Stocks in Asia were set for a mixed start to September after a muted session on Wall Street as traders await Friday’s jobs reading to gauge the outlook for Federal Reserve policy. Bond yields fell and the dollar strengthened.

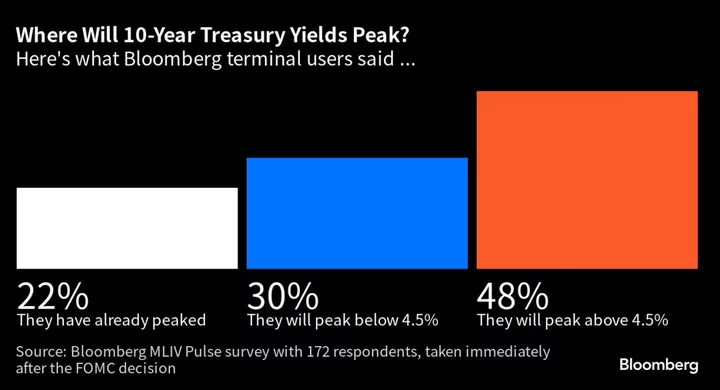

Futures for equity benchmarks in Japan and Australia pointed to declines, while those for Hong Kong showed a slight increase. Futures for the S&P 500 were little changed after the index closed lower on Thursday to notch its first monthly slide since February. Treasury 10-year yields extended their retreat after recently hitting levels last seen in 2007 while an index of the dollar had its best month since February.

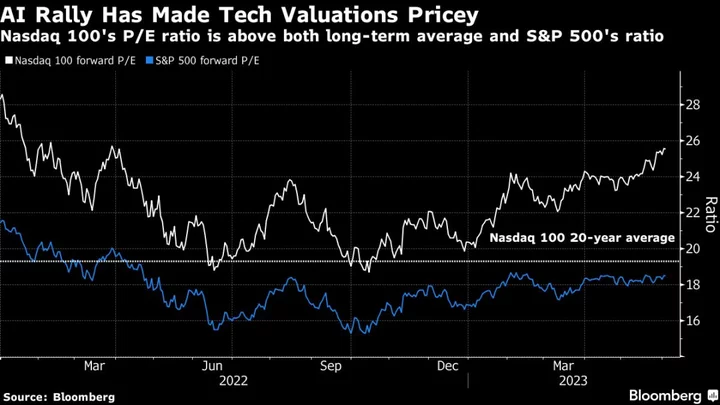

Concerns that the Fed will keep interest rates higher for longer to prevent a flare-up in price pressures has taken the wind out of equity markets around the world, adding to worries about China’s faltering economic growth.

The Fed’s preferred measure of underlying inflation saw the smallest back-to-back increases since late 2020, encouraging consumer spending. Markets took the report in stride, with the numbers illustrating the divergence within the US economy, according to Jeffrey Roach at LPL Financial.

Wall Street is now bracing for Friday’s labor-market data, which will provide further insights on the Fed’s next steps. The report is forecast to show employers boosted their payrolls by nearly 170,000 in August, while the unemployment rate held at a historic low of 3.5%.

“Given the continued strength in the labor market and the fact that the economy is still growing above trend, the Fed will view inflation as cooling, but not sufficiently cool,” said George Mateyo, chief investment officer at Key Private Bank.

More than 60% of investors surveyed by 22V Research expect softer-than-estimated August payrolls data, while 78% see wage inflation at or below consensus. Meantime, 49% of them said the report will be “risk-on” and only 24% expect a “risk-off” reaction.

Fed Outlook

The Fed may be slower to cut rates than many market participants expect, said Bridgewater Associates Co-Chief Investment Officer Karen Karniol-Tambour.

“When you look at what it takes to get fast rate declines, usually you need the economy collapsing pretty quickly,” she said in an interview for an upcoming episode of Bloomberg Wealth with David Rubenstein. “That’s very far from where we are today.”

Fed Bank of Atlanta President Raphael Bostic said policymakers need to be cautious not to overtighten monetary policy and risk unnecessary harm to the US labor market.

The Bloomberg Commodity Index resumed its declines in August after two months of gains. That came despite oil posting its third monthly advance amid low US inventories and news that Russia had agreed on further OPEC+ cuts and iron ore defying the deepening gloom over China’s debt-laden economy.

Key events this week:

- China Caixin manufacturing PMI, Friday

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday

- US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 8:07 a.m. Tokyo time. The S&P 500 fell 0.2%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 0.2%

- Hang Seng futures rose 0.2%

- S&P/ASX 200 futures fell 0.5%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0842

- The Japanese yen was little changed at 145.53 per dollar

- The offshore yuan was little changed at 7.2763 per dollar

- The Australian dollar was unchanged at $0.6484

Cryptocurrencies

- Bitcoin was little changed at $26,011.07

- Ether fell 0.1% to $1,647.31

Bonds

- The yield on 10-year Treasuries was little changed at 4.11%

- Australia’s 10-year yield declined three basis points to 4.00%

Commodities

- West Texas Intermediate crude fell 0.1% to $83.53 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.