Asian equities looked set to open higher Wednesday after a rally on Wall Street that was fueled by strength in US consumer confidence and home sales.

Futures rose for benchmarks in Japan, Australia and Hong Kong, while an index of US-listed Chinese stocks climbed the most in three weeks.

Yet the data showing economic resilience also underscored the likelihood that the Federal Reserve has further to go in tightening monetary policy. Treasuries dropped Tuesday, pushing yields higher at the same time as the Nasdaq 100 jumped almost 2% and the S&P 500 halted a two-day drop.

Tech megacaps led the rebound in US equities. Tesla Inc. rallied after a 6% plunge, Snowflake Inc. jumped on an artificial intelligence-related partnership with Nvidia Corp. and Facebook’s parent Meta Platforms Inc. gained as Citigroup Inc. lifted its target. Alphabet Inc. underperformed with an analyst saying Google’s owner was moving “too fast” in AI.

Investors in Asia will be watching the release of figures for Chinese industrial profits, amid calls for Beijing to provide more stimulus, and Australian inflation data, which will help shape the central bank’s thinking on interest rates.

The offshore yuan and the Australian dollar were both steady in early Asian trading. The yen was also little changed but hovering in an area of concern for authorities in Japan after weakening to 144 versus the dollar.

Later Wednesday, the focus will turn back to a gathering in Portugal and a panel discussion featuring the chiefs of the Fed, the European Central Bank, the Bank of Japan and the Bank of England.

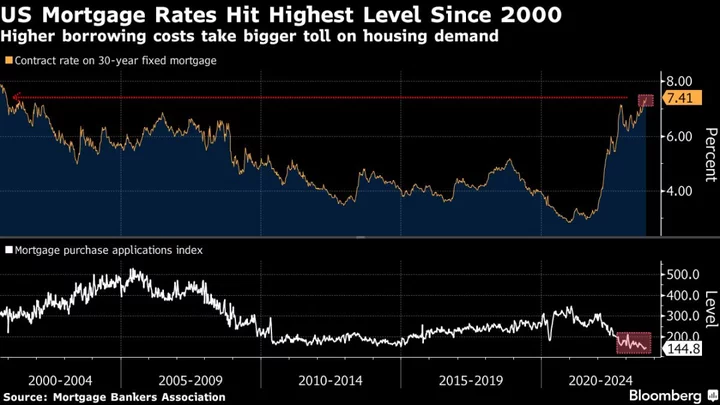

For the first time since early 2022, the US consumer confidence report showed that a larger percentage of people expected higher stock prices relative to lower equity values, according to Bespoke Investment Group. Meanwhile, new-home sales advanced to the fastest pace in over a year.

“Stocks are bouncing back after some strong US economic data gave a boost to consumer discretionary stocks and as investors piled back into AI trades,” said Edward Moya, senior market analyst at Oanda. “The strong consumer confidence report will likely suggest expectations are not for the labor market to deteriorate quickly, which should confirm expectations that a recession will not happen this year, but most likely next.”

In the run-up to the results of the Fed’s stress test, a nearly $3 billion exchange-traded fund tracking regional lenders was up over 1.5%. Analysts largely expect banks to sail through the tests even as regulators explore more stringent requirements in the aftermath of a few collapses in the financial industry.

A Bloomberg Intelligence model known as the Market Regime Index — which clusters periods into three phases dubbed accelerated growth (green), moderate growth (yellow) and decline (red) — has flipped out of the cautious red zone that it’s been stuck in for 15 straight months and into yellow. That signals brighter times ahead for stocks, according to BI’s Gina Martin Adams and Gillian Wolff.

Key events this week:

- US wholesale inventories, goods trade balance, Wednesday

- Fed to unveil results of annual banking industry stress test, Wednesday

- Policy panel with ECB’s Christine Lagarde, Fed Chair Jerome Powell, BOJ’s Kazuo Ueda and BOE’s Andrew Bailey, Wednesday

- Eurozone economic confidence, consumer confidence, Thursday

- US GDP, initial jobless claims, Thursday

- Atlanta Fed President Rafael Bostic speaks, Thursday

- China manufacturing PMI, non-manufacturing PMI, balance of payments, Friday

- US personal income and spending, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.1% as of 7:31 a.m. Tokyo time. The S&P 500 rose 1.15% Tuesday

- Nasdaq 100 futures fell 0.3%. The Nasdaq 100 rose 1.75%

- Nikkei 225 futures rose 0.7%

- Australia’s S&P/ASX 200 Index futures rose 0.4%

- Hang Seng Index futures rose 0.2%

Currencies

- The euro was unchanged at $1.0961

- The Japanese yen was little changed at 144.02 per dollar

- The offshore yuan was little changed at 7.2251 per dollar

- The Australian dollar was little changed at $0.6685

Cryptocurrencies

- Bitcoin was little changed at $30,674.5

- Ether was little changed at $1,892.5

Bonds

- The yield on 10-year Treasuries advanced four basis points to 3.76% Tuesday

Commodities

- West Texas Intermediate crude rose 0.3% to $67.92 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.