising to 68.25 US cents. Three-year bond yields jumped 12 basis points, heading for their largest one-day increase since July 7.

“The ‘lucky country’ keeps on delivering strong data,” said James Wilson, a senior portfolio manager at Jamieson Coote Bonds in Melbourne. The result is supportive of August being a “live” meeting, he added.

While the RBA’s 12 hikes over the past 15 months are slowing demand in the economy, Thursday’s data suggest more work might be needed to loosen the labor market. RBA Governor Philip Lowe has said the board will closely monitor the economy and inflation and has warned further rate rises “may be required” to tame persistent inflation.

What Bloomberg Economics Says...

“Stronger-than-expected jobs growth is likely to push the RBA over the line into delivering a final 25-basis-point hike at its Aug. 1 meeting”

— James McIntyre, economist.

For the full note, click here

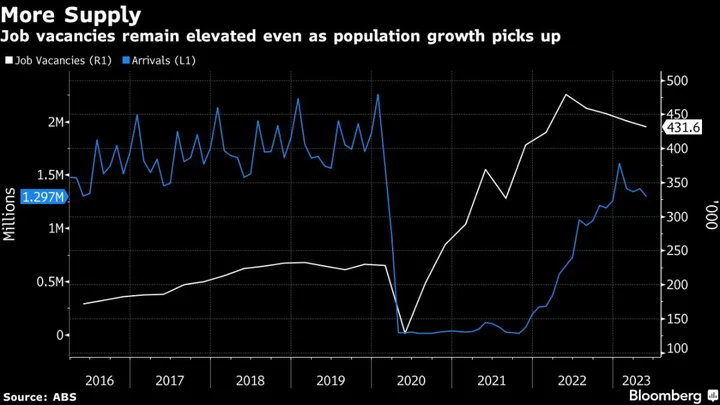

Employment strength has been a key factor in the RBA’s confidence that Australia can avoid a recession. Thursday’s figures showed that annual jobs growth eased to 3% from 3.1% at the start of the year. The pace is expected to moderate further given job advertisements are now edging down.

“We expect that weakness will emerge in the labor sector as we move through the second half of 2023,” said Anneke Thompson, chief economist at CreditorWatch Pty Ltd., citing recent redundancies at major firms including Telstra Group Ltd., Lend Lease Corp. and Westpac Banking Corp.

“As business conditions continue to weaken and profit margins fall, headcounts will get a lot of attention,” Thompson added.

Economists say the next crucial piece of data is Wednesday’s quarterly inflation report which will help the RBA solidify its position on the policy outlook.

Thursday’s jobs report also showed:

- The participation rate edged down to 66.8% from 66.9%

- Underemployment held at 6.4% and underutilization fell to 9.9%

- Full-time roles rose by 39,300 while part-time fell 6,700

- The employment to population ratio held at a record-high 64.5%

The data are a mixed blessing for the center-left Labor government. While lower unemployment is a positive, the prospect of it driving borrowing costs even higher will leave Prime Minister Anthony Albanese concerned about the potential political fallout.

The RBA has hiked by 4 percentage points since May 2022 to take the cash rate to 4.1% as it grapples with sticky inflation. A Bloomberg survey of economists last month showed the risk of a recession jumped to the highest level since the pandemic amid concerns of further tightening.

The central bank is forecasting unemployment will climb to 4% by year’s end as rising borrowing costs drag on economic activity. It estimates the jobless rate will need to reach 4.5% to achieve sustainable inflation around the 2-3% target. The RBA will release its quarterly update of forecasts on Aug. 4.

--With assistance from Tomoko Sato and Garfield Reynolds.

(Adds comments from economists.)