Equity markets in Asia are poised to open higher after US shares gained for a fourth day as traders shrugged off a hotter-than-estimated wholesale inflation reading.

Australian stocks rose in early trading, while futures for benchmarks in Japan and Hong Kong gained. Contracts for US stocks also advanced after the S&P 500 capped the longest winning streak since August on Wednesday as investors focused on less hawkish comments from Federal Reserve speakers. Australian 10-year bonds headed for a sixth day of gains on Thursday.

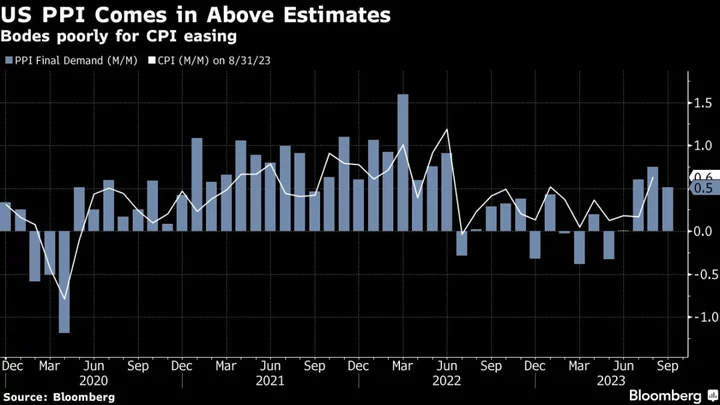

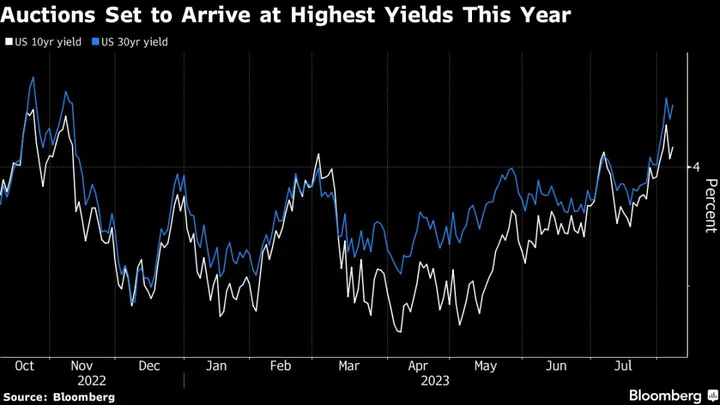

Following data that showed a measure of producer prices rose by more than forecast in September, Treasuries delivered mixed results Wednesday with long-dated tenors holding most of their advances. Elsewhere, the dollar saw its longest losing streak since March, while oil fell after an early-week surge.

Boston Fed President Susan Collins said officials are taking a more patient approach now that rates are at or near their peak. Her Atlanta counterpart Raphael Bostic said the central bank doesn’t need to keep tightening unless inflation’s descent starts to stall. Meanwhile, Governor Christopher Waller noted the Fed can “watch and see” what happens before taking further action with rates as financial markets tighten.

For Krishna Guha at Evercore, Waller’s remarks confirm “a lot has changed” since the Fed’s September gathering, when officials “were not at all focused on the surge in bond yields that had taken place by the time of that meeting.”

Restrictive Policy

Fed minutes Wednesday showed that central bank officials agreed last month that US policy should remain restrictive for “some time” to keep cooling down inflation — while noting risks had become more balanced.

“The Fed is near the end of their rate hiking campaign and the events of the past weekend likely solidify this view,” said Jeffrey Roach, chief economist at LPL Financial. “The risk of overtightening appears to be in balance with the risk of insufficient tightening.”

Investors now await Thursday’s consumer price index with policymakers recently noting that the risks of overtightening now had to be balanced against keeping inflation on a downward path toward 2%.

“Tomorrow’s CPI could paint a different picture, but today’s PPI suggests we haven’t seen the end of sticky inflation — and high interest rates,” said Mike Loewengart, head of model portfolio construction at Morgan Stanley Global Investment Office. “Either way, investors will need to remain patient. Lowering inflation significantly from last year’s highs was one challenge, getting it down to the Fed’s 2% target level is another.”

Earnings-Revision Momentum

Wall Street analysts are boosting US earnings forecasts even before results start rolling in, signaling the worst of the profit slump is likely over as ebbing inflation eases the pressure on a broad swath of industries.

That’s pushed an indicator known as earnings-revision momentum — a gauge of upward-to-downward changes to expected per-share earnings over the next 12 months — to roughly positive territory and well over its November 2022 low of negative 70%, according to data compiled by Bloomberg Intelligence. It’s the most positive reading ahead of an earnings season since the first quarter of 2022, with forecasts recently only getting marked up after executives deliver the latest guidance.

Bank of America Corp. strategists predict US companies will deliver financial results that substantially beat analyst expectations, prompting a boost to their 2023 earnings estimate as a recovery gets underway this reporting season. The expectation is for a “sizable” beat, strategists including Ohsung Kwon and Savita Subramanian wrote.

JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. will kick off the earnings season Friday, with the biggest US banks poised to write off more bad loans than they have since the early days of the pandemic as higher-for-longer interest rates and a potential economic downturn put borrowers in a bind.

Key events this week:

- Japan machinery orders, PPI, Thursday

- Bank of Japan’s Asahi Noguchi speaks, Thursday

- UK industrial production, Thursday

- US initial jobless claims, CPI, Thursday

- European Central Bank publishes account of September policy meeting, Thursday

- Fed’s Raphael Bostic speaks, Thursday

- China CPI, PPI, trade, Friday

- Eurozone industrial production, Friday

- US University of Michigan consumer sentiment, Friday

- Citigroup, JPMorgan, Wells Fargo, BlackRock results as the quarterly earnings season kicks off, Friday

- G20 finance ministers and central bankers meet as part of IMF gathering, Friday

- ECB President Christine Lagarde, IMF Managing Director Kristalina Georgieva speak on IMF panel, Friday

- Fed’s Patrick Harker speaks, Friday

Some of the main moves in markets as of 8:10 a.m. Tokyo time:

Stocks

- S&P 500 futures rose 0.2%. The S&P 500 rose 0.4% on Wednesday

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.7%

- Nikkei 225 futures rose 0.3%

- Hang Seng futures rose 1.1%

- S&P/ASX 200 rose 0.3%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0623

- The yen rose 0.1% to 149.02 per dollar

- The offshore yuan was little changed at 7.2996 per dollar

- The Australian dollar was little changed at $0.6418

Cryptocurrencies

- Bitcoin rose 0.2% to $26,762.58

- Ether was little changed at $1,564.26

Bonds

- Australia’s 10-year yield declined nine basis points to 4.34%

Commodities

- West Texas Intermediate crude fell 0.3% to $83.27 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.