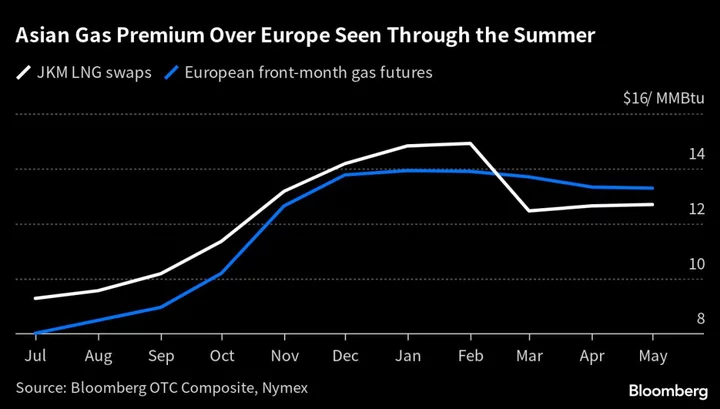

Spot prices for liquefied natural gas in Asia are trading at a consistent premium over the European benchmark for the rest of this year, signaling that competition for the fuel could tighten if demand rebounds.

Exports from the US are currently more profitable to Asia in July, August and September, according to BloombergNEF. Europe’s gas prices erased gains Thursday after Norway’s Equinor ASA said a leak at its LNG plant has been stopped and normalization is under way.

Competition for spare cargoes is expected to increase in the second half of the year, according to Bloomberg Intelligence analysts Patricio Alvarez and Joao Martins. With Russian pipeline-gas flows at a bare minimum, LNG imports are set to meet 40% of Europe’s demand in 2023, up from about 20% in 2021, they said.

“Europe can’t be complacent as only 40-45% of its winter LNG demand is contracted, narrowing the buffer versus demand upswings or potential disruptions,” the analysts said. The focus is also on how full inventories will be for the winter 2024-2025.

Still, for now demand remains muted across the globe amid sluggish economic activity and after record prices last year battered key industries. Attention is turning to summer weather as heat waves can trigger increased use of the fuel for cooling.

The Asian premium over European rates doesn’t pose a substantial risk to Europe’s supply of flexible Atlantic LNG cargoes for now amid muted spot LNG demand from major Northeast Asian importers, said Leo Kabouche, an analyst at Energy Aspects Ltd. in London.

“We would need to see a very hot summer in Asia pushing gas burns higher to generate substantial levels of restocking demand,” he said. “Such a scenario could indeed result in Asia pulling US spot cargoes via Panama Canal or Cape of Good Hope, but we are still a long way from that.”

Still, the second half of 2023 will be “supported by weather-driven demand in Europe and Asia,” according to senior analyst Masanori Odaka at Rystad Energy. “The risk of strong demand this summer will keep putting pressure on the global LNG market.”

Dutch front-month gas prices, the benchmark contract in Europe, slumped 7.5% to €24.85 a megawatt-hour by 10:05 a.m. in Amsterdam, after gaining 8.8% on Wednesday.

--With assistance from Eamon Akil Farhat.