By Selena Li

HONG KONG (Reuters) -Asian shares were flat on Thursday with markets holding onto their gains for the week as confidence grows that interest rates globally will head lower next year, while oil prices fell on the prospects for smaller-than-expected output cuts by OPEC+.

Investors are also looking to Chinese policymakers for clues on possible support for the long-suffering property market, in line with broader growth targets they are hammering out.

MSCI's broadest index of Asia-Pacific shares outside Japan edged down 0.03% in thin trading, with Japan and the United States on holiday.

China's benchmark share index fell 0.16% on Thursday, with the real estate sub-index retrieved earlier losses to gain 2.11%.

Bloomberg reported late on Wednesday that China has placed debt-laden Country Garden Holdings Co on a draft list of 50 developers eligible for a range of financing support, citing sources.

Meanwhile, a large wealth manager with heavy exposure to the property market disclosed that it faces insolvency with relevant liabilities of up to $64 billion.

Chinese government advisers will recommend to an annual policymakers' meeting that economic growth targets for next year be set at 4.5% to 5.5%, Reuters reported on Wednesday.

Trading worldwide was expected to be quiet due to the Thanksgiving holiday in the U.S.

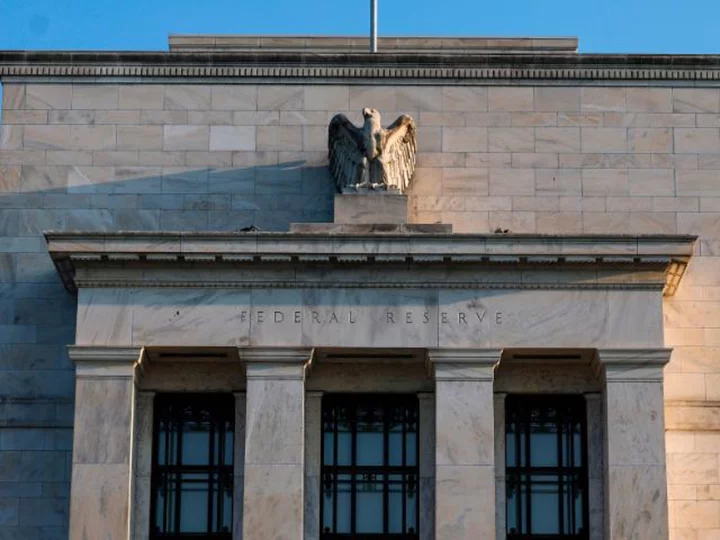

The U.S. market, which has priced out the chances of another rate hike in December, shrugged off strong weekly jobs data Wednesday night that may nevertheless reduce the prospects for quicker-than-expected rate cuts by the Federal Reserve, said Redmond Wong, Greater China market strategist at Saxo Markets.

Japanese markets are closed for a national holiday on Thursday, after the Nikkei 225 edged up 0.3% the day before and approached a three-decade high.

Hong Kong's Hang Seng index lost 0.22% while Australia stocks fell 0.62%.

Markets have generally been buoyant this month, with stocks rallying on expectations of a more benign interest rate backdrop.

Wall Street's benchmark S&P 500 is nearing a fresh high for 2023, with the S&P 500 and MSCI's all-country index both up more than 8% this month alone. The tech-heavy Nasdaq Composite is up 11% for the month.

The next set of forward-looking flash November PMIs will help investors to assess recession risks and how quickly rate cuts might begin.

The minutes of the European Central Bank's October meeting and flash PMIs for a host of European countries are Thursday's highlights. U.S. PMI data is due out on Friday.

The PMIs for the euro zone and Britain are already below the 50 threshold, suggesting that economic activity is contracting, while the U.S. Oct manufacturing PMI contracted sharply.

The yield on benchmark 10-year notes was at 4.408% on Thursday, after sliding to a two-month low of 4.363%.

The dollar index rose overnight, bouncing from a 2-1/2 month low after data showed the number of Americans filing new claims for unemployment benefits fell more than expected last week.

U.S. crude fell 1.14% to $76.22 per barrel and Brent was at $80.92, down 1.27%, extending losses from the previous session after OPEC+ postponed a ministerial meeting, which stoked expectations that producers might cut output less than had been anticipated.

Sterling weakened on Wednesday and Britain's FTSE 100 fell for a third straight session after UK Finance Minister Jeremy Hunt unveiled tax cuts and other measures in his autumn budget to boost growth, but forecast a far more sluggish economic outlook than previously expected.

In cryptocurrencies, Binance chief Changpeng Zhao has stepped down and pleaded guilty to violations of U.S. anti-money laundering laws as part of a $4 billion settlement resolving a years-long investigation into the world's largest crypto exchange.

Bitcoin fell slightly by 0.77% on Thursday to $37,337 after rose nearly 5% on Wednesday.

Spot gold added 0.3% to $1,996.59 an ounce.

(Reporting by Selena Li; Editing by Edmund Klamann and Stephen Coates)