A who's who of Big Tech companies is set to invest in one of the most highly anticipated initial public offerings in recent memory, a blockbuster event that could value a British chip designer at as much as $52.3 billion.

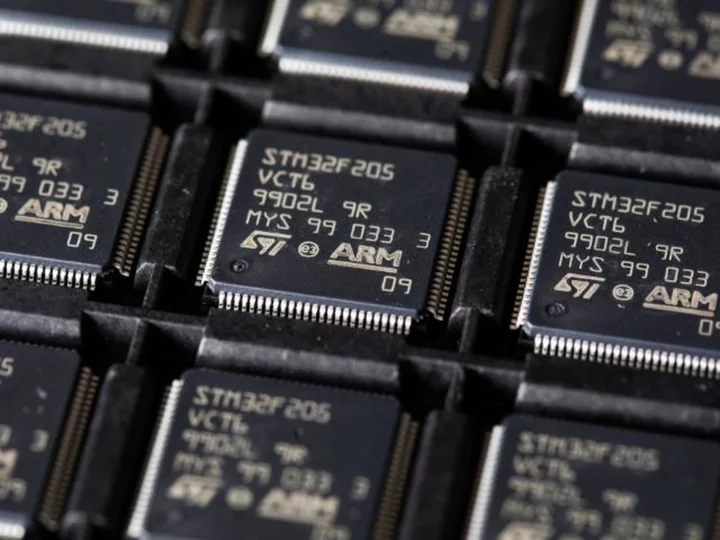

Arm, which designs chips for 99% of the world's smartphones, is aiming to price its shares between $47 and $51 each when they hit the US stock market later this month.

The firm's Japanese owner SoftBank is hoping to raise as much as $4.9 billion when Arm starts trading on the Nasdaq, according to a Tuesday filing with the Securities and Exchange Commission. That could rise to $5.2 billion if the banks underwriting the IPO exercise an option to buy additional shares from SoftBank.

Many of the biggest names in global tech, including Apple (AAPL), Google (GOOGL), Nvidia (NVDA), AMD (AMD), TSMC (TSM), Samsung and Intel (INTC) have all indicated an interest in acting as cornerstone investors, and could buy shares worth up to $735 million collectively in the IPO.

The Cambridge-based firm develops microchips for phones and tablets and licenses them to CPU makers, including Apple and Samsung. The company was public until 2016, when Japan's SoftBank bought it for $32 billion.

In 2020, SoftBank tried to offload Arm to Nvidia for $40 billion, in what would have been the biggest chip deal of all time. But it didn't pass muster with global antitrust regulators, and was called off in February 2022.

Still, if the IPO values Arm at $52 billion, that would represent a retreat from the valuation of about $64 billion implied by SoftBank's purchase of the remaining 25% stake in the company from its Vision Fund unit for approximately $16.1 billion just last month. Smartphone sales have been on the decline as hardware innovation slows down and customers hold onto their devices for longer stretches of time.

The company's return to the public market is being closely watched as it promises to be the biggest US IPO since 2021.

It's also expected to be the world's largest IPO in about a year, since Porsche raised about $8.7 billion in a Frankfurt offering last September, according to data from Dealogic.

Arm made nearly $2.7 billion in revenue in the fiscal year ended March, according to its prospectus.

SoftBank will continue to own approximately 90% of Arm's shares following the listing, according to the filing.