A move by Volkswagen AG’s Audi division to partner with SAIC Motor Corp. to develop electric vehicles marks a turning point in China’s automotive industry from learning from foreign manufacturers to innovating its own technology.

The 113-year-old German luxury brand said Thursday it reached an agreement with state-owned SAIC in which the two companies will accelerate the electrification of their portfolio as China’s auto market rapidly shifts to EVs.

“Chinese carmaking has finally come of age,” said Stephen Dyer, the Shanghai-based managing director at consultancy AlixPartners. “To get a vote of confidence from VW Group on platforms, you can’t underestimate the significance.”

An automotive platform is the structural underpinnings of a car, including functions and components like the powertrain, chassis and electrical architecture. Platforms are used to maximize return on investment and save costs by being shared across a range of different models.

While VW has used platforms from others in the past, like Ford Motor Co.’s truck platform, it hasn’t gone with a Chinese partner before.

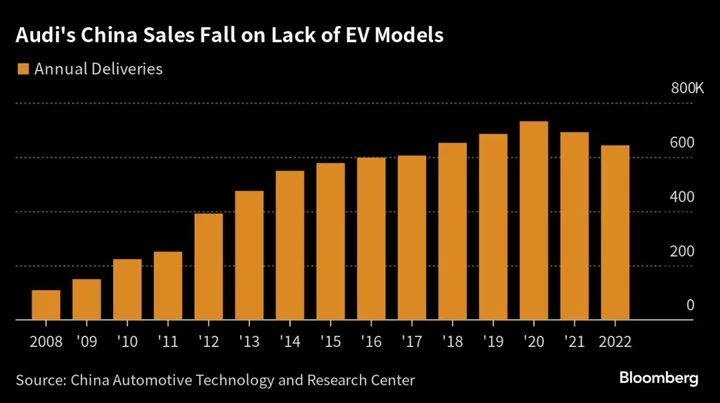

The deal comes just weeks after Audi appointed new Chief Executive Officer Gernot Döllner, a 54-year-old VW veteran, to address challenges such as being slow to electrify and coming up with new models. Tesla Inc. outsold Audi globally in the first quarter and its market share in China is shrinking.

Read more: BYD, Li Auto Smash Foreign Rivals Amid China Car Price War

Audi needs to accelerate its electrification in China to maintain market share, but new EV launches have been constrained by VW’s long development cycle, especially for its new Premium Platform Electric — produced with Porsche. This makes Audi less competitive against rapidly upgrading local competitors, said Jing Yang, the director of China Corporate Research at Fitch Ratings.

As China’s largest auto group, SAIC has accumulated a complete set of EV technologies, and the success of its MG brand in Europe and the emerging IM Motor premium marque shows its capability in producing competitive cars across market segments, including the high-end, said Yang.

Read more: MG Shows a British Pedigree Can Do Wonders for a Chinese Brand

“Their cooperation sets a good start for the Chinese auto industry in that China automakers are starting to be the licensor, not the licensee, of technologies,” she said.

Chinese manufacturers are gaining more bargaining power with their global partners, and more international manufacturers may seek deals with Chinese firms, at least to serve the local market as they need to ramp up EV sales, Yang said.

New energy vehicle sales, which includes EVs and plug-in hybrids, rose 37% in the first half of 2023, while sale of gasoline cars fell 8%.

Yale Zhang, the managing director of Shanghai-based consultancy Automotive Foresight, said VW and Audi are in the process of building a plant in Changchun to make vehicles on the Premium Platform, but the first models won’t roll off the production line until late 2024 and the software features in several of VW’s platforms keep getting delayed.

“The deal shows VW’s software capability is lacking,” Zhang said. “It’s evident that China is now leading in developing intelligent EVs and in the transition to EVs.”