By Kane Wu

HONG KONG Asia stocks fell on Wednesday after faltering growth in China and Europe heightened concerns about global economic momentum, while the dollar firmed as investors weighed the outlook for Federal Reserve interest rates.

London and U.S. markets are poised to open lower with FTSE futures and E-mini futures for the S&P 500 index down 0.42% and 0.13% respectively at 0520GMT.

MSCI's gauge of Asia Pacific stocks outside Japan dipped 0.45%.

The Hang Seng Index lost 0.56% and China's benchmark CSI300 Index fell 0.59%, ahead of China's August trade data set to be released on Thursday, with analysts expecting exports and imports to continue their declines, but at a slower pace.

Investor sentiment was dampened by a private-sector survey on Tuesday that showed China's services activity expanded at the slowest pace in eight months in August, reflecting weak demand.

"The China decline was bigger than expected," said Redmond Wong, Greater China market strategist at Saxo Markets.

"The Chinese government has become more active and is relaxing more regulation but whether it is good enough remains to be seen," he added.

China is also set to release lending and inflation data in the coming days.

Manufacturing data from Germany, Britain and the euro zone also showed declines, while their service sectors fell into contraction.

"The Europe data were rather weak. We think there is still a high chance to have a mild recession in the U.S. and Europe toward the end of the year or beginning of next year," Wong said.

Australia's S&P/ASX 200 extended losses to 0.76%, even as second-quarter gross domestic product beat forecasts with a 0.4% rise.

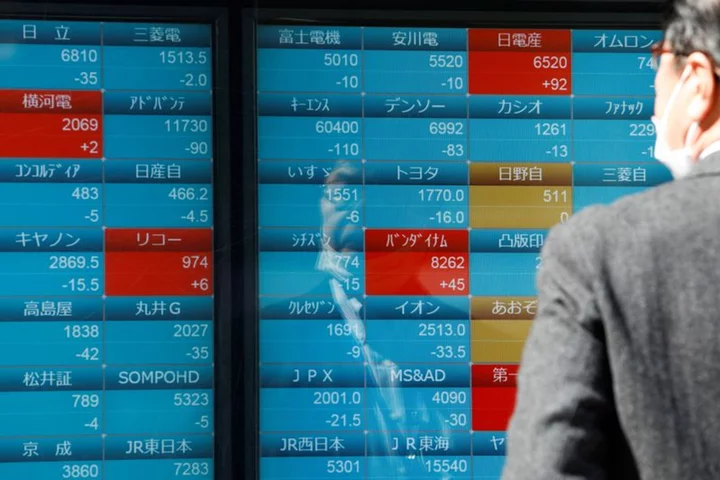

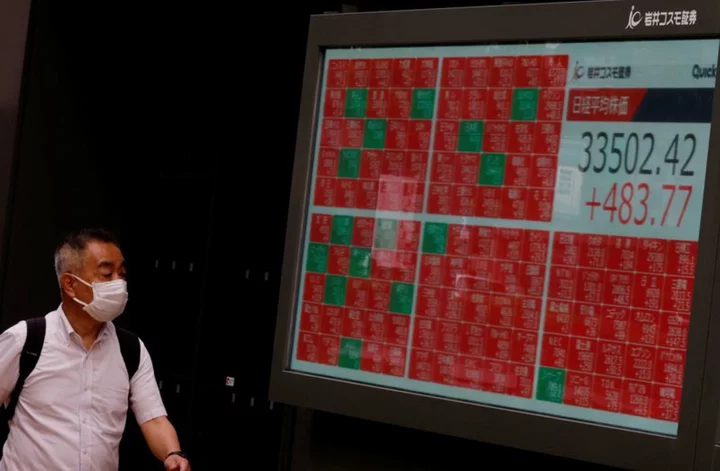

Japan's Nikkei 225 share average stood out to gain 0.52% with the weakest yen rate since November boosting exporters such as automakers, while energy shares outperformed amid a surge in crude oil prices.

The yield on the benchmark U.S. 10-year Treasury note rose 9 basis points to 4.26% after reaching 4.268%, its highest since Aug. 25, while the U.S. dollar rose to a near six-month high against a basket of currencies.

Investors are digesting recent signals on potential U.S. interest rate hikes. Fed Governor Christopher Waller said on Tuesday that the latest round of economic data was giving the U.S. central bank space to see if it needs to raise rates again.

"[The] Fed is a focus for us, we think they have more work to do with potential for U.S. rates to continue heading higher," said John Milroy, investment adviser at Ord Minnett.

"We see central banks being forced to keep policy tight to lean against inflationary pressures," the BlackRock Investment Institute said in a note Wednesday.

The Institute for Supply Management (ISM) is set to release U.S. services PMI on Wednesday.

U.S. crude was up 0.06% at $86.74 a barrel. Brent gained 0.07% to trade at $90.10 a barrel.

Oil prices surged more than 1% in the previous session, as markets worried about a supply shortage after Saudi Arabia and Russia extended their voluntary supply cuts to the end of the year.

Spot gold rebounded up 0.09% at $1,927.79 per ounce by 0534 GMT, after posting its biggest one-day loss since Aug. 1 on Tuesday.

(Reporting by Kane Wu; Editing by Edmund Klamann and Sam Holmes)