Asian stocks rose as China’s largest banks reportedly prepare to cut interest rates and investors speculate that the Federal Reserve is nearing the end of its tightening campaign.

Shares were higher at the open in Japan, South Korea and Australia, while futures for Hong Kong stocks advanced more than 1%, boosted by news that Chinese state-owned lenders will reduce rates on the majority of the nation’s outstanding mortgages as well as on deposits. A gauge of US-listed Chinese companies jumped 3.7%, shaking off continued signs of financial stress in the Asian nation’s property sector.

US equity futures were little changed in Asian trading. American shares had climbed the most since June on Tuesday and bond yields retreated after job openings fell by more than expected, offering fresh evidence that labor demand is slowing in the world’s largest economy, taking pressure off the Fed. Separate data showed consumer confidence dropped amid souring views on jobs, higher borrowing costs and lingering inflation.

Treasuries steadied, with the policy-sensitive two-year yield hovering at around 4.9% after sinking 15 basis points Tuesday. Yields on government bonds in Australia and New Zealand fell Wednesday.

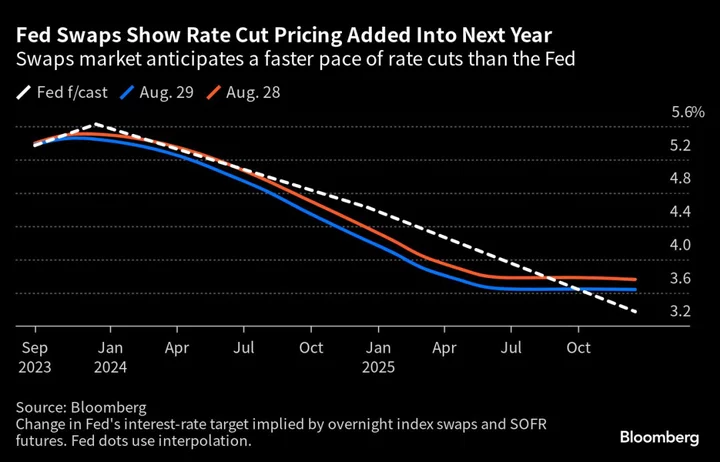

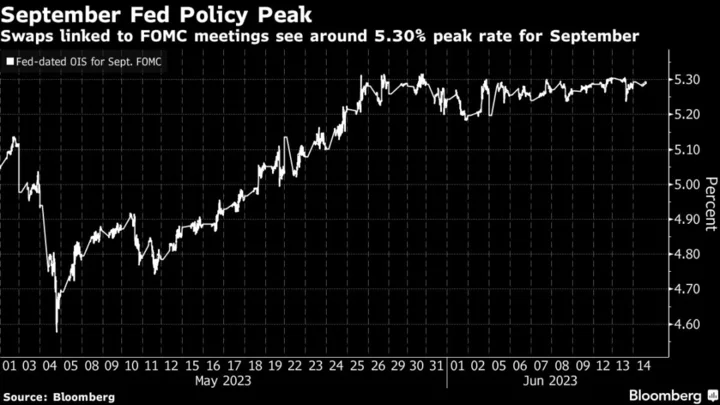

The US economic data triggered lower wagers in swap contracts for a Fed hike in 2023, and a greater chance of a policy pivot in the first half of 2024. Traders also brought forward bets on the expected start of rate cuts to June from July of next year.

“With markets ready to pounce on softer US data, any sign of weakness is likely to weigh further on yields and the US dollar,” said Matthew Simpson, a senior market analyst at City Index. “That could be great for equity market sentiment.”

Nearly 90% of the S&P 500 companies rose as the gauge closed just shy of 4,500. A rally in megacaps like Tesla Inc. and Nvidia Corp. sent the Nasdaq 100 up more than 2%.

Major currencies steadied after a gauge of dollar strength slid Tuesday. The yen weakened slightly.

The crypto space extended gains that started Tuesday as a US court ruling potentially paved the way for the country’s first Bitcoin exchange-traded fund. Bitcoin was 0.5% higher after jumping more than 6% in the previous session.

In commodities, West Texas Intermediate rose for a fifth day, set to match the winning streak last seen in March. Gold steadied after rising to the highest since early August on easing Fed rate hike bets.

Key events this week:

- Eurozone economic confidence, consumer confidence, Wednesday

- US GDP, wholesale inventories, pending home sales, Wednesday

- China manufacturing PMI, non-manufacturing PMI, Thursday

- Japan industrial production, retail sales, Thursday

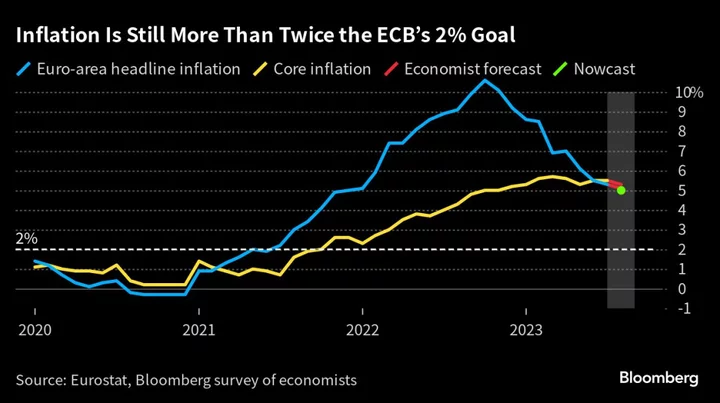

- Eurozone CPI, unemployment, Thursday

- ECB publishes account of July monetary policy meeting, Thursday

- US personal spending and income, initial jobless claims, Thursday

- China Caixin manufacturing PMI, Friday

- Eurozone S&P Global Eurozone Manufacturing PMI, Friday

- South African central bank governor Lesetja Kganyago, Atlanta Fed President Raphael Bostic, BOE’s Huw Pill, IMF’s Gita Gopinath on panel at the South African Reserve Bank conference, Friday

- Boston Fed President Susan Collins speaks at virtual event, Friday

- US unemployment, nonfarm payrolls, light vehicle sales, ISM manufacturing, construction spending, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:11 a.m. Tokyo time. The S&P 500 rose 1.5%

- Nasdaq 100 futures rose 0.1%. The Nasdaq 100 rose 2.2%

- Japan’s Topix index rose 0.5%

- Australia’s S&P/ASX 200 Index rose 0.6%

- Hong Kong’s Hang Seng futures rose 1.1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1% to $1.0869

- The Japanese yen fell 0.1% to 146.07 per dollar

- The offshore yuan was little changed at 7.2837 per dollar

- The Australian dollar was little changed at $0.6477

Cryptocurrencies

- Bitcoin rose 0.4% to $27,703.48

- Ether rose 0.2% to $1,729.85

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.14%

- Australia’s 10-year yield declined three basis points to 4.07%

Commodities

- West Texas Intermediate crude rose 0.3% to $81.41 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.