By Kevin Buckland

TOKYO Asian stocks hovered close to a sixteen-month peak on Tuesday and oil held near recent highs as investors found more cause for cheer over global economic prospects than reasons to worry, even as data showed risks remain.

The dollar hit a three-week high against the yen as investors continued to seek clarity on the Bank of Japan's recent adjustment to its yield curve control and what that might mean for monetary policy.

The Aussie dollar slumped after the Reserve Bank kept rates unchanged, even as it suggested more tightening may be needed in the future.

MSCI's broadest index of Asia-Pacific shares edged slightly higher, inching back toward the high reached Monday, which was its strongest level since April of last year.

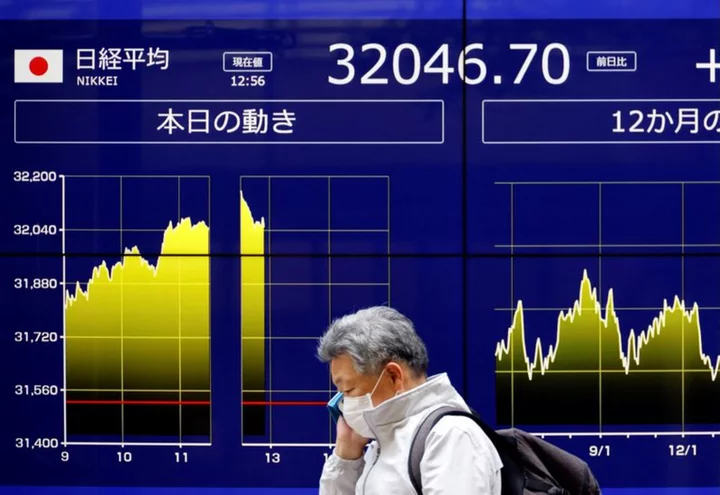

Japan's Nikkei provided support, gaining 0.83% on the back of a weaker yen.

U.S. E-mini stock futures also pointed to a small rise after the S&P 500 ticked up 0.15% overnight.

"We're in a kind of economic nirvana, with an incredibly resilient economy, solid earnings reports and cooling inflation," said Tony Sycamore, a markets analyst at IG in Sydney.

"A little more than halfway through the year, it feels like we're in a very good spot."

Signs of a peaking out in European inflation on Monday echoed the narrative in the United States, providing more evidence that the biggest central banks are nearing the end of their tightening cycles.

However, China's stumbling post-pandemic recovery remained in focus after a surprise contraction in manufacturing in a private-sector survey released Tuesday.

Hong Kong's Hang Seng shed early advance to be about flat, with its property subindex flipping from gains to slide 1.47% as investors took profits after the previous day's rally, built on stimulus hopes.

An index of mainland Chinese blue chips drooped 0.36%.

"At this point, we remain sceptical that there will be any big-bang stimulus package forthcoming," said Alec Jin, investment director of Asian equities at abrdn.

"Investors are still waiting to see some meaningful comeback in high frequency indicators."

The positive U.S. narrative also faces some crucial tests this week, with several closely watched jobs reports due, culminating with monthly payrolls on Friday.

Corporate earnings later in the day include global bellwether Caterpillar.

In currencies, the U.S. dollar index - which measures the currency against six major peers - rose as high as 102.07 for the first time since July 10.

That was aided by a continued retreat in the yen to a three-week low of 142.84 per dollar, as investors looked past the BOJ's surprise tweak of its 10-year yield ceiling to view changes to the negative short-term rate as a still distant prospect.

A closely watched auction of 10-year notes saw relatively weak demand, although the yield reacted little, sticking around 0.6%, well back from the new de facto cap at 1%.

The Aussie weakened as much as 0.9% to $0.66575 after the RBA opted to keep policy steady for a second meeting running. Markets had priced 70% odds for no action, and 30% probability of a hike.

"It's unsurprising that the knee-jerk reaction is negative, but I wouldn't expect it to be onwards and downwards for Aussie," said Ray Attrill, head of FX strategy at National Australia Bank, who predicts a recovery toward $0.70 in coming weeks if risk sentiment stays positive.

"On a valuation basis, (Aussie) is looking pretty cheap."

Oil prices were little changed on Tuesday, trading near a three-month high reached on Monday, on signs of tightening global supply, as producers implement output cuts, and strong demand in the United States, the world's biggest fuel consumer.

Brent crude futures for October were down 0.2% or 18 cents at $85.25 a barrel. Front-month Brent settled at its highest since April 13 on Monday.

U.S. West Texas Intermediate crude was at $81.64 a barrel, down 0.2% or 16 cents from the previous session's settlement, which was its highest since April 14.

(Reporting by Kevin Buckland; Additional reporting by Ankur Banerjee; Editing by Sam Holmes and Lincoln Feast)