Shares in Asia were little changed, mirroring a flat day on Wall Street as bonds extended a rally on bets the Federal Reserve may start cutting interest rates in the first half of 2024.

Australian and Japanese stocks were flat at the open while equity futures for Hong Kong were slightly higher, even as the Golden Dragon index of US-listed Chinese companies slipped 1.3%. A small gain for US futures in early Asian trading eroded Wednesday declines for the S&P 500 and tech-heavy Nasdaq 100.

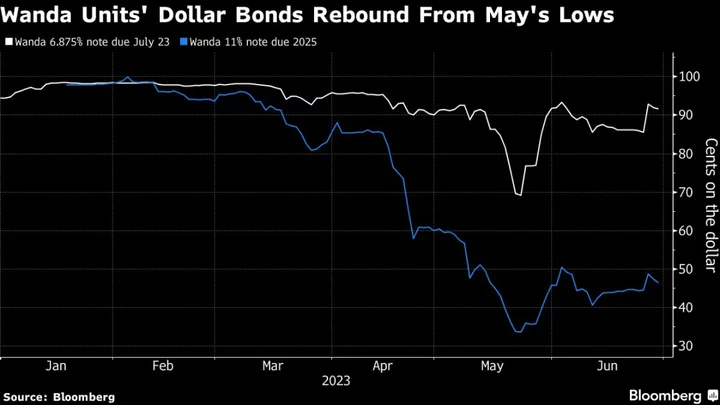

In Asia, investors will closely watch China PMIs for further signs of resilience in the world’s second largest economy. A handful of global investors including Fidelity International and Invesco Ltd are beginning to bet on a turnaround for Chinese stock and credit markets.

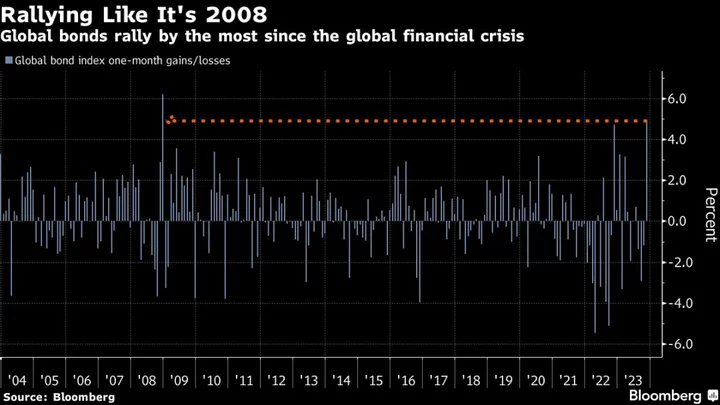

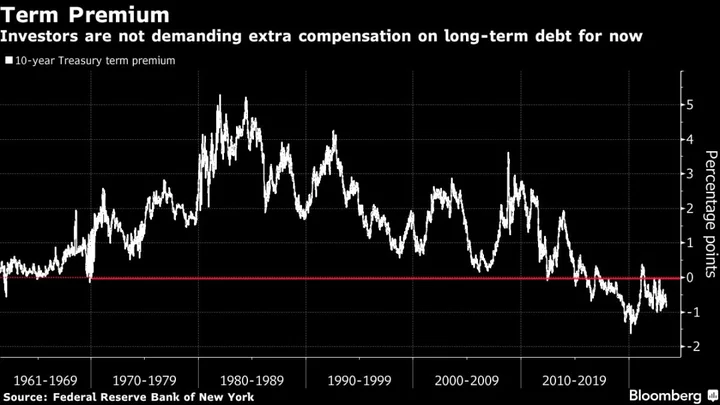

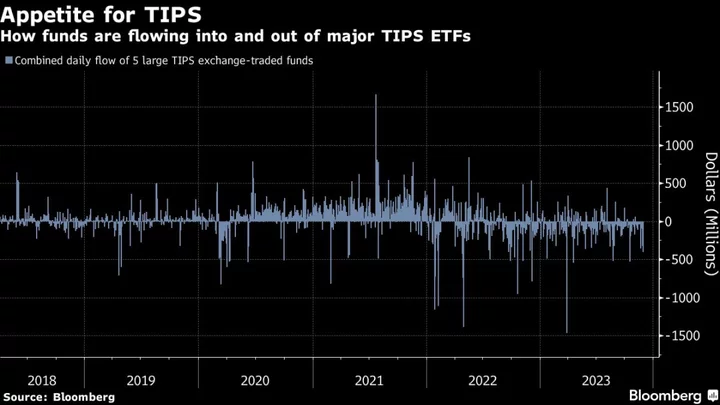

Bond bulls again latched onto comments from Fed officials, juicing a rally in November that has placed a gauge of global sovereign and corporate debt on track for the best month since 2008. Treasuries were steady early Thursday trading after two-year yields fell nine basis points, while those on 10-year notes eased seven basis points lower to 4.26%. Australian and New Zealand bond yields also tracked lower Thursday.

“The Fed could find themselves in a ‘sweet spot’,” said Jeffrey Roach at LPL Financial. “Inflation is trending lower, the consumer is still spending — but at a slower pace — and the Fed could end its rate hiking campaign without much pain inflicted on the economy.”

The rise in bonds followed a ramping up of expectations the Fed will cut rates quicker than previously expected. Swaps pricing now reflects market forecasts that the central bank will cut by 25 basis points in May, bringing forward prior expectations for a June cut.

Those moves reflected comments from Cleveland Fed President Loretta Mester, who suggested she would support another rate pause at the Fed’s December meeting. Atlanta Fed President Raphael Bostic, meanwhile, voiced further confidence that inflation was on a downward path. The comments echo sentiment from Fed speakers on Tuesday, further emboldening bond bulls.

“I’m sensing greater clarity about a few important currents,” Bostic wrote in the essay released Wednesday. “Our research and input from business leaders tell me the downward trajectory of inflation will likely continue.”

Hard data provided support for a soft landing for the US economy. Economic activity slowed in recent weeks as consumers pulled back on discretionary spending, the Fed said in its latest “Beige Book”. Gross domestic product rose at the fastest pace in nearly two years, while consumer spending advanced at a less-robust rate and the Fed’s preferred inflation metric — the personal consumption expenditures price index — was revised lower.

Elsewhere, Japan industrial production in October was stronger than expected, while retail sales for the month fell short of estimates. South Korea’s central bank will hand down a monetary policy decision. Later Thursday, inflation and unemployment data for the Eurozone will be released, as will US jobless claims and the PCE deflator.

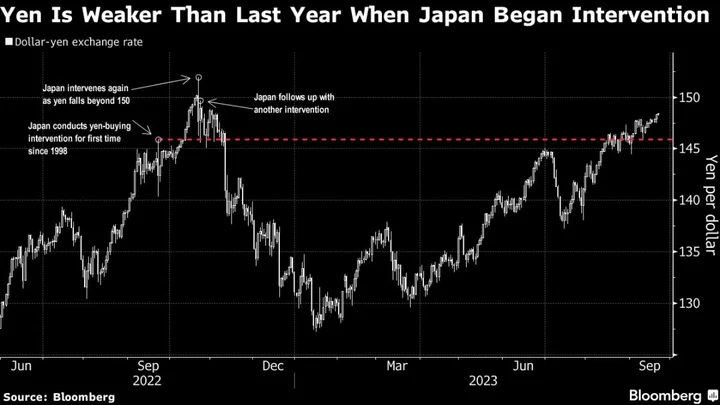

In currencies, the dollar was weaker against most Group-of-10 peers, led by the Japanese yen which added to its four days of gains and hovered around 147 versus the greenback. Elsewhere, oil steadied after a two-day advance as traders count down to a key meeting that may see OPEC+ extend or deepen production cuts.

Shares in Australia-listed Origin Energy Ltd fell after the company said in a statement that a takeover bid from Brookfield Asset management was not in shareholders’ best interests, damping confidence a deal will proceed.

Other corporate highlights included Walt Disney Co. Chief Executive Officer Bob Iger saying no longer is considering selling the company’s traditional TV channels, like ABC and FX, reversing comments he made earlier this year. General Motors Co., meanwhile, will boost its dividend by 33% and repurchase $10 billion of shares — its biggest-ever buyback plan. The automaker’s stock jumped.

Key events this week:

- China non-manufacturing PMI, manufacturing PMI, Thursday

- OPEC+ meeting, Thursday

- Eurozone CPI, unemployment, Thursday

- US personal income, PCE deflator, initial jobless claims, pending home sales, Thursday

- China Caixin Manufacturing PMI, Friday

- Eurozone S&P Global Manufacturing PMI, Friday

- US construction spending, ISM Manufacturing, Friday

- Fed Chair Jerome Powell to participate in “fireside chat” in Atlanta, Friday

- Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:29 a.m. Tokyo time. The S&P 500 fell 0.1%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 fell 0.1%

- Hang Seng futures rose 0.4%

- Japan’s Topix fell 0.4%

- Australia’s S&P/ASX 200 was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0974

- The Japanese yen rose 0.1% to 147.07 per dollar

- The offshore yuan was little changed at 7.1410 per dollar

- The Australian dollar was little changed at $0.6618

Cryptocurrencies

- Bitcoin rose 0.2% to $37,798.88

- Ether was little changed at $2,029.25

Bonds

- The yield on 10-year Treasuries was little changed at 4.25%

- Japan’s 10-year yield declined 2.5 basis points to 0.650%

- Australia’s 10-year yield declined two basis points to 4.34%

Commodities

- West Texas Intermediate crude fell 0.2% to $77.67 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.