Asian equities were set to climb Thursday after US inflation slid to a two-year low, easing pressure on global markets from rising interest rates in the world’s biggest economy.

Futures for benchmarks in Hong Kong and Australia pointed to strong opening gains while contracts for Japan suggested a smaller move upward, in part reflecting the drag from the recent rebound of the yen.

In an early hint of moves to come in the region, yields on sovereign bonds in New Zealand dropped, following sharp moves lower in rates on US Treasuries on Wednesday.

Major currencies steadied after a gauge of dollar strength dropped almost 1% in the previous session to the lowest in more than a year. The yen traded around 138.40 versus the greenback after its biggest advance in around four months.

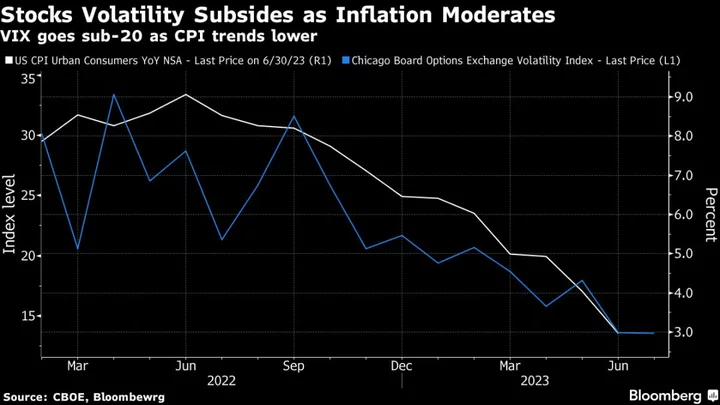

The US consumer price index rose 3% in June from a year ago. The core measure — which economists view as the better indicator of underlying inflation — advanced just 4.8%, the lowest since 2021. While traders expect the Federal Reserve will still go ahead with one more rate hike this month, the likelihood of further increases appears to be receding.

The inflation data propelled the S&P 500 to finish at its highest since April 2022. The tech-heavy Nasdaq 100 outperformed with a jump of 1.2%. Two-year Treasury yields, which are more sensitive to imminent policy moves, slid 13 basis points to 4.74%. Brent crude climbed above $80 a barrel.

“It’s too early to pop the champagne, but it’s not too early to start chilling the bottle,” said Ronald Temple, chief market strategist at Lazard. “Better-than-expected data increases the likelihood that a Fed rate increase on July 26 will be the last of this cycle.”

In corporate news, Meta Platforms Inc. and Nvidia Corp. led gains in megacaps. Domino’s Pizza Inc. jumped on a third-party ordering agreement with Uber Technologies Inc. Microsoft Corp. is set for a second shot at winning UK approval for its takeover of Activision Blizzard Inc., but regulators warn that any antitrust fixes would trigger a new probe.

An index of US-listed Chinese stocks rallied more than 3% while futures for Hong Kong’s Hang Seng Index climbed almost 2%, setting the scene for Chinese equities to outperform Thursday.

Chinese Premier Li Qiang met with senior executives from the country’s leading technology firms on Wednesday in another sign that the government is ending its crackdown on the industry amid a weakening economy.

The Bank of Korea is widely expected to keep interest rates unchanged at a meeting later on Thursday. That would be the fourth straight meeting with the BOK standing pat, which has supported South Korea’s Kospi stocks benchmark. The index has gained about 15% this year while the won has fallen around 1.8%.

Key events this week:

- China trade, Thursday

- Eurozone industrial production, Thursday

- US initial jobless claims, PPI, Thursday

- US University of Michigan consumer sentiment, Friday

- US banks kick off earnings, Friday

Some of the main move in markets:

Stocks

- S&P 500 futures rose 0.1% as of 7:01 a.m. Tokyo time. The S&P 500 rose 0.7%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 1.2%

- Nikkei 225 futures rose 0.3%

- Australia’s S&P/ASX 200 Index futures rose 0.9%

- Hang Seng Index futures rose 1.9%

Currencies

- The euro was little changed at $1.1133

- The Japanese yen was little changed at 138.43 per dollar

- The offshore yuan was little changed at 7.1663 per dollar

- The Australian dollar was little changed at $0.6790

Cryptocurrencies

- Bitcoin was little changed at $30,350.44

- Ether fell 0.1% to $1,870.62

Bonds

- The yield on 10-year Treasuries declined 11 basis points to 3.86%

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.