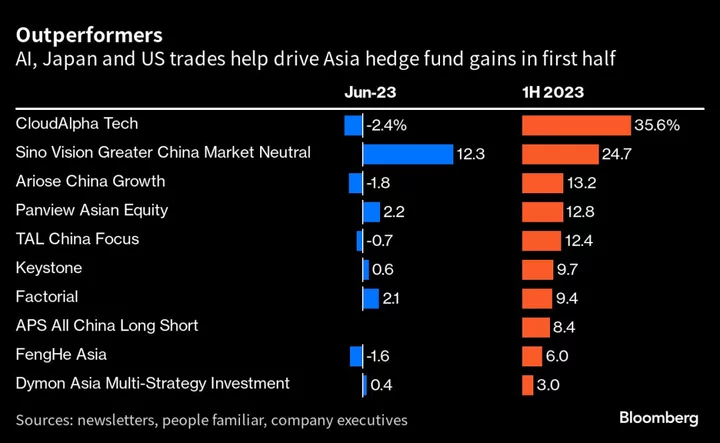

Several Asia-based hedge funds used bets tied to artificial intelligence, along with Japanese and US stocks, to beat their peers in the first half.

AI-related shares powered the nearly 36% return of CloudAlpha Tech Fund and 25% surge at Sino Vision Greater China Market Neutral Fund in the six months, according to people familiar with the results. Japan was a key driver behind Panview Asian Equity Fund’s 13% gain, another person said.

They easily beat peers, with the average Asia hedge fund edging up just 1.4% in the first half, Eurekahedge figures show, trailing the MSCI Asia-Pacific Index’s 4.8% advance. Markets were tricky to navigate as the exuberance over China’s exit from Covid restrictions petered out and uncertainty reigned over the Federal Reserve’s fight to contain inflation.

The $690 million Sino Vision fund has concentrated its AI bets in Taiwan, “a key beneficiary as an epicenter of the AI ecosystem,” its Hong Kong-based manager Grand Alliance Asset Management Ltd. said in an email. In particular, its wagers on semiconductor and hardware suppliers to AI data servers and data centers paid off. Those Taiwanese companies were previously off the radar screen of analysts and international investors and have only begun to garner global attention, the firm said.

CloudAlpha’s profitable AI bets were mainly in the US, said a person with knowledge of the matter. The Hong Kong-based hedge fund known for its concentrated, gutsy wagers is swinging back from a 37% loss last year.

Keystone Investors Pte’s hedge fund was up 9.7%, confirmed Ken Tonkinson, chief executive officer of the Singapore-based firm whose assets are approaching $1.3 billion. Its 15-month-old fund made money from long and short bets in Greater China and globally. Semiconductor, software and entertainment companies contributed to the return, as did trades involving consumers, real estate and healthcare stocks.

Encouraged by Japan’s corporate governance improvements, former Goldman Sachs Group Inc. partner Ryan Thall’s Panview found opportunities among smaller companies that have been overlooked by investors. A lot of the gains it made in the country were from technology hardware stocks, although it’s less excited about the space going forward, said the person.

TAL China Focus Master Fund surged 12% in the six months, according to people with knowledge of the matter. Its manager Trivest Advisors Ltd., which earlier made its name as a savvy Chinese stock trader, boosted holdings of US-listed stocks by 56% in the first quarter. Some of the increase would have been the result of rising stock prices, rather than buying more shares. However, it added to positions in Meta Platforms Inc., Nvidia Corp. and Microsoft Corp., according to its latest regulatory filings.

Not all the money was made from long investments. Panview found lucrative bets against some Chinese companies that had been Covid beneficiaries. It saw increased competition and decreased margins for those firms, whose stock prices had got a boost from investors who were over-exuberant about China’s post-Covid rejuvenation, the person said.

APS Asset Management’s APS All China Long Short Fund was up 8.4% in the first half, according to a letter to investors that was seen by Bloomberg News. It made money in the second quarter shorting two Chinese e-commerce companies after deducing that intensifying competition and slowing industry growth would eventually spook investors, it told clients.

One of last year’s best performers continued to churn out returns. Ariose Capital Management’s hedge fund rose 13% in the first half, after surging nearly 49% in 2022, according to people with knowledge of the matter.

Barun Agarwal’s Hong Kong-based Factorial Management Ltd. maintained the winning streak that saw it post gains in each year since its 2012 inception. In the first half, the pan-Asia multi-strategy hedge fund rose 9.4%. “Credit was the biggest driver, especially from long-term investments in various Indian credit,” the firm said in an email.

Also contributing to the profits were equity investments, including initial public offerings, as well as block, corporate event and arbitrage trades across Greater China, Australia, Japan, Southeast Asia, India and the Middle East. Convertible bond and volatility trading, mainly in Hong Kong and China, Taiwan and South Korea, was another money maker.

Representatives from Ariose, CloudAlpha, FengHe, Panview and Trivest declined to comment.

Author: Bei Hu, David Ramli and Nishant Kumar